Join Our Telegram channel to stay up to date on breaking news coverage

The adoption of digital assets is rapidly expanding in today’s market, as exemplified by the British bank Standard Chartered launching a spot cryptocurrency trading operation in London. This strategic move targets institutional investors interested in Bitcoin and Ethereum. It seamlessly integrates digital assets into traditional banking services through its FX division. Beyond trading, the bank is actively enhancing the digital asset ecosystem with services like access and custody. Such integration is pivotal in advancing cryptocurrency’s widespread adoption and global acceptance across financial sectors.

Biggest Crypto Gainers Today – Top List

Today, investor sentiment in the crypto market remains cautious, with the Fear & Greed Index hovering around a neutral 53. Over the past 24 hours, 32% of cryptocurrencies have gained value, contrasting with 68% that have seen losses. Leading the gains is Mog Coin, soaring by 19.68%, while Terra Classic takes the day’s biggest hit with a steep 17.20% loss.

Amidst these fluctuations, Solana, Illuvium, UNUS SED LEO, and ArcBlock showcase remarkable resilience and substantial market progress. Let’s explore the intricacies of these top gainers and uncover what distinguishes them in the world of digital assets today.

1. Solana (SOL)

Solana is a highly functional open-source project that utilizes blockchain technology to provide decentralized finance (DeFi) solutions. The idea began in 2017, with the official launch by the Solana Foundation in March 2020. Solana aims to facilitate decentralized app (DApp) creation and enhance scalability through a proof-of-history (PoH) and proof-of-stake (PoS) consensus model.

Solana’s PoH consensus, developed by Anatoly Yakovenko, enables greater scalability and usability. Renowned for its incredibly short processing times, Solana’s hybrid protocol drastically reduces validation times for transactions and smart contracts. This feature has attracted substantial institutional interest. Solana promises low transaction costs and fast processing for small-time users and enterprise customers, setting it apart from other blockchain platforms.

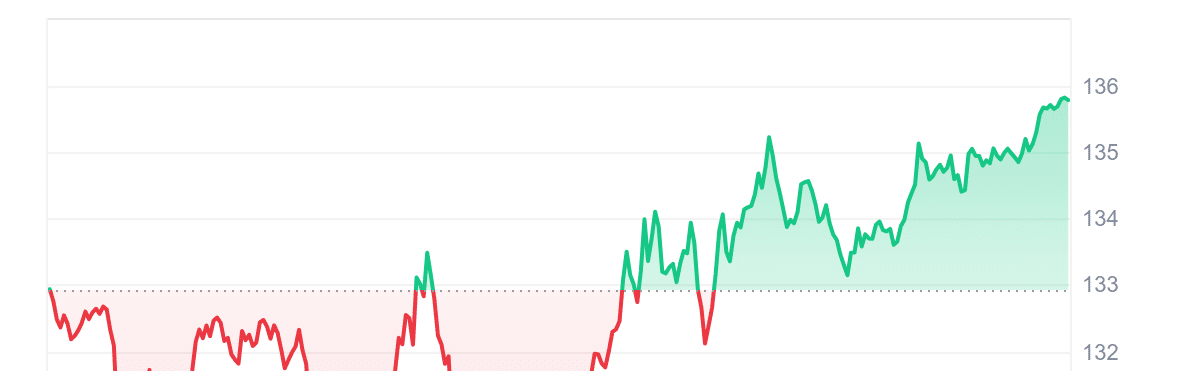

As of today, Solana is priced at $136.07, with a 2.30% increase in the last 24 hours. The 14-day RSI stands at 44.54, indicating neutral trading conditions. It had 10 positive trading days in the past month, with a volatility rate of 8%. Currently, Solana trades 4.23% above its 200-day SMA of $130.49.

This is the one chart you need to see today: ZK Compression brings the cost of state down to scale anything. https://t.co/oKS9XZI8Wc pic.twitter.com/yp2EBFta9X

— Solana (@solana) June 21, 2024

Over the past year, Solana’s price surged by 706%, outsurpassing 96% of the top 100 crypto assets. Despite these impressive metrics, Solana has faced repeated outages and criticism for favoring venture capital investors. Investors should consider these factors when evaluating Solana’s potential.

2. Illuvium (ILV)

Illuvium is a unique open-world fantasy battle game on the Ethereum blockchain. Often called the first AAA game on Ethereum, it offers a rich gaming experience for casual players and hardcore DeFi enthusiasts. Players capture and train creatures called Illuvials, which they can use in battles and trade as NFTs.

The game leverages Immutable X, a layer-2 solution, to provide zero gas fees and fast transactions for minting and trading NFTs. Its built-in IlluviDEX facilitates seamless asset trading, and a 5% fee from each sale is funneled into the rewards pool for ILV stakers. Additionally, Illuvium features a yield farming program that allocates 30% of the maximum ILV supply to users who contribute liquidity and participate in partner reward schemes.

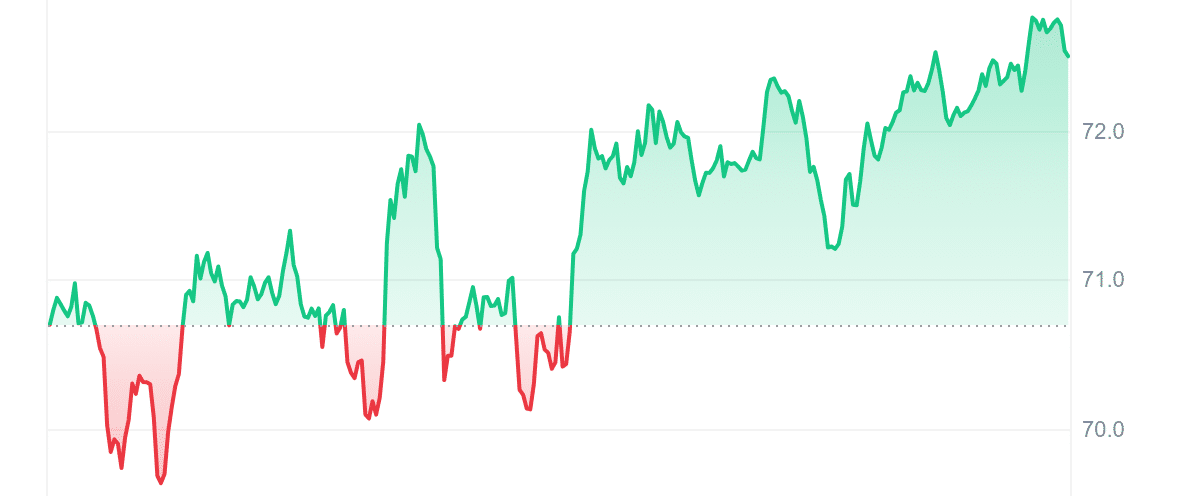

The ILV token is central to the game’s ecosystem, rewarding in-game achievements. It entitles holders to a share of the Illuvium Vault and enables participation in the game’s governance. Currently, Illuvium’s price stands at $72.58, having increased by 2.52% in the last 24 hours. It boasts high liquidity, with a market cap of $314.49M and a 24-hour trading volume of $15.49M.

🎬 Making Our Cinematic Trailer! 🎬

Rangers, presenting the making of our cinematic trailer, which was created in collaboration with @GlowCinematic! Watch the behind-the-scenes video and witness the incredible passion and detail that went into bringing Illuvium to life. 🌟

A… https://t.co/0N3AbFeyhn pic.twitter.com/BYDd3xukKA

— Illuvium (@illuviumio) June 21, 2024

The 14-day Relative Strength Index (RSI) is 40.97, indicating a neutral stance. Illuvium’s 30-day volatility is low at 8%, suggesting price stability. The game is trading 10.79% above its 200-day Simple Moving Average (SMA) of $65.52 and has seen a 55% price increase over the past year. However, it outperformed only 43% of the top 100 crypto assets by market cap during this period.

3. Pepe Unchained (PEPU)

Pepe Unchained is revolutionizing the meme coin space by evolving from a playful concept to a robust Layer 2 solution on Ethereum. This transformation promises faster and cheaper transactions. It also establishes Pepe Unchained as the pioneering Pepe-themed token on its dedicated blockchain, aiming to uphold the original project’s excitement while boosting functionality.

This recent launch has seen enthusiastic demand, offering its native token, PEPU, at a compelling price of just $0.008 per token. Already surpassing $280k towards its $406k goal, the presale anticipates further value growth leading to PEPU’s official launch.

Fantastic news! 🎉 $250K raised!

Pepe's vision is becoming a reality thanks to your support. The journey is just beginning, and there's so much more to come! 🚀💪 pic.twitter.com/Bie6vszBFO

— Pepe Unchained (@pepe_unchained) June 21, 2024

It offers an enticing staking feature that has drawn considerable interest from investors seeking passive income opportunities. Early adopters can enjoy an impressive Annual Percentage Yield (APY) rate of over 65,000% when staking their tokens. More than 2.3 million tokens have already been staked, reflecting strong early participation in the staking program.

Pepe Unchained has strategically allocated its PEPU token, totalling 8 billion tokens. This includes 20% for presale and marketing, boosting visibility, and another 10% each for liquidity, project finance, and chain inventory, ensuring operational stability. Notably, 30% is earmarked for staking rewards, emphasizing long-term holder incentives. Investors can dive into the Pepe Unchained presale using ETH, USDT, or BNB tokens.

4. UNUS SED LEO (LEO)

Unus Sed Leo is a utility token developed by iFinex, the parent company of Bitfinex, to raise funds. Issued on Ethereum and EOS blockchains, LEO allows users to pay exchange fees on Bitfinex and other platforms managed by iFinex. The token’s value is supported by Bitfinex’s profits, with the exchange purchasing and burning LEO regularly to maintain scarcity and value.

LEO’s uniqueness lies in its direct link to Bitfinex’s profitability and its role in improving transparency. Bitfinex uses a part of its profits to buy back LEO tokens, ensuring a stable demand. Additionally, regular token burns reduce supply, supporting the token’s price. This mechanism provides a clear utility, helping users reduce trading fees and promoting investor confidence.

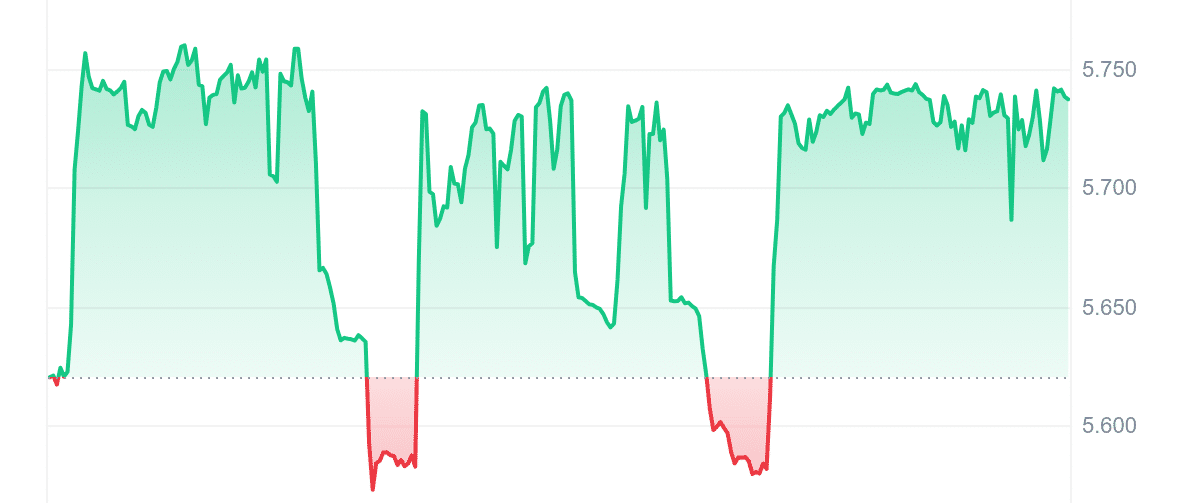

Reaching $5.71, LEO has experienced a steady 1.47% rise over the last day. Impressively, it trades 48.41% above its 200-day SMA of $3.85. Over the past year, LEO’s price surged by 50%, marking 14 green days within the last 30 days. At 41.04, the 14-day RSI points to a neutral stance in market sentiment. Although LEO outperformed 41% of the top 100 crypto assets, its 30-day volatility remains low at 2%, reflecting stable performance. When evaluating its potential, investors should consider LEO’s strong ties to Bitfinex’s success and its ongoing efforts to enhance transparency.

5. ArcBlock (ABT)

ArcBlock leads decentralized application (dApp) and blockchain development, simplifying the process with a user-friendly, scalable platform. It provides essential tools like flexible SDKs, code packages, and developer services for building blockchain applications and custom blockchains. ArcBlock’s approach removes adoption barriers, focusing on speed, ease of use, and creating enterprise-grade solutions for complex business needs.

Its architecture scales across platforms, starting with AWS and Azure, and seamlessly integrates diverse blockchain protocols via Open Chain Access Protocol (OCAP). This empowers developers to switch between blockchain platforms effortlessly. ArcBlock also introduces Blocklet, using serverless architecture to enhance platform service and application development. Emphasizing user experience and cost efficiency, ArcBlock aims to advance blockchain applications, making technology more accessible and practical for mainstream use.

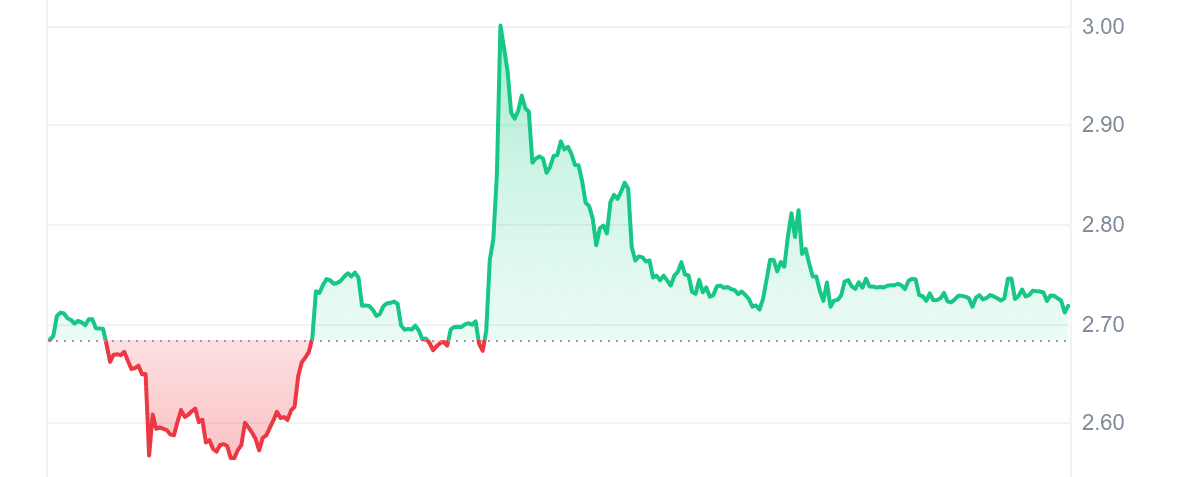

ArcBlock is valued at $2.72, with a modest 1.34% increase in the last 24 hours. It maintains medium liquidity, which is evident from its 0.0169 volume-to-market cap ratio. The 14-day RSI stands at 46.41, signalling neutrality and potential sideways movement. Over the past 30 days, ArcBlock experienced only 8 green days, accounting for 27% positivity.

Despite a 30-day volatility of 15%, indicating moderate price swings, it impressively trades 321.68% above its 200-day SMA of $0.644543. Notably, the cryptocurrency has surged by an impressive 3,135% over the past year, outperforming 97% of the top 100 crypto assets.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage