Join Our Telegram channel to stay up to date on breaking news coverage

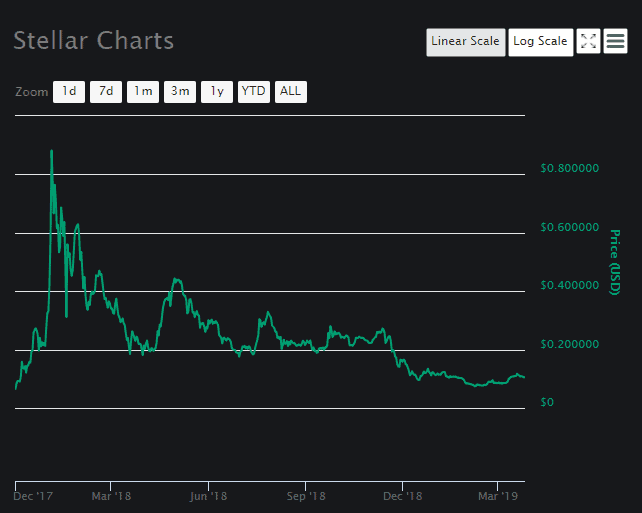

Stellar (XLM) has had just as bad a year in 2018 as most other cryptocurrencies. The coin managed to hold rather well for most of the year, after the initial drop from its all-time high. It never had an extremely high price, and the highest it ever went was still below $1.

Stellar reached its all-time high trading at $0.885 on January 4th, 2018. After that, the coin’s price kept going down, but not as easily as prices of other coins. XLM took every break the bear market made to make attempts at growth, and so when its price dropped from $0.80 to $0.50, it grew back to $0.62. When it dropped again to $0.40, it grew back to $0.60. And when it dropped to $0.30, it returned to above $0.40.

All of these drops and surges occurred before February 23rd, 2018, but on this day, Stellar finally dropped below $0.40 and allowed this level to become its major resistance. Until July, its price fluctuated between $0.20 and $0.40, but as the year progressed, its growths became weaker and weaker, with its major resistance at $0.40 eventually being replaced with the one at $0.30, and then $0.25.

This continued until mid-November when BCH hard fork caused another market crash — one with devastating consequences for Stellar price. The coin broke its support at $0.20 for the first time and was searching for a new bottom. Meanwhile, even the greatest supporters of Stellar became hesitant about their decision to buy XLM.

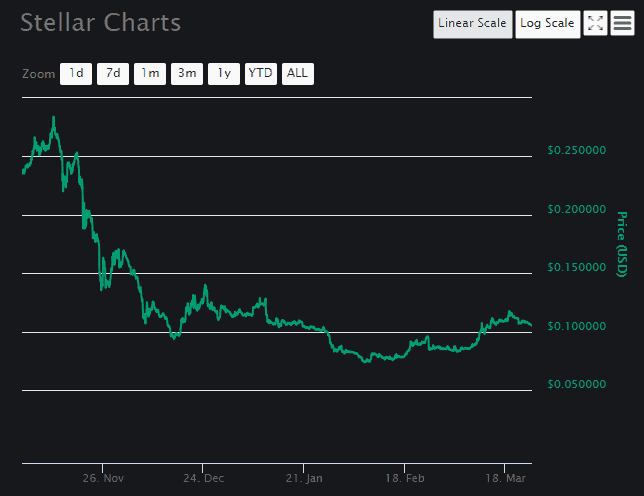

Considering the fact that the coin started breaking one resistance after another in the next month, this is hardly surprising. Stellar price dropped below $0.20, as and it also broke support at $0.15, eventually settling just above $0.10. This was considered its new bottom, and for a long while, the coin treated it as suck. It mostly fluctuated between $0.10 and $0.12 for the rest of the last year, and it ended 2018 at $0.1146.

Stellar sinks deeper in 2019

In early 2019, Stellar actually remained close to its upper border at $0.12, even managing to briefly breach it once. However, this changed around January 10th, when the weakening bear market struck, forcing the coin to rely on its support at $0.10. XLM price remained stuck to this support until January 28th, when another wave of bearish influence forced it to break this support, as well as the one at $0.09.

Stellar’s drop continued until $0.075, which has been the lowest point the coin has reached in the past 14 months. Of course, this is still nowhere near its all-time low, which the coin experienced in its lifetime before the 2017 surge. But, this was its lowest point in 2019 to this day. While February brought an entire series of smaller bull runs, it took a while for Stellar to join the rest of the market.

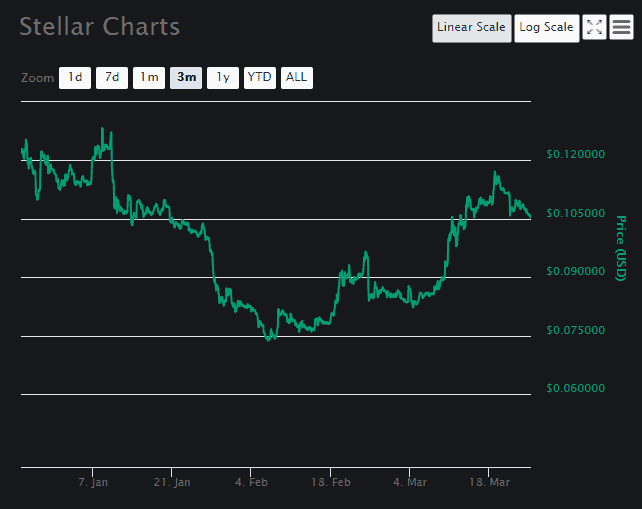

It almost ignored the first one completely, and it only joined around February 18th, when its price surged back up until it reached the resistance at $0.09. The coin even managed to briefly breach it, inspiring its community to once again buy XLM. Unfortunately, the bear market decided to strike once again on February 24th, cutting Stellar’s growth and impacting the entire market as well.

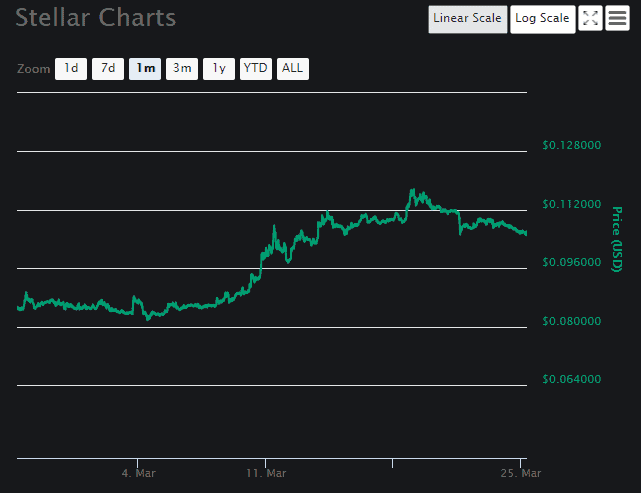

XLM dropped down to its another minor support at $0.085, where it remained until March 4th. Another major bull run started on this day, and it had a much greater effect on XLM than any before it.

The coin started growing, and it breached resistances at $0.09, as well as the one at $0.10, seemingly without much effort. It even continued to grow, closing in on $0.12, but the growth stopped before the coin managed to grow that far up.

At the time of writing, XLM price is at $0.105340, after it just broke its support at $0.108 yesterday, March 24th. The coin currently continues to see losses, although it is believed that a minor support at $0.102 might prevent it from falling deeper. In the following days, Stellar is likely to participate more in new bull runs, and a strong one might help it reach new heights, which might make this the perfect time to buy XLM.

Join Our Telegram channel to stay up to date on breaking news coverage