Join Our Telegram channel to stay up to date on breaking news coverage

In the past several weeks, the non-fungible token market has gotten smaller in nearly every metric. The NFT market began to shrink sometime last month, leaving many projects in massive losses. In this article, we have listed several tips that collectors and investors can still use to make a profit despite the bear market.

It’s worth noting that the non-fungible token market operates within its own district economic cycle. In that context, the recent drop in the floor price of popular NFTs has perplexed many investors and enthusiasts, especially for blue-chip NFTs.

Nonetheless, the crypto bear market also presents an opportune time for investors to accumulate assets at lower prices and trigger a new hot wave in the NFT market. The new Opepen Threadition, an NFT project from the digital artist Jack Butcher, is a recent perfect example.

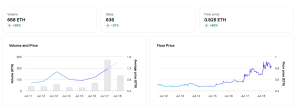

Recently, Opepen Threadition injected new energy into the NFT market with its “for the culture” vibe. The new vibe created a short market frenzy amid the bear, resulting in a remarkable 72.7% increase in the floor price of Opepen Edition over the past seven days.

Stats of Opepen Edition NFT collection. Source: OpenSea

Therefore, it is crucial to identify the optimal timing to buy the dip and maximize potential returns. Before diving into money-making tips amid the bear market, we have shared how investors can identify more opportunities to trade NFTs before any price drop.

1. Whales Market Activity

Investors can identify more trading opportunities by looking out for unusually increased price volatility, which can be caused by an imbalance between sellers and buyers due to whales selling off. In most cases, whale activity in the crypto market correlates closely with price changes, as recently evidenced by the Bored Ape Yacht Club NFT collection trend.

Source: NFTGo.io, Floor price & Whale Sales of Bored Ape Yacht Club

Data from NFTGo substantiates correlation and coefficient between whale sales and floor price changes are over 0.7, which reveals a strong positive relationship, indicating that as whale sales increase, the floor price tends to decrease. By tracking whale activities, investors can anticipate upcoming uncertain market fluctuations.

2. Market Imbalance: Sellers Vs. Buyers

Market imbalance, characterized by an evident surplus of sellers compared to buyers, is another important factor investors should track to unlock more market opportunities. Based on the recent 10,000 transactions related to Bored Ape Yacht Club, the number of unique addresses engaged in selling for the past few weeks is twice the number of addresses purchasing NFTs. This discrepancy suggested the potential beginning of another bear season.

3. Short Term Accumulation

The sudden surge of short-term buyers is another aspect investors should keenly observe to set the proper time for trading. In June, the majority of Bored Ape Yacht Club investors capitalized on the price reaching its lowest point. At the time, short-term buyers took advantage of crashing floor prices, purchasing NFTs at the most favorable value.

Source: NFTGo.io, Holding Period Trends&Distribution

This market strategy suggests a sense of urgency and opportunism among these buyers, who aim to secure profits given the attractive price levels. Subsequently, the swift return to average short-term holder numbers in the subsequent days indicates that these investors sold off their newly acquired BAYCs, reinforcing their speculative intent.

4. Abnormal Floor Price Increase

Lastly, an abnormal increase in floor prices is another factor hinting at upcoming price drops. In this case, Bored Ape Yacht Club is a perfect example. In February this year, the Bored Ape Yacht Club NFT collection experienced an unusual spike in its floor price. The sudden spike was followed by a floor price decrease from sometime in June.

Source: NFTGo.io, Floor Price & Liquidity

Moreover, from the start of the year, the global NFT market experienced a surge in liquidity, potentially from seller activity. Again, the high liquidity volatility attracted an imbalance in the market, contributing to the recent floor price crash. Therefore, monitoring liquidity changes and volatility can offer valuable insights and act as a signal for potential price declines in the NFT market.

Five Tips You Can Use To Make Profits

Despite the recent crypto bear market that has left many NTF floor prices crashing by more than 70%, collectors and investors can identify opportunities to trade NFTs and generate revenues. Below we have listed some common strategies that notable profit-making NFT holders employ amid the bear market:

Source: NFTGo.io, Top PnL traders

1. Multiple Trading Platforms

Limiting oneself to single popular platforms like OpenSea might result in missing out on unique opportunities on other NFT marketplaces like Magic Eden, Blur, X2Y2, and LooksRare. In the contest, exploring multiple marketplaces can broaden investors’ selection and offer unique investment opportunities.

2. Bulk Mint Trading

Bulk minting is another new strategy most full-time investors use to generate revenue despite the market slump. This trading strategy primarily involves participating in the initial minting process of new NFT projects in large quantities. In this case, traders secure their position on the whitelist by solving prerequisite tasks, thereby earning the privilege of minting NFTs ahead of other traders.

Bulk minting allows investors to access free mints, leading to significant profits. However, its worth noting that the bulk-mint strategy is multifaceted and requires a high level of involvement and knowledge about the nuances of non-fungible token project launches.

3. Diversification

Diversification is a trading strategy involving the purchase of NFTs based on the rarity within blue-chip projects and emerging NFT projects. Rarer NFTs often retain their value better, making them a worthwhile investment. In this case, investors can set alerts to buy specific rarer NFTs and resell for better returns amid the recent NFT slump.

4. Bottom-Fishing Trading

Lastly, Bottom-fishing is a trading strategy suitable for high-risk traders. The high-risk, high-reward strategy involves making below-market-value offers for NFTs to acquire undervalued assets. However, the market trick requires excellent market knowledge to identify potential bargains and the patience to wait for the market to realize these NFTs’ actual value.

Are These Trading Tricks Viable?

Pransky.eth is a perfect example of a trading address that has applied some of the listed strategies and somewhat gained impressive returns. Over the past three months, Pranksy.eth minted around 1.1K NFTs, including 121 from Ether Avatar and many from lesser-known projects, demonstrating a deft execution of the bulk-mint strategy.

Moreover, among the 331 NFT collections the NFT investor bought, 90% are from lesser-known NFTs, embodying strategic selection and diversification. The combination of these two strategies reduces exposure to single-project volatility and broadens the possibility of hitting high-value assets. Notably, the crypto market is speculative and requires much sensitivity.

Related NFTs News:

- NFT Investor ‘JKLaub” Loses Over $150K Worth Of NFTs In A Hack

- CyberKongz And Sky Mavis Join Hands To Launch An NFT Collection

- NFTs Aren’t Dead – This NFT Collection Has Just Sold Out In Seconds

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage