Join Our Telegram channel to stay up to date on breaking news coverage

In keeping with the latest global market news, Robinhood is shaking up the crypto world with a $200 million deal to acquire Bitstamp. This bold move will let Robinhood users trade over 85 cryptocurrencies, thanks to Bitstamp’s vast global reach and solid regulatory reputation.

As of June 7, 2024, Robinhood’s stock has soared to $22.97. Moreover, their Q1 revenue surged 40% to $618 million, with crypto transaction revenue skyrocketing by 232%. Consequently, this acquisition could catapult Robinhood into the ranks of prominent global crypto trading players.

Biggest Crypto Gainers Today – Top List

In today’s bustling crypto market, four top gainers are stealing the spotlight: Aurora, Injective, DeXe, and IOTA. But they’re not just riding the wave of price gains; they’re surging forward with groundbreaking innovations reshaping the industry.

Aurora leads the pack with its innovative update, integrating Pyth Network’s price feeds on Aurora Cloud, driving a notable 9.01% surge in its price. Injective follows suit with a remarkable 10.3% increase, fueled by the burning of over 12,000 INJ tokens, signaling heightened user engagement. DeXe makes waves with its groundbreaking DAO governance infrastructure, reflected in a solid 5.62% rise. Meanwhile, IOTA’s launch of its Layer 2 Ethereum Virtual Machine network adds to the frenzy, contributing to a 7.62% surge.

1. Aurora (AURORA)

The leader among today’s top gainers is Aurora, an EVM-compatible blockchain on the NEAR Protocol. It powers innovations like Aurora Cloud, helping web2 businesses transition to web3. Aurora allows seamless deployment of Ethereum applications without rewriting smart contracts. It supports all Ethereum ecosystem tools and offers gasless transactions.

Aurora integrates with the Rainbow Bridge and LayerZero, enabling asset transfers between multiple blockchains. It uses NEAR tokens for transactions and rewards, with NEAR tokens collected and used to buy back and burn AURORA tokens.

The good news in this camp is that Pyth Network has launched its price feeds on Aurora Cloud after collaborating with Aurora Labs. This integration makes Pyth Price Feeds accessible to all Aurora Virtual Chains.

These Chains facilitate immediate integration with the Pyth oracle, providing low-latency price data for various assets. Developers can now access over 500 real-time price feeds, enhancing efficiency and interoperability within the Aurora ecosystem.

We are thrilled to announce that the Aurora Cloud Data Oracle is now available for all our Virtual Chains, with no additional development needed from @PythNetwork. Accessing reliable data is now easier than ever for Aurora Cloud customers 🔥https://t.co/6uoVi9kR4a

— Aurora (@auroraisnear) June 4, 2024

As of today, Aurora’s price is $0.262182, up 9.01% in the last 24 hours. The value increased by 193% in the past year, surpassing 66% of the top 100 crypto assets. It also trades 53.62% above the 200-day SMA, indicating a solid performance.

However, the 14-day RSI is 77.49, suggesting it is overbought and may soon decline. Aurora has had 11 green days in the last 30 days, with 30-day volatility at 7%, showing moderate stability. The market activity on this project shows strong support for the new collaboration.

2. Injective (INJ)

Next on the list is Injective, a blockchain built for finance. It powers next-generation DeFi applications like decentralized exchanges, prediction markets, and lending protocols. Injective offers a unique financial infrastructure, including a decentralized, MEV-resistant on-chain order book.

It supports various financial markets, cross-chain bridging with Ethereum, IBC-enabled blockchains, and non-EVM chains like Solana. Its smart contract platform, based on CosmWasm, enables advanced interchain capabilities. Key features include a Tendermint-based Proof-of-Stake consensus mechanism, instant transaction finality, and the ability to handle 10,000+ TPS.

Recently, 12,266 INJ tokens were permanently removed, showing increased user engagement. Users are expected to have burned 6 million INJ tokens by next week. This recurring process of usage, revenue generation, and token burn strengthens token scarcity and value. As more tokens burn, the circulating supply decreases, boosting the token’s price. The transparent and decentralized token burn auctions build user trust and confidence.

$INJ token burn auctions are steadily increasing in size.

12,266 tokens were burned forever just today. By next week Injective users will have burned 𝟔 𝐌𝐢𝐥𝐥𝐢𝐨𝐧 INJ to date 🔥

More usage = More protocol revenue = More INJ burned pic.twitter.com/Y9KnATgAxg

— Injective 🥷 (@injective) June 6, 2024

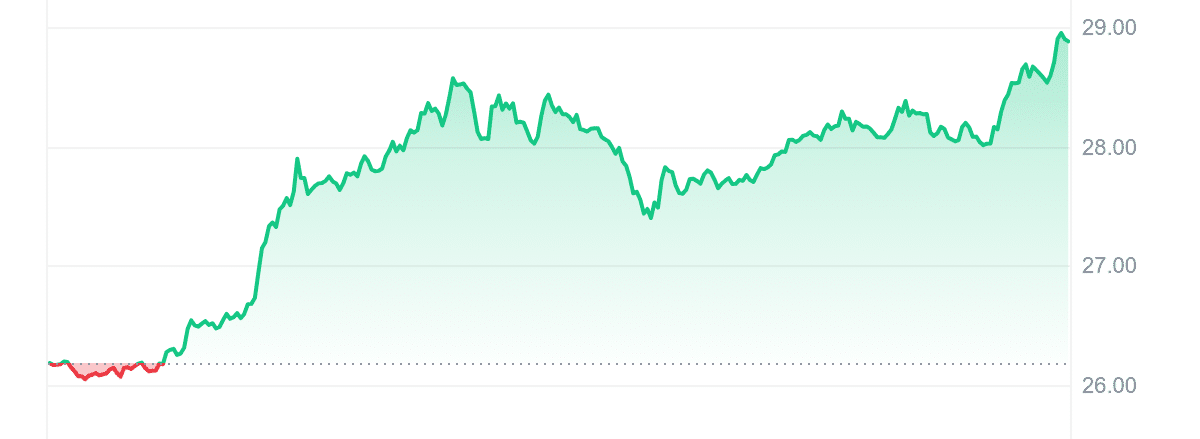

The Injective’s price has already increased by 10.3% in the last 24 hours, reflecting the impact of this move. Furthermore, the price increased 331% over the past year, outperforming 76% of the top 100 crypto assets. It is 162.34% above the 200-day SMA, indicating a solid trajectory.

Moreover, the 14-day RSI at 79.76 suggests it is overbought, similar to Aurora. The last 30 days saw 13 green days, indicating consistent performance. With 6% volatility, the price remains relatively stable.

3. Sealana (SEAL)

Sealana’s presale, closing on June 25 at 6 PM UTC, has raised over $3 million. The project combines comedic American patriotism with political satire, drawing inspiration from South Park’s “World of Warcraft guy.” This meme coin’s unique persona has captured the Solana community’s interest, merging humor with degen crypto culture.

#Sealana has got some big news for y'all today! 🦭🍻 After a long night of drinking, doin' American $SEAL things 🇺🇸 and blacking out! 😵 He woke up with some real mental clarity and made the call that the #Presale's gonna end on June 25th at 6 pm UTC! ⏰

You know what that… pic.twitter.com/va7W8abVjb

— Sealana (@Sealana_Token) June 6, 2024

Sealana’s transition from a Solana-only token to a multichain asset is noteworthy. It is now available on Binance Smart Chain and Ethereum. The team has ensured a seamless process despite not setting a presale cap.

The token is priced at a fixed $0.022, and the community’s enthusiasm continues to grow. Investors still have time to buy $SEAL before the IEO. They can join the presale by sending crypto to the project’s wallet or using the buy widget on the presale site.

With only 18 days remaining until the presale ends, Sealana is gearing up for its exchange launch. Post-presale tokens will be airdropped to investors across all blockchains, cutting gas fees and streamlining the process. With increasing community support and a dynamic ecosystem, Sealana is set for a bright future.

4. DeXe (DEXE)

DeXe boldly leads the charge in DeFi by introducing an innovative infrastructure tailored to create and govern DAOs. At its core, DeXe’s protocol champions the development of fair, meritocratic, and highly efficient DAOs, strongly emphasizing active engagement and expertise alignment.

Driven by the dynamic DeXe DAO and powered by the influential DEXE token, it empowers holders to shape the platform’s future through impactful decision-making. Additionally, by partnering with entities like SwissBorg, DeXe strengthens its ecosystem. It’s committed to expanding the utility and fostering adoption in the blockchain landscape.

Security is paramount in the DeXe ecosystem, with smart contracts automating rules to reduce errors and trust reliance. Its decentralized DAO structure ensures transparency and fairness in decision-making, while non-custodial wallets enhance user asset control, mitigating centralized custody risks. DeXe’s strong security instills confidence, while community engagement and vigilance are vital for navigating the evolving crypto space and ensuring investment safety.

🚀 #DeXe is more than just a trading pair in the #BinanceWorldChampionship2024

It’s your one-stop shop for launching DAOs & Memecoins, managing assets & building communities.

Follow us and get DeXentralized, #BUIDL with us!

Do not forget to join @Binance Spot Trading… pic.twitter.com/cuDgVlFvDq

— DeXe Protocol (@DexeNetwork) June 6, 2024

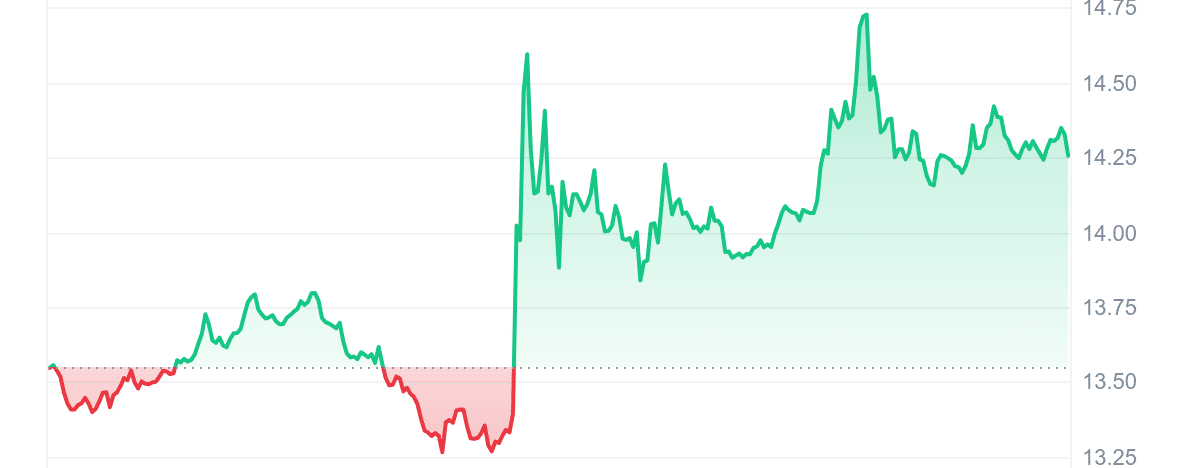

DeXe’s current price is $14.27, marking a notable 5.62% increase in the last 24 hours. Remarkably, over the past year, its value surged by a staggering 534%, outperforming 85% of the top 100 crypto assets. It stands impressively at 411.04% above the 200-day SMA of $2.80.

Notably, the price maintains a relatively stable trajectory with 30-day volatility of just 3% and 13 green days. Furthermore, its medium liquidity, with a 0.0196 volume-to-market cap ratio, underscores investor confidence.

5. IOTA (IOTA)

IOTA is a distributed ledger technology (DLT) built on a directed acyclic graph (DAG) called the Tangle. It enables decentralized data and value exchanges. Unlike traditional blockchains, IOTA processes transactions in parallel, enhancing scalability and efficiency.

Its architecture eliminates the need for external validators and transaction fees, ensuring cost-effective and secure transfers. IOTA supports Web3 through tools for creating Layer 2 chains, deploying smart contracts, minting tokens, and NFTs, and introducing digital identities.

IOTA recently launched its Layer 2 Ethereum Virtual Machine (EVM) network. This network focuses on real-world asset (RWA) usage and introduces smart contracts, cross-chain capabilities, and MEV resistance.

The launch aims to attract institutional investors and facilitate decentralized financial (DeFi) applications. Co-founder Dominik Schiener emphasized the network’s potential to bring trillions of assets on-chain, highlighting its unique positioning with the IOTA Ecosystem DLT Foundation.

✨IOTA’s #EVM Mainnet Unleashed✨ Today marks a significant milestone for #RWA and real utility: the launch of #IOTAEVM, a fully EVM-compatible Layer 2 solution for the #IOTA network. Dive into it here, or check the 🧵⤵️🔗https://t.co/w7yghhSI8F pic.twitter.com/JvMEFVtlPw

— IOTA (@iota) June 4, 2024

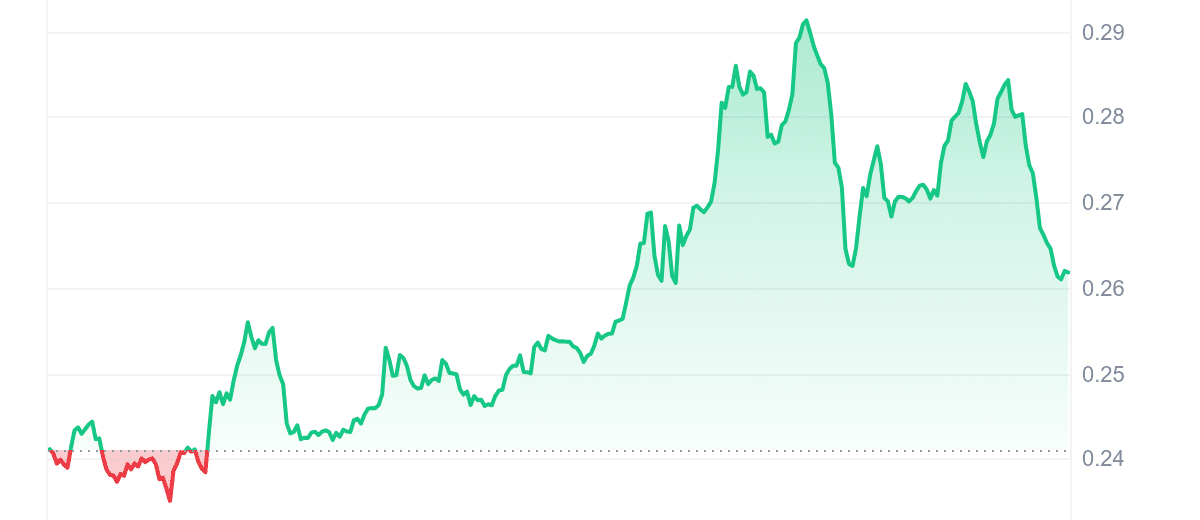

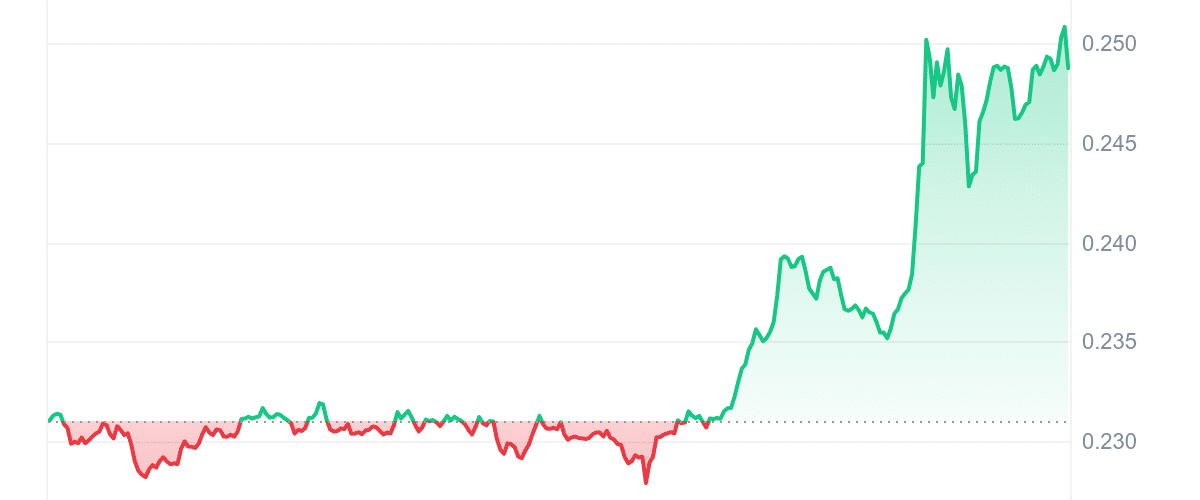

Following this update, IOTA’s price is $0.248612, marking a 7.62% increase in the last 24 hours and a 39% rise over the past year. It trades 30.17% above its 200-day SMA, showcasing robust market momentum.

Like Injective, IOTA has had 13 green days in the last 30 days, indicating moderate stability. The 14-day RSI is 56.08, suggesting neutral market sentiment. With a 30-day volatility of 3%, IOTA exhibits low volatility and high liquidity, supported by a market cap of $815.86 million and a 24-hour volume of $73.39 million.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage