Join Our Telegram channel to stay up to date on breaking news coverage

In response to the broader startup downturn, Sequoia Capital, a leading venture firm in Silicon Valley, is scaling back funds allocated for startups, including cryptocurrency ventures.

The firm is taking this measure to address past excessive spending during its expansion phase and navigate the challenges it faced under the leadership of new CEO Roelof Botha, who took over from Doug Leone in April 2022.

This strategic move aims to ensure the company’s sustainability amid the prevailing setbacks in the startup ecosystem.

Cryptocurrency Fund Cut from $585 Million to $200 Million

Sequoia Capital’s cryptocurrency fund and ecosystem fund have experienced significant reductions, with the former being halved from $585 million to $200 million and the latter from $900 million to $450 million, as reported by the Wall Street Journal.

Although the venture firm did not officially disclose these details, it informed investors in March 2023 about adjusting the funds to better align with the evolving market conditions.

The cryptocurrency fund was initially designed to support young startups that were impacted by the crypto winter triggered by FTX and the subsequent decline in overall crypto interest.

Sequoia Capital’s move to reduce the funds came ahead of reports that crypto investors had departed from the firm following changes in the VC team, according to Bloomberg’s coverage.

These adjustments reflect the dynamic nature of the cryptocurrency market and the efforts of venture firms to adapt to the ever-changing landscape to provide optimal support for startups in the crypto space.

Crypto investors depart Sequoia Capital in VC team reshuffle: Bloomberg https://t.co/YzXswAuv9Q

— The Block (@TheBlock__) July 20, 2023

TA recent VC reshuffle at Sequoia resulted in the departure of five partners, including crypto-investors Daniel Chen and Michelle Fradin.

The reshuffle was prompted by FTX’s decline, which inflicted a significant loss of $213.5 million on Sequoia’s global growth fund, leading to reputational damage for the firm.

This loss played a role in the decision of the two crypto investors to leave the company.

Funds Cut to Manage Worst Slump of the Decade

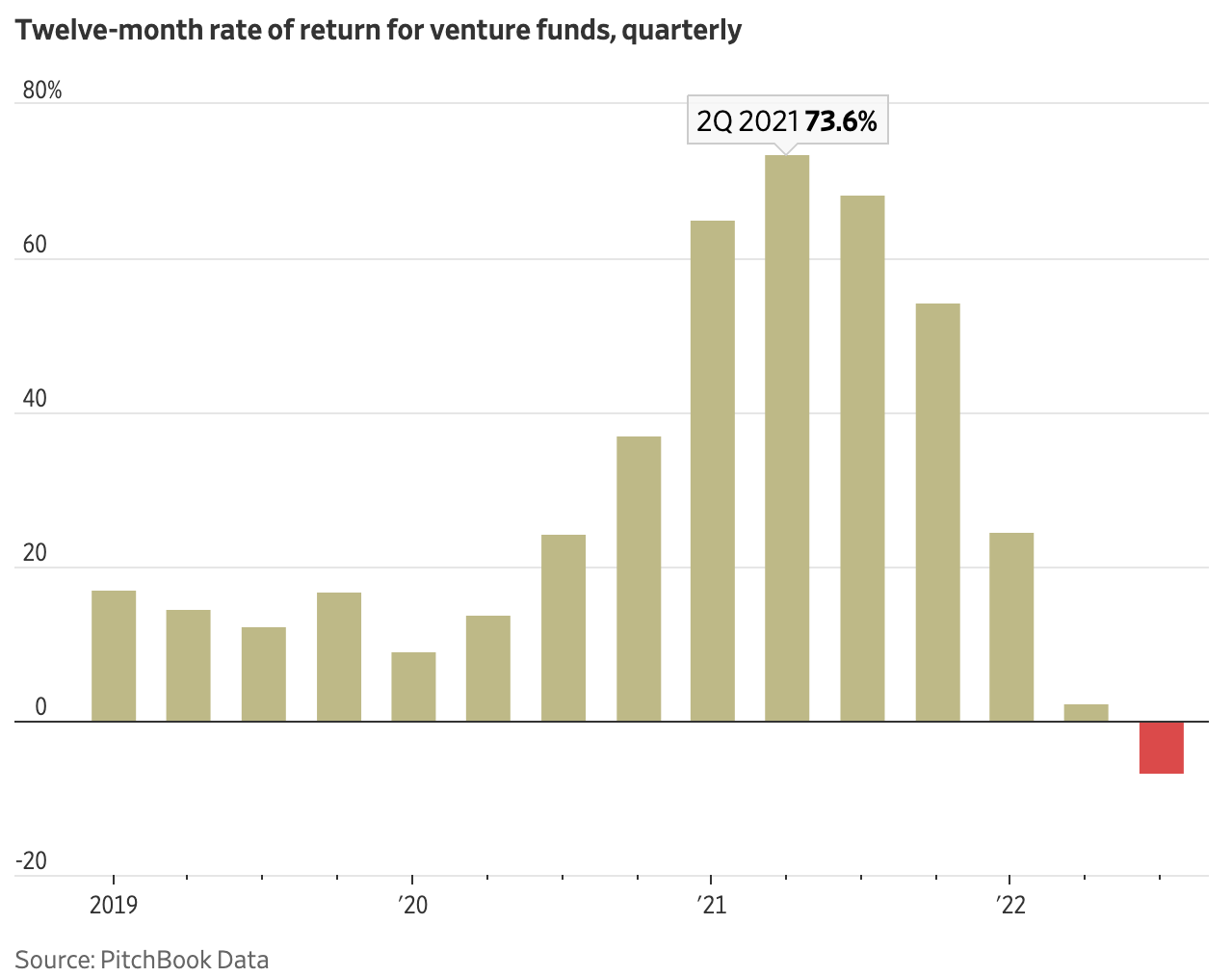

On March 16th, Wall Street General highlighted that Sequoia experienced a significant return decline attributed to the startup downturn.

The negative trend persisted for three consecutive quarters, as reported by Pitchbook Data.

The data revealed an internal rate of -7% in the third quarter, marking the lowest figure since 2009. This decline indicates challenges for Sequoia in navigating the current market conditions affecting startups.

Sequoia, once optimistic about its technological advancements, faced setbacks as returns triggered fears among fund investors, leading to reduced exposure.

The firm’s aggressive investments during the bull run, enabled by a new fund structure, caused high spending by limited partners.

However, the abrupt market crash of 2022 resulted in sub-par returns, causing fear and frustration among Sequoia’s stakeholders.

In response to the damage, the venture firm is now reducing the investments required from its limited partners, advising them to manage their expectations as the situation may remain challenging before improvement.

Implications for Wider Crypto Market?

Sequoia, a once optimistic venture firm, encountered setbacks amid market turbulence as returns fell short of expectations, causing concerns among fund investors and prompting a decrease in exposure.

The firm’s aggressive investments during the bull market, facilitated by a new fund structure, led to heightened spending by limited partners. However, the sudden market crash of 2022 resulted in sub-par returns, triggering fear and frustration among Sequoia’s stakeholders.

In light of the challenges faced, Sequoia is now taking measures to mitigate the damage.

The firm is reducing the investment requirements from its limited partners and advising them to manage their expectations, as the situation may remain difficult before showing signs of improvement.

Related

- SEC Chair Gary Gensler Says Crypto is “Rife with Fraud” and “Hucksters”

- Bitcoin NFTs and Back in Action

- How to Buy Bitcoin

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage