Join Our Telegram channel to stay up to date on breaking news coverage

XTZ Price Analysis – August 10

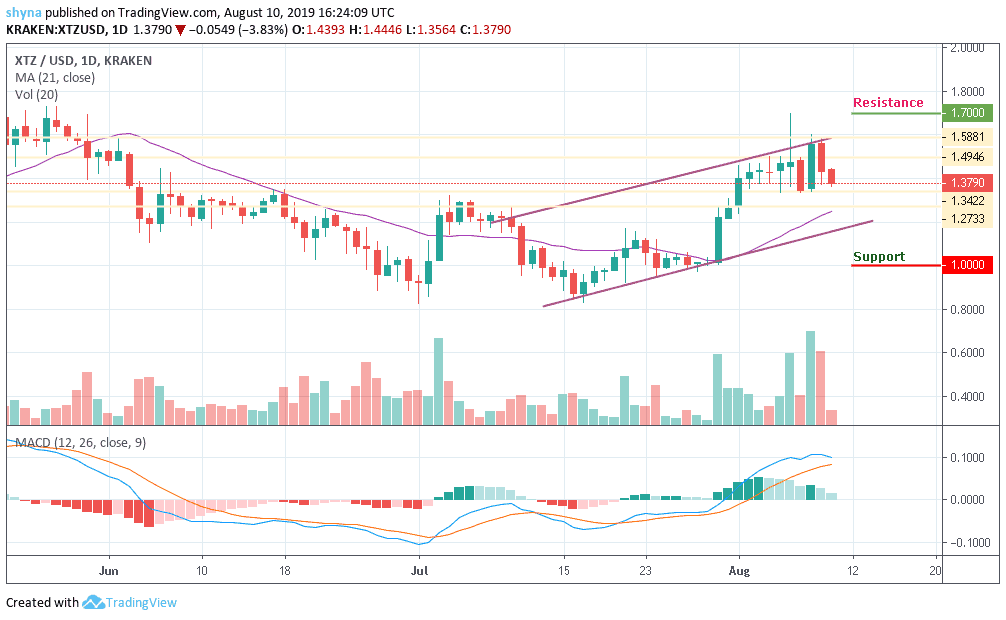

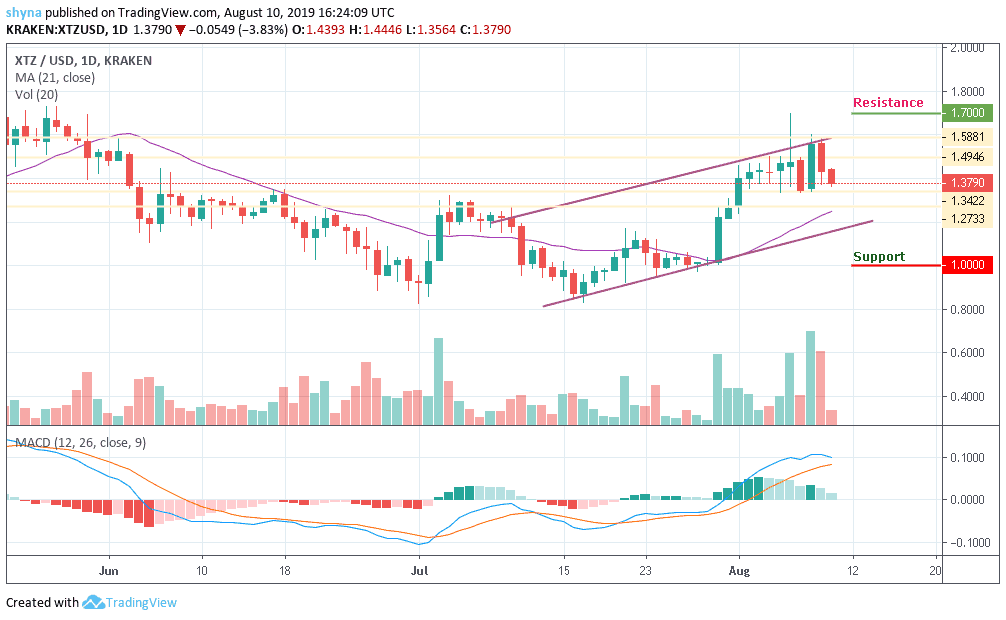

Tezos broke the $1.45 support level for the second time this month. Before falling, its price reached $1.58 as the market opened yesterday.

XTZ/USD Market

Key Levels:

Resistance levels: $1.7, $1.8, $1.9

Support levels: $1.0, $0.9, $0.8

Despite the fact that all altcoins are under selling pressure, Tezos has been the most successful cryptocurrency with more than 45% gain in recent weeks. The buying volume of Tezos has been considerable since the beginning of August. Tezos broke the $1.35 support level for the second time this month. Beforehand, Tezos price reached $1.58 as the market opened yesterday and traded around 13% on a daily basis.

However, should the buyers manage to power the market; they may likely find the resistance at $1.7, $1.8 and $1.9 levels. More so the bulls seem to be re-testing the support level of $1.45 before rising again. If the market experience more drops, it could hit the nearest support at $1.0 and a further drop could pull the market to $0.9 and $0.8 respectively. The MACD is on the positive side, indicating more bullish signals in the nearest term.

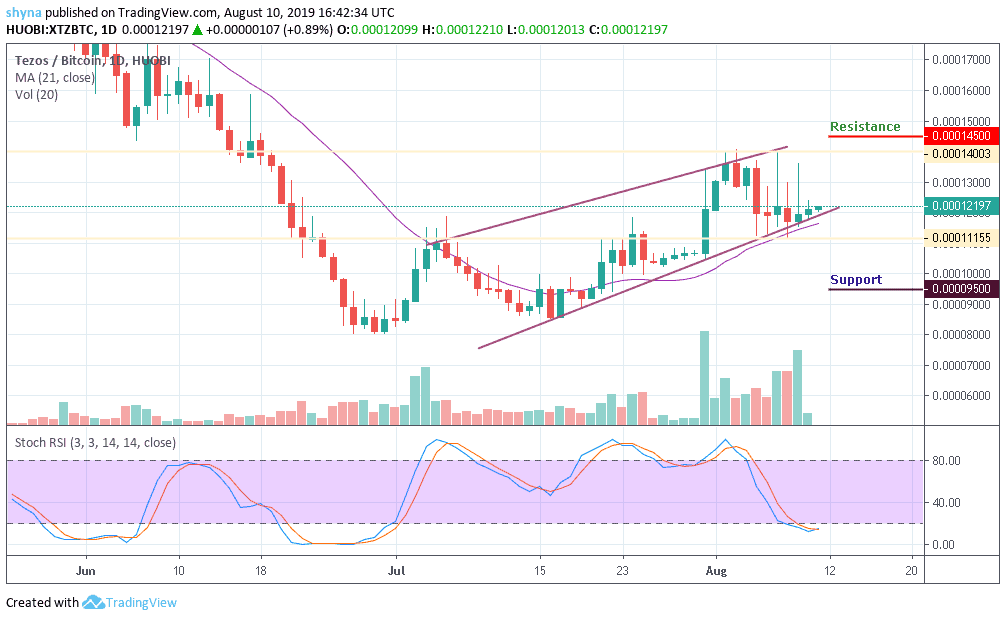

XTZ/BTC Market

Against Bitcoin, the support which felt safe in 2019 around 0.00012 BTC has been broken despite the increasing volume and a sharp rise on August 9. The support is currently around 0.000095 BTC, and resistance in this range is 0.00014 BTC. The stochastic RSI is revealed at the oversold condition, suggesting a potential price rise for the market.

Moreover, if the bulls can break above 0.0014 BTC, further resistance is found at 0.00015 BTC and 0.00016 BTC respectively. Therefore, should the sellers push the price beneath the current 0.00012 BTC, the next level of support is located at 0.00010 BTC and more supports may likely reach 0.00009 BTC and 0.00008 BTC.

Please note: insidebitcoins.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Join Our Telegram channel to stay up to date on breaking news coverage