Join Our Telegram channel to stay up to date on breaking news coverage

Today’s crypto market is experiencing a strong rally, driven by positive U.S. economic data and gains in American stocks. Specifically, Bitcoin has surged to over $62,000, marking an impressive 8% jump in just 24 hours. Meanwhile, Ethereum is riding high too, climbing 10% to hit $2,690. Additionally, Solana has joined the party, rising to $158, a solid 2.3% increase.

This surge is a welcome change from the recent slump driven by recession worries and a stronger Japanese yen. However, with investor sentiment now lifting thanks to a drop in unemployment benefit claims, the market is experiencing a broad and enthusiastic rebound.

Biggest Crypto Gainers Today – Top List

In the midst of this exciting market rebound, today’s top crypto gainers are standing out with impressive performances. Injective has surged by 12.01%, reaching $17.71, thanks to its robust DeFi infrastructure and high liquidity. Ethereum is also making waves with a significant 10.45% increase, now trading at $2,690. Stacks has climbed 10.80% to $1.53, benefiting from its unique integration with Bitcoin, while Nexo has seen an 8.97% rise to $1.095748. This surge in key cryptocurrencies highlights the dynamic shifts in the market and reveals potential opportunities for savvy investors.

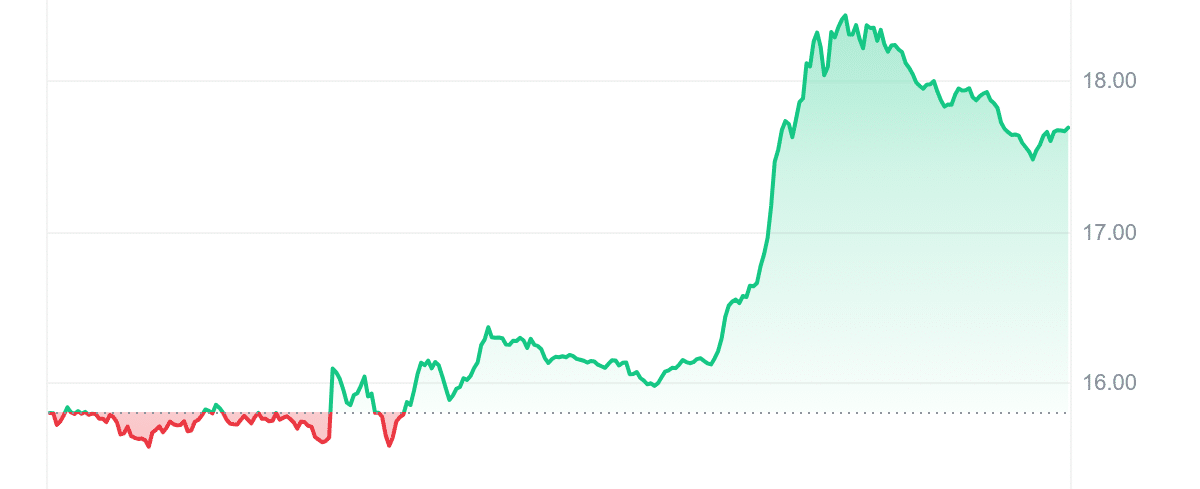

1. Injective (INJ)

Injective is crafted for finance, powering advanced DeFi applications. It delivers a decentralized infrastructure for spot and derivatives exchanges, prediction markets, and lending protocols. By providing a decentralized, MEV-resistant on-chain order book, it supports diverse financial markets. Moreover, its cross-chain bridging connects Ethereum, IBC-enabled blockchains, and non-EVM chains like Solana. Consequently, Injective offers seamless interoperability and functionality for a wide range of financial activities.

Additionally, Injective utilizes CosmWasm and the Cosmos SDK to enable high-speed transactions with Tendermint-based Proof-of-Stake consensus. This architecture supports over 100 projects and a global community of 150,000 members. Recently, Utila integrated Injective, enhancing digital asset management. This update allows for effortless transfers, a unified view of INJ and IBC tokens, and robust governance. Furthermore, Utila offers automated workflows and simplified exchange integration. Thus, Injective remains a leader in innovation, streamlining financial processes in the DeFi space.

Leading institutional MPC wallet, Utila, has natively integrated Injective after having processed over $3 Billion in asset transfers to date.

Utila also offers asset tokenization capabilities for institutions to seamlessly onboard and manage new RWA offerings on Injective 🏦 pic.twitter.com/M168hrtdRC

— Injective 🥷 (@injective) August 8, 2024

Currently, INJ is experiencing a notable 12.01% surge in the last 24 hours, bringing its price to $17.71. It boasts strong liquidity with a volume-to-market cap ratio of 0.2672. However, with a 14-day RSI of 79.76, it appears overbought, hinting at a possible pullback. Despite this, INJ is performing well, trading 60.51% above its 200-day SMA and showing a 132% increase over the past year. Although it has outpaced 73% of the top 100 crypto assets, it still trails behind STX in recent one-year gains.

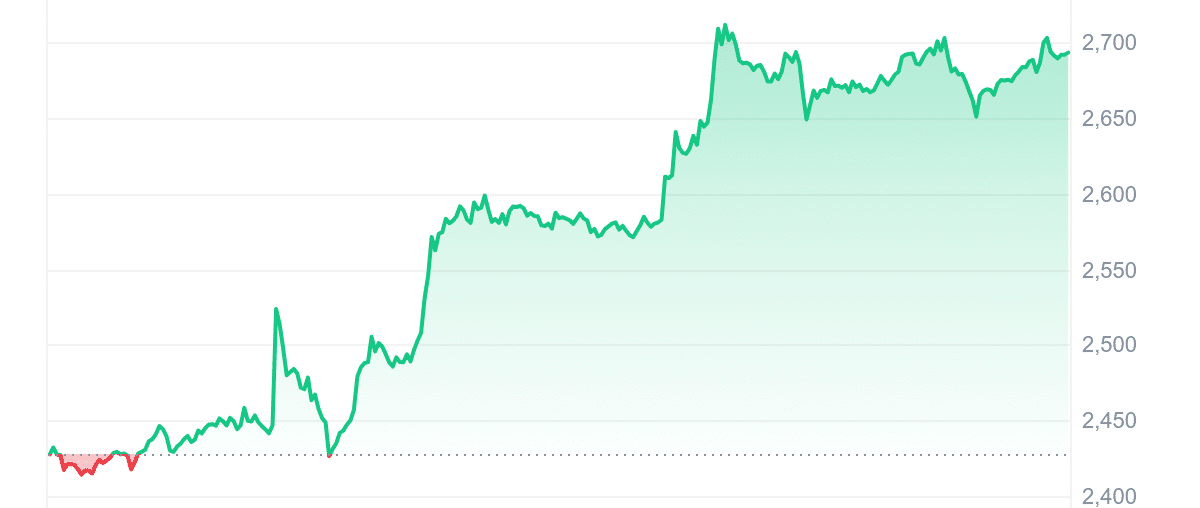

2. Ethereum (ETH)

Ethereum is a decentralized, open-source blockchain platform designed for DApps and smart contracts. Unlike Bitcoin, which primarily serves as digital money, Ethereum enables developers to create and deploy applications. It uses smart contracts—self-executing agreements coded into the blockchain. These contracts automate terms, eliminate intermediaries, and reduce errors.

One audit competition to rule them all 🏆

Immunefi, in collaboration with the @Ethereum Foundation, presents the first-ever Attackathon to enhance Ethereum’s protocol security. 💪

Become a sponsor and help make history ✨

1/4#EFxImmunefi pic.twitter.com/m1HtH6G2r0— Immunefi (@immunefi) July 8, 2024

Furthermore, Ethereum’s blockchain acts as a “world computer” on a distributed network of nodes. Each node keeps a complete copy and runs smart contracts, ensuring no single entity controls the system. The Ethereum Virtual Machine (EVM) uses Solidity, a Turing-complete language, to support complex programming. Consequently, it facilitates a wide range of applications, from financial tools to games. Additionally, ETH, Ethereum’s native cryptocurrency, covers transaction fees and services, boosting Ethereum’s functionality in the blockchain ecosystem.

Ethereum, currently priced at $2,690.06, has surged by an impressive 10.45% in just the last 24 hours. With a strong volume-to-market cap ratio of 0.1191, it continues to showcase high liquidity and vibrant market activity. However, its 14-day RSI of 38.20 shows a neutral market sentiment, hinting at potential sideways trading. Unlike Injective and Stacks, ETH is trading below its 200-day SMA by 14.63%, reflecting a recent dip. Yet, its 45% annual growth and 53% positive trading days in the last month show that ETH is still holding its ground, outpacing 52% of top crypto assets.

3. Pepe Unchained (PEPU)

Pepe Unchained is shaking up the crypto world with its innovative meme coin approach. As the first meme coin Layer 2 solution on Ethereum, it tackles the high gas fees and slow transaction speeds that have plagued its predecessors. Operating as an independent blockchain with a unique consensus mechanism, Pepe Unchained delivers significantly lower costs and transaction speeds up to 100 times faster than Ethereum.

Moreover, Pepe Unchained isn’t just about speed. Its Layer 2 solution also boosts interoperability. The project is set to integrate with various Ethereum Layer 2 networks, thanks to upcoming improvements like EIP-7683. Consequently, $PEPU holders will enjoy easier asset exchanges and broader opportunities across different Layer 2 solutions. This enhanced integration will attract developers, further expanding $PEPU’s ecosystem and reach.

The Breaker of Chains did it again!

$7.5M raised! 🐸⛓️ pic.twitter.com/ygR2ivQhtl

— Pepe Unchained (@pepe_unchained) August 7, 2024

Investors are eagerly embracing Pepe Unchained, with the presale already surpassing $7.6 million and continuing to gain momentum. Priced at $0.00894610, $PEPU offers an impressive annual percentage yield (APY) of 256% for staking. With its smart contract passing rigorous audits, the project promises security and reliability. For those seeking to capitalize on the meme coin trend, Pepe Unchained presents a compelling opportunity with its cutting-edge features and strong growth potential.

4. Stacks (STX)

Stacks is a Bitcoin Layer that enables smart contracts and decentralized apps to settle directly on the Bitcoin blockchain. This integration, importantly, unlocks $500 billion in Bitcoin capital, fully leveraging the strength and security of the Bitcoin L1 for Dapps. Notably, it’s a powerful tool for decentralized apps, unique in its ability to power atomic BTC swaps and support assets owned by BTC addresses.

Thanks to its Proof of Transfer and the Clarity language, Stacks can consistently read from the Bitcoin state. Moreover, it automatically hashes and settles all transactions on Bitcoin Layer 1 (L1), securing its blocks with 100% of Bitcoin’s hashpower. Therefore, any attempt to reorder Stacks blocks would require a reorganization of the entire Bitcoin blockchain, making such attacks extremely difficult. Additionally, Stacks combines Bitcoin’s Proof of Work with its own Proof of Transfer for unparalleled security. Users transfer BTC to mine STX, further safeguarding the network.

Did you know that Stacks is the leading Bitcoin L2 in developer activity? 🟧

Hundreds of developers are building on Stacks to activate the Bitcoin economy.

Are you one of these developers? Make sure to code, commit, and earn from a 10,000 STX prize pool. Join below 👇 1/2 pic.twitter.com/U93Hd620bh

— stacks.btc (@Stacks) August 8, 2024

In the past 24 hours, Stacks has seen a significant price increase, climbing 10.80% to $1.53. Although its liquidity is high, it doesn’t quite match Injective, with a volume-to-market cap ratio of 0.1145. Unlike INJ, STX isn’t overbought, with an RSI of 37.18, signaling a more neutral market stance. Impressively, it’s trading 57.50% above its 200-day SMA and has achieved a remarkable 162% price increase in the last year, even outpacing Injective in long-term gains. STX’s consistent performance, with 14 green days out of 30, showcases its steady climb.

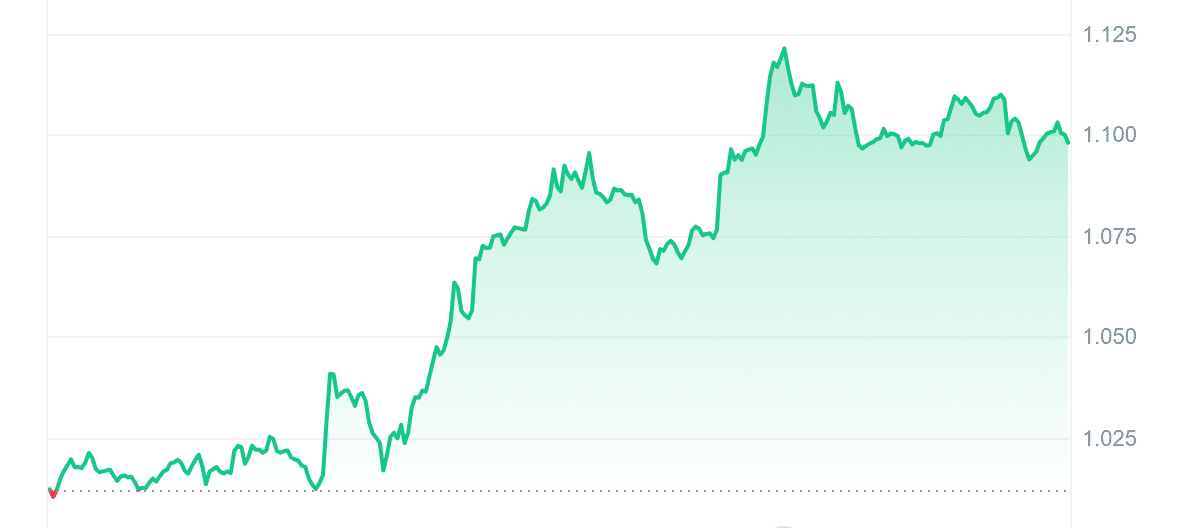

5. Nexo (NEXO)

Nexo is a top digital assets institution that maximizes digital asset value with advanced trading solutions. It offers liquidity aggregation, tax-efficient credit lines, and the NEXO Token, an ERC-20 Ethereum-based token. This token provides access to Nexo’s Loyalty Program and benefits like preferential rates and cash-back.

It stands out with its Instant Crypto Credit Lines, which offer loans in over 40 fiat currencies or stablecoins using digital assets as collateral. Additionally, it provides daily payouts, compounding interest, and flexible yields with no fees. Users can swap interest-earning cryptocurrencies for better assets. Nexo also offers futures trading with up to 50x leverage and the Nexo Card, which allows spending fiat value from crypto holdings. For institutional clients, Nexo Prime offers a complete platform for trading, borrowing, and secure storage. Nexo maintains high security with ISO certifications, 2FA login, and a strict over-collateralized policy.

Send #crypto to friends in seconds – anytime, anywhere.

It’s as easy as sending a GM. All you need is a phone number or email:

👌 Completely free

🆕 Import phone numbers from contacts

🤝 Send to anyone, even folks without a Nexo account

🌱 Your buddy starts earning immediately pic.twitter.com/9K9FK4LNYa— Nexo (@Nexo) August 8, 2024

Nexo has surged by 8.97%, raising its price to $1.095748. This uptick places it in a solid position, with medium liquidity and a 0.0109 volume-to-market cap ratio. The 14-day RSI stands at 46.19, reflecting a neutral stance comparable to top gainers like Ethereum and Stacks. Notably, its price is 17.70% above its 200-day SMA, indicating strong support, and it has soared by 71% over the past year.

Moreover, Nexo has demonstrated steady performance with 50% green days in the last 30. This consistency outpaces 62% of the top 100 crypto assets, making it a reliable player. However, while Nexo remains a solid contender, it hasn’t been as explosive as Stacks or Injective in recent gains.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage