Join Our Telegram channel to stay up to date on breaking news coverage

For the past few years, the non-fungible token market has experienced exponential growth, gaining mainstream traction among notable institutions, investors, and businesses more than ever before. The NFT market bull run began sometime in late 2021, leaving the majority of NFT projects flourishing to new all-time market highs.

Unfortunately, the non-fungible token market has recently experienced a short market downturn, which has left many NFT projects shielding over 70% of their value. The non-fungible token market comedown began sometime in June last year before slowing down at the beginning of this year.

The NFT market slump again started worsening sometime last month, leaving many NFT projects in massive losses. This is the first time the non-fungible has recorded minimum trading sale volume since it came into the spotlight sometime in 2021. Below will look in-depth to see whether the NFT market will ever return its past glory.

In a July 24 blog post, Kermit, a renowned NFT Growth Consultant, shared a thread explaining whether the non-fungible token market, which has now reached its all-time low, will ever regain its former market glory. The NFT growth consultant has also shared several recommendations needed to revive the NFT market.

The NFT market has hit an all-time low!

Will it ever return to its former glory?

Or is this the end of it all?

Here's how we can steer the ship to a better course👇

(1/19)🧵 pic.twitter.com/nyjUkqB6X9

— Kermit 🐸 (@crypto__kermit) July 24, 2023

The State Of NFTs Right Now

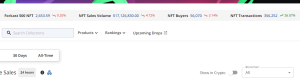

The global non-fungible token market is down 5% today, recording a trading sales volume of $17 million in the past 24 hours. The number of collectors trading in the NFT market has also cooled off, with just 56,070 buyers trading in the past 24 hours.

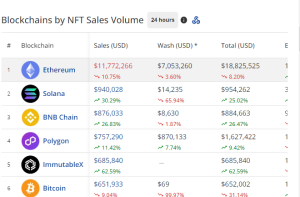

Source: CryptoSlam.io

Ethereum NFTs dominate the NFT market today with just $11 million, unlike previous market cycles, where these NFTs used to record millions of dollars. Solana NFTs distantly follow Ethereum NFTs, recording a trading sales volume of $940,028 in the past 24 hours.

Source: cryptoslam.io

Bitcoin ordinals, which previously traded right behind Ethereum NFTs in the past several weeks, have significantly dropped in sales volume, recording just 651,933 in the past 24 hours. Bitcoin NFTs have now paved the way for other NFTs such as BNB Chain, Polygon, and Immutable X NFTs.

Data compiled by CoinGecko, an on-chain data aggregator, indicates that CryptoPunks, an NFT collection featuring a limited edition of 10,000 NFTs hosted on Ethereum net, is today’s top-selling NFT collection. In the past 24 hours, the NFT collection has attracted a sales volume of $342.

source: CoinGecko.com

Mutant Ape Yacht Club, an NFT collection from digital asset firm Yuga Labs featuring a fixed set of 20,000 NFTs, ranks second in today’s top-selling NFT list. In the past 24 hours, the NFT collection has attracted a trading sales volume of just 112 ETH. In the past several weeks, high-profile NFT collections like Mutant Ape Yacht Club and Bored Ape Yacht Club used to record thousands of thousands of ETH in daily sales.

But, How Did We Get Here?

According to Kermit, good news can alter community sentiments, but bad or negative news can completely destroy it. In most cases, a declining sentiment score moves downward with floor price prices across various communities. Azuki, an NFT collection featuring a limited edition of 10,000 NFTs on the Ethereum network, is a perfect example.

Last month, the Azuki team launched their highly anticipated NFT collection, ‘Azuki Elementals NFTs.’ The NFT collection did not meet the expectation of many since the majority of NFTs looked similar to the original Azukis. The disgruntlement pushed Azuki’s floor price from around 15 ETH to no 5.75 ETH, representing more than a 70% loss.

Other NFTs collection that has suffered from negative sentiment include Clone X, an NFT collection from Nike’s digital asset incubation studio RTFKT, Y00ts, and DeGod, an NFT collection featuring a limited supply of 10,000 NFTs previously hosted on the Solana chain but now on Ethereum network.

As we can see here, there's a clear correlation between a declining sentiment score and downward floor price movement across various communities.

This is evident when comparing the sentiment and prices of Azuki, Clone X, Degods, or Y00ts over the past quarter.

(4/19) pic.twitter.com/4OS6Hjl47w

— Kermit 🐸 (@crypto__kermit) July 24, 2023

On the other hand, a positive sentiment or sentiment reversal hardly impacts the floor prices of an NFT collection. Pudgy Penguin, an NFT collection featuring a limited set of 9,999 NFTs; Moonbirds, an NFT collection from digital asset firm Proof Collective featuring a fixed set of 10,000 NFTs; and Doodles, another NFTs collection featuring 10,000 NFTs on Ethereum, are perfect examples of NFTs that had little to no effect on their prices despite experiencing recent sentiment shift.

So, What Can We Do To Revive The NFT Market?

1. Remove Bad Actors And Negative Press

The NFT market witnessed numerous bad actors and negative publicity in the past few years. In that context, It’s worth noting that the NFT market has suffered from all sorts of crime, including hacks and phishing scams, which have left the majority of NFT investors in massive losses and interest.

In his blog, Kermit noted that the NFT industry now needs time and will eventually heal. “We must allow enough time to pass, letting investors and collectors gradually forget the past negativity associated with the NFT space, “he noted.

2. The NFT Market Needs More Projects

The non-fungible token market now needs creators and developers to launch more projects to revive again. Before summarizing, Kermit noted that creators should focus on building more projects with utility rather than just seeking the easiest ways to extract money from the market. They should get rid of initial tactics like hyped mints or unnecessary airdrops.

Related NFT News:

- NFT Sales Fall 24% This Week – Here’s Why Some NFT Projects Are Crashing

- NFT Trading Volume Fell 35% In Q2 2023 – Will Q3 Brings An Uptrend?

- NFT Sales Pump 4% In The Past 24 Hrs, As Opepen Edition PFP Goes Viral

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage