Join Our Telegram channel to stay up to date on breaking news coverage

Despite a 20% dip this past month, Bitcoin’s long-term potential remains strong. Earlier this year, Bitcoin surged nearly 50% due to key catalysts like the approval of spot-price Bitcoin ETFs and the halving event in April. Recent declines are driven by the disbursement of bitcoins from Mt. Gox and the German government’s liquidation of seized bitcoins. These concerns, while significant, account for a small fraction of Bitcoin’s market cap. For long-term investors, this pullback may present a buying opportunity amidst a burgeoning AI-driven cryptocurrency market.

Biggest Crypto Gainers Today – Top List

Today’s crypto market is ablaze with excitement as top gainers like Covalent, Ronin, Maker, and DeXe surge ahead with remarkable gains. Covalent has seen an impressive 21.31% increase, fueled by a recent $5 million funding round and strategic insights from industry luminary Arthur Hayes. Following closely, Ronin boasts a notable 10.65% rise, boosted by its integration of PHPC liquidity, enhancing its role in the burgeoning NFT and gaming sectors.

Furthermore, Maker maintains a steady course with a solid 7.54% increase, demonstrating steadfast governance over the DAI stablecoin. DeXe rounds out the lineup with a robust 6.74% gain, affirming its rise in DeFi through focused DAO governance and sustainable growth strategies. Now is the time to analyze these projects in greater detail for more insightful and profitable decision-making.

1. Covalent (CQT)

Covalent harnesses big-data technologies to distill actionable insights from an immense pool of data points, empowering investors and developers to direct their efforts toward more impactful objectives. It aggregates information from multiple sources, delivering individualized data by wallet, including current and historical investment performance across all digital assets. The Covalent API ensures rapid, consistent data delivery through a single interface. The native token, CQT, serves governance, staking, and network access purposes.

Recently, RockTree Capital led a successful $5 million funding round for Covalent, supporting its strategic expansion into Asian markets. This financial boost will enhance data availability in key regions such as China and Singapore. Over $20 million has been raised through token sales, showcasing robust market trust in Covalent’s offerings. The involvement of advisors like Arthur Hayes, founder of BitMEX, further strengthens Covalent’s strategic framework. Hayes’s expertise is expected to drive forward Covalent’s mission to revolutionize blockchain data access worldwide.

1/ The moment you’ve all been waiting for 🫴

We are stoked to announce that Covalent has secured $5M in a strategic funding round led by @RockTreeCapital, with @CMCC_Global, @MoonrockCapital, and @DoublePeakGroup on board 🤝 pic.twitter.com/fjTjfvsdOU

— Covalent (@Covalent_HQ) June 26, 2024

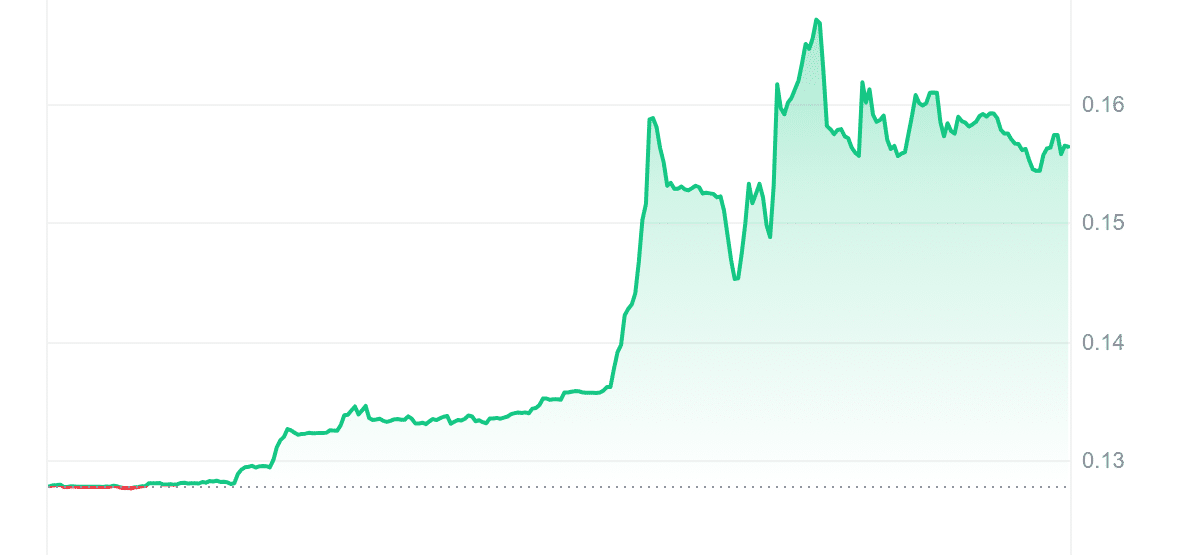

CQT has impressed investors with a remarkable 21.31% increase in the last 24 hours, placing it at the forefront of the top gainers. Despite being overbought with a 14-day RSI at 100.00, suggesting a potential price correction, its performance remains noteworthy. Unlike Ronin’s 33% of green days, Covalent boasts 43%, indicating a more consistent upward trend over the past month. However, its price trades below the 200-day SMA by 43.15%, highlighting a significant growth potential. While its yearly gain of 58% is modest compared to DeXe’s 320%, Covalent’s balanced volatility at 16% ensures stability and predictability for cautious investors.

2. Ronin (RON)

Our next top gainer, Ronin, is an EVM blockchain tailored for gaming, developed by Sky Mavis, the creators of Axie Infinity. This blockchain has proven its scalability by supporting millions of daily users and processing over $4 billion in NFT volumes. With near-instant transactions and minimal fees, Ronin offers a seamless experience for Web3 games. It focuses on high-quality apps, ensuring minimal spam and high uptime for games. Backed by Sky Mavis, Ronin benefits from their expertise in product development, community building, and go-to-market strategies.

In recent news, Coins.PH, a regulated Filipino crypto exchange, has integrated PHPC liquidity on Ronin. The Philippines is a significant sector for Axie and Ronin communities. With PHPC on Ronin, users can make fast, low-cost transactions in the Philippine Peso. This integration supports peer-to-peer transfers, merchant payments, remittances, and business transactions. The launch of PHPC enhances economic freedom in the Philippines, making it easier for users to utilize their Ronin wallets for everyday needs.

PHPC is LIVE on Ronin! 🇵🇭

The stable coin of the Philippines has arrived ⚔️

• 1 PHPC ≈ 1PHP⁰• Approved by the Bangko Sentral ng Pilipinas⁰• Supported by @coinsph

Full announcement 👇

📜 : https://t.co/wNAWuCJdsO pic.twitter.com/C4IsbreU2V

— Ronin (@Ronin_Network) July 8, 2024

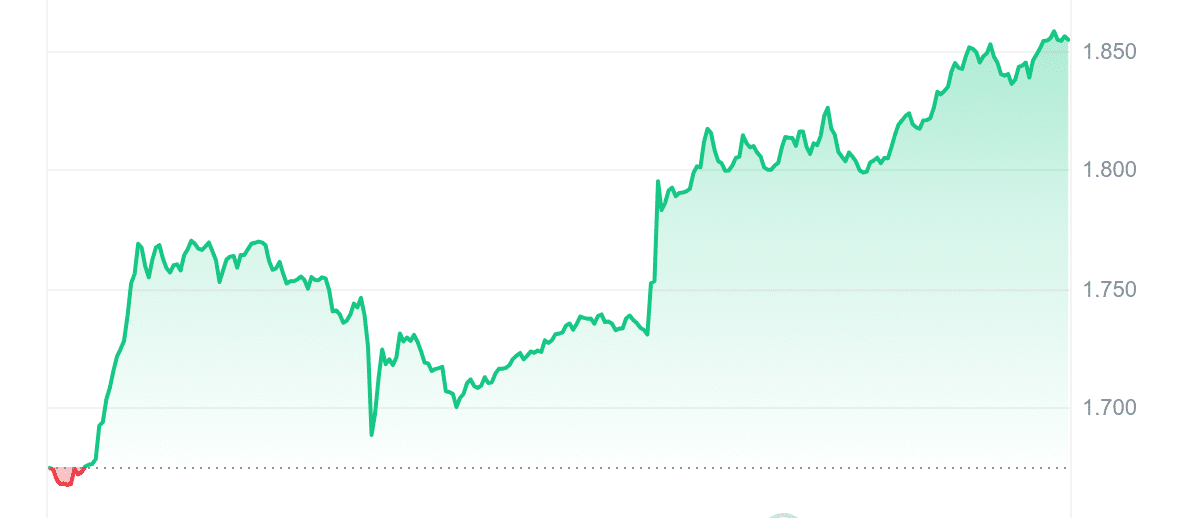

RON surged 10.65% in the last 24 hours, driven by the recent PHPC liquidity integration, showcasing its robust market presence. This token’s high RSI of 71.32 indicates it’s overbought, akin to Covalent, but it stands out with a significant 179% price increase over the past year. Although it experienced fewer green days (33%) than Covalent (43%) and Maker (53%), Ronin’s trading above the 200-day SMA by 140.40% highlights its strong upward momentum. Its moderate volatility of 16% matches Covalent’s, offering a stable investment option. Ronin’s impressive liquidity ratio of 0.0539 underscores its market efficiency and investor confidence.

3. WienerAI (WAI)

Alongside our look at today’s top gainers, let’s take a moment to highlight an exciting presale investment opportunity. As AI industry giant Nvidia aims for a remarkable $4 trillion valuation, signaling a booming AI industry, WienerAI is carving its niche with innovative AI-driven solutions. The project has already raised over $7 million in its ICO phase, defying the downward trends seen in many meme coins.

We've hit the $7M milestone! 🌭🚀

A huge thank you to our amazing community! The journey is just beginning, and the future is bright! 💰🐾 pic.twitter.com/ZPmTgXb6Lu

— WienerAI (@WienerDogAI) July 3, 2024

WienerAI distinguishes itself with an amazing AI-powered trading bot that executes trades without fees, leveraging advanced algorithms for optimal market outcomes. This strategic advantage has garnered a strong following of over 14,500 on Twitter and 12,000 on Telegram, reflecting robust community support and investor confidence.

Its tokenomics are equally compelling, with a total supply of 69 billion tokens strategically allocated to ensure sustainability and growth. This includes 30% for the presale, 20% for staking rewards, and another 20% dedicated to community building through airdrops and giveaways. The project’s commitment to transparency and security is underscored by smart contract audits conducted by SolidProof. Investors are seizing the opportunity with WienerAI, attracted by its innovation, strong community, and potential for significant returns, with staking yields estimated at 163%.

4. Maker (MKR)

Third on the list of top gainers is Maker, which serves as the governance token for MakerDAO and the Maker Protocol, operating on the Ethereum blockchain. This platform allows users to issue and manage the DAI stablecoin, a decentralized cryptocurrency with a value soft-pegged to the US dollar. MKR tokens enable holders to vote on key decisions regarding the Maker Protocol’s development and operation. Although MKR tokens do not provide dividends, they are expected to appreciate as DAI succeeds.

MKR holders can vote on adding new collateral assets, adjusting risk parameters, changing the DAI Savings Rate, selecting oracles for off-chain data, and upgrading the platform. Additionally, MKR is an ERC-20 token secured by the Ethereum blockchain, which uses the Ethash proof-of-work function. This security framework ensures the Maker Protocol’s integrity, leveraging Ethereum’s infrastructure to maintain trust and prevent vulnerabilities.

Understanding MakerDAO Governance

MakerDAO’s decision-making process involves Governance Proposals, Governance Polls, and Executive Votes.

MKR holders exercise their voting power to approve or reject changes within the Maker Protocol and the DAO itself.

Here are the stages of… pic.twitter.com/gXcYXiovcj

— Maker (@MakerDAO) June 20, 2024

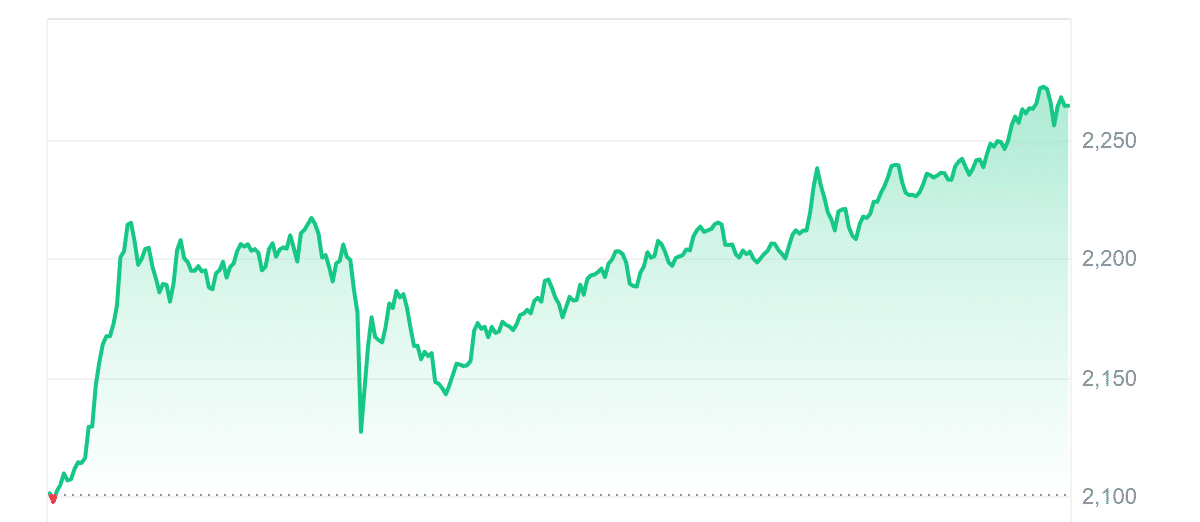

MKR has delivered a steady 7.54% increase in the past 24 hours, showing its reliable performance. Unlike Covalent and Ronin, Maker avoids overbought territory, providing a potentially safer entry point for investors. It’s impressive 53% of green days over the last month, indicating a more consistent upward trend. With a lower volatility of 5%, Maker offers a stable investment compared to CQT and RON’s 16%. Trading 29.67% above its 200-day SMA and with a 144% annual gain, Maker’s solid foundation and high liquidity ratio of 0.3146 make it an appealing choice for long-term investors.

5. DeXe (DEXE)

DeXe Protocol is an innovative infrastructure designed for creating and governing DAOs, focusing on meritocracy and proper incentive alignment. It emphasizes active and meaningful participation from members and aims to foster rapid and sustainable growth. Governed by the DeXe DAO, the protocol’s $DEXE token serves as the governance token, playing a crucial role in decision-making and policy direction. This setup ensures that DeXe remains aligned with the needs of its community and the broader DeFi sector.

DeXe supports the development of DAOs by providing direct funding for research, development, education, and advocacy. The protocol leverages smart contracts and non-custodial wallets to enhance security, minimizing risks associated with centralized custody. Partnerships with entities like SwissBorg expand its ecosystem and application, promoting a more inclusive and fair DeFi environment. The DEXE token also rewards active participants, ensuring their contributions are recognized and valued.

💥 New DAO Alert!

Thrilled to unveil a new DAO on #DeXe, boasting a TVL of over $110M! @your_boxy DAO has successfully concluded its #tokensale and listed on @pancakeswap, showcasing a successful project launch. 🌐💪 Grow and innovate with #DeXe! pic.twitter.com/l8CrG789Mz

— DeXe Protocol (@DexeNetwork) July 4, 2024

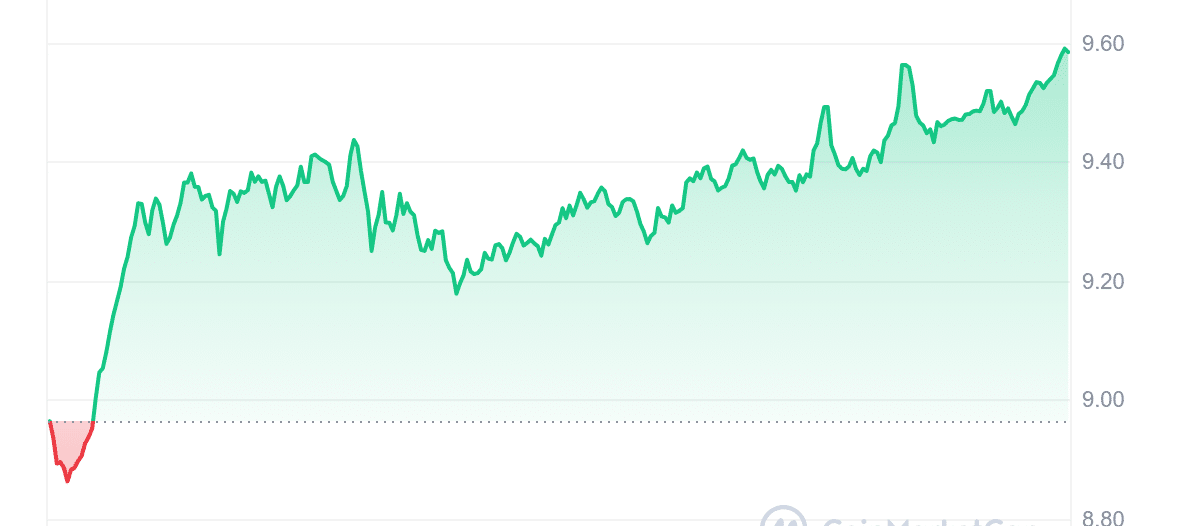

DEXE has shown a notable 6.74% rise in the last 24 hours, maintaining a strong performance despite being less liquid compared to other gainers. While its ten green days (33%) over the past month align with Ronin, it lags behind Maker’s 53% and Covalent’s 43%. However, DeXe stands out with a remarkable 242.08% trading above its 200-day SMA, far surpassing the others, and a 320% price increase over the past year. Its neutral RSI at 38.33 suggests stable trading conditions, contrasting with Covalent’s and Ronin’s overbought status. With moderate volatility of 10%, DeXe presents a balanced investment opportunity, combining high returns with manageable risk.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage