Join Our Telegram channel to stay up to date on breaking news coverage

The9 Ltd stands as a gaming firm based in China, with a listing in NASDAQ, to boot. Now, however, the firm saw a monumental rise in stock prices, going up by 87%, when it announced on Monday that it would start to pivot into the crypto mining space.

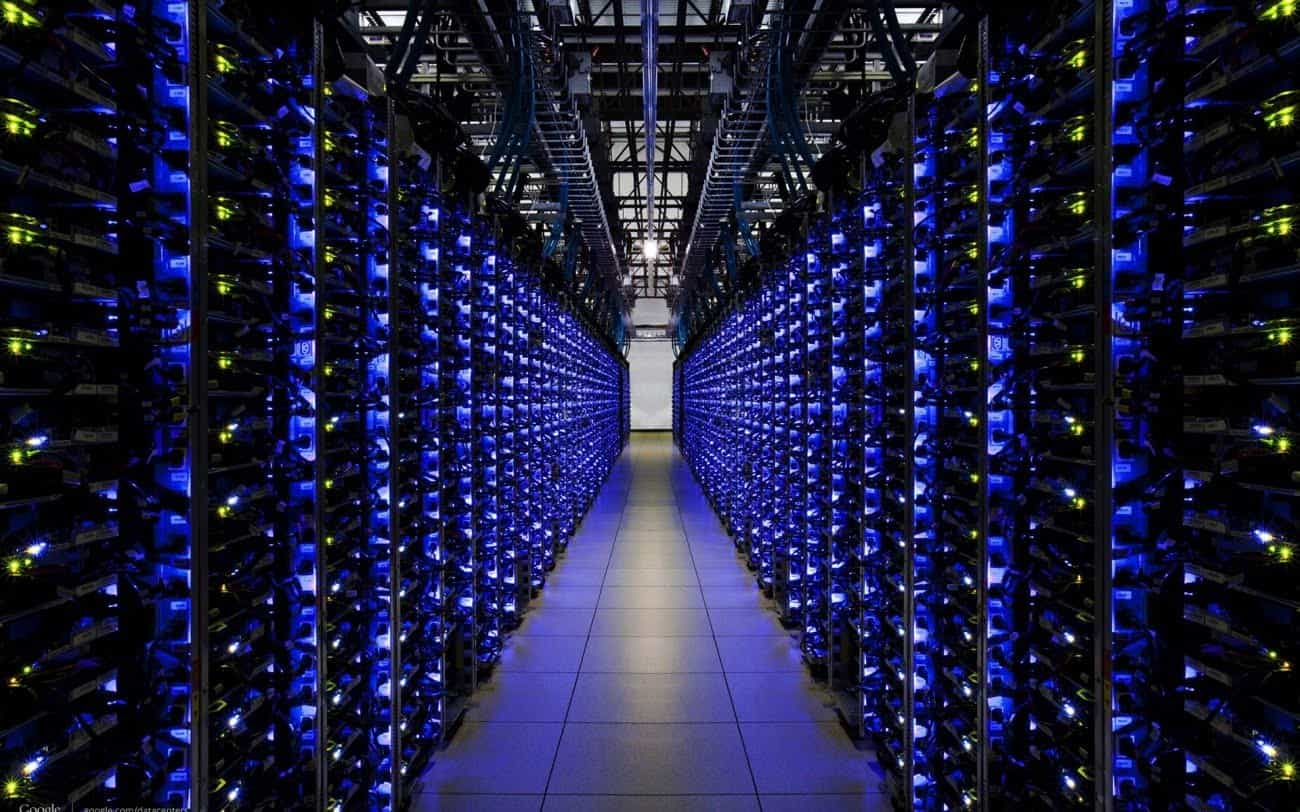

Moving From Games To Crypto Mining

The gaming firm itself, based in Shanghai, launched all the way back in 2004. Its big edge over the rest of the market was its exclusive license for World of Warcraft operation within China at large. On Monday local time, the firm stated that it had inked a new legally binding investment term sheet.

This sheet was made with several former directors of Canaan, a Bitcoin miner maker. These names include Zhang Li, Sun Qifeng, as well as Kong Jianping. Jianping, in particular, had boasted the position of co-chairman of Canaan in the past.

This term sheet’s goal’s entire point is to allow The9 to issue these former Canaan directors with Class A ordinary shares and warrants. Through this agreement, these former directors will help The9, in turn, in the development of its own crypto mining business. This includes the sourcing process for crypto mining equipment.

The Mandatory Kind Words

Should all of these warrants be exercised, it’s expected by The9 that it will raise approximately $34 million in USD and/or cryptocurrencies. From there, the firm plans on opening a new wholly-owned subsidiary to spearhead its new crypto mining venture, going by the name of NBTC Limited.

Jun Zhu stands as the Chairman and CEO of The9, and gave a public statement about the matter at large. He explained that his firm’s goal is to contribute anywhere between 8% and 10% of the global Bitcoin hash rate through the building of crypto mining machines. Furthermore, the CEO and the firm is aiming for a 10% global hash rate on both Grin and Ethereum’s global networks as well.

A Move Making Investors Proud

It seems that this news was very good for investors. After the announcement, the stock price for The9 saw a rise by a factor of 87% within US trading hours come Monday. With this, the firm has managed to push its market capitalization up to $58 million in total.

This pivot isn’t groundbreaking on its own, however. Many a publicly listed company, especially in the US, has made a similar move as of late. It all started back in 2017 when the great crypto price rally occurred, and hasn’t stopped since. A notable example of this would be Riot Blockchain, which was known as Bioptix before its rebranding as it moved into the space.

Something to make a note of, however, is The9 receiving a notice from NASDAQ’s listing qualification division. On the 17th of November, NASDAQ notified The9 that tit no longer met the listing requirements needed for it, as it failed to maintain a market capitalization of $35 million. This announcement changed things around quite quickly.

Join Our Telegram channel to stay up to date on breaking news coverage