Join Our Telegram channel to stay up to date on breaking news coverage

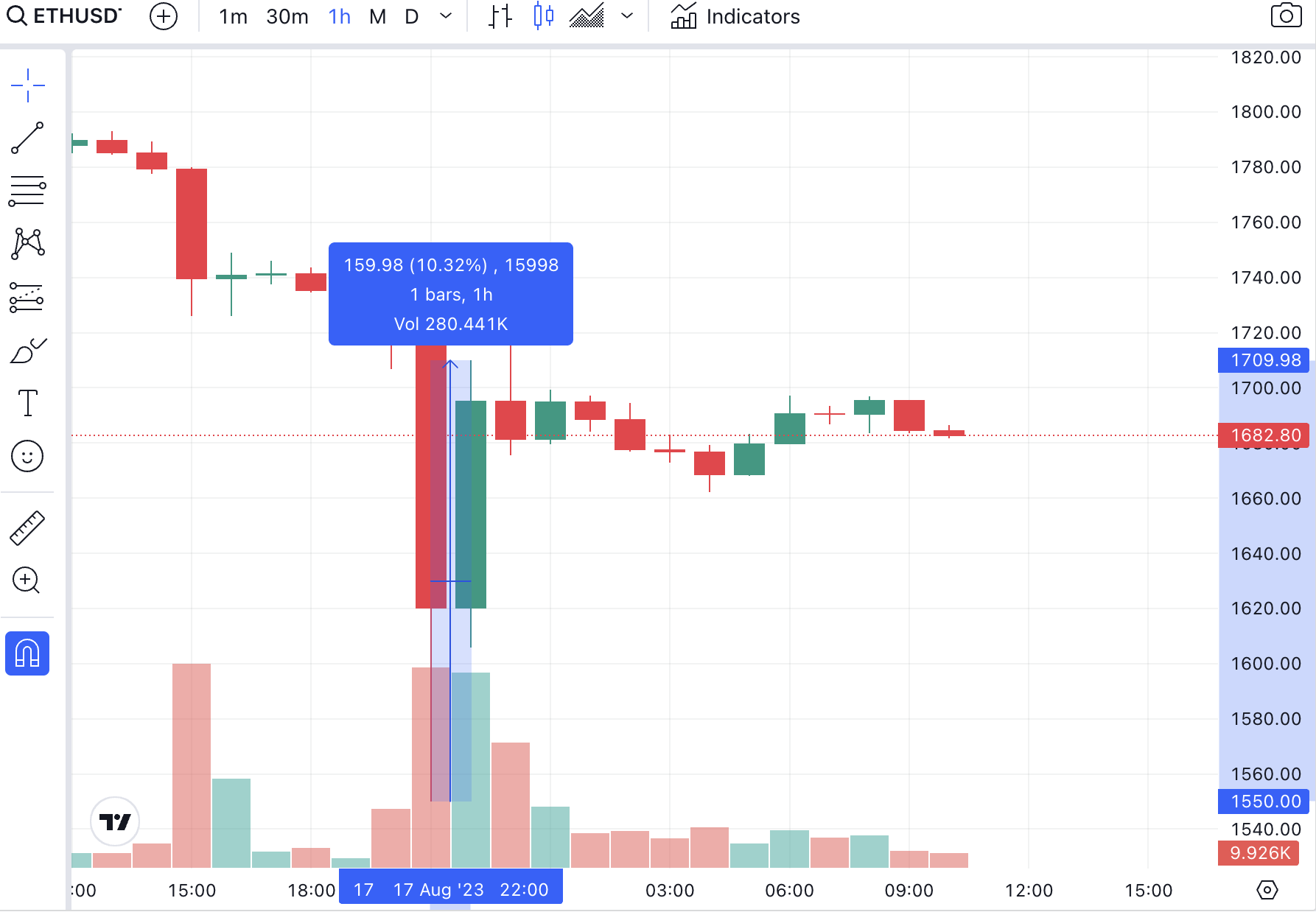

The Ethereum price jumped by almost 11% after an August 17 report from Bloomberg cited many sources that said the US Securities and Exchange Commission would likely allow the ETH Futures ETF applications to go through.

🚨 Breaking 🚨

The SEC is expected to green light an ETH futures ETF

The beginning of something potentially massive here… pic.twitter.com/x9KtOpCqei

— Bankless (@BanklessHQ) August 17, 2023

Expectations that the SEC would likely accept spot Bitcoin ETF applications have led a flurry of companies to apply for ETH Futures ETF.

12 companies have filed to provide ETH Futures ETF, including Volatility Shares, Valkyrie Bitwise, Roundhill, and ProShares.

While the news is good, it is not yet clear which companies will get their ETF applications approved. That said, reports say multiple applications will be approved in October.

“This is not surprising to us,” said ETF analyst Eric Balchunas, expressing his confidence that the US SEC will approve ETH Futures ETF.

He also questioned what it means for spot ETFs, adding that the current news indicates that SEC’s stance regarding the matter can change for the positive.

This not surprising to us, we had said they would approve Ether Futures early on in race. Nice to be validated. Now what does it mean for spot? Hard to say beyond it shows that their views/policy/tolerance can change. https://t.co/JXCxNUpj2U

— Eric Balchunas (@EricBalchunas) August 17, 2023

Ethereum Price Drops with Bitcoin Downturn, But Gets Second Wind with ETH Futures ETF News

Bitcoin lost its $29k support today, dropping to just over $26k. This bloodbath has resulted in the entire market dropping from Binance Coin dropping by 5% and SUI experiencing a 10% dip.

As a result, Ethereum’s price has gone down by 5% in the last 24 hours, and it is currently trading below $1.7k, likely acting as its current psychological resistance.

In reaction to the current bearish trend, Ethereum’s trading volume has increased 185% in the last 24 hours. Hourly charts also show that Bulls are trying to reclaim ETH’s price with multiple green candles forming.

These bulls are likely acting on the news about the ETH Futures ETFs. Ethereum’s RSI has rebounded from 20 to 38. Although the condition is still bearish for the world’s largest altcoin, the RSI signals stabilization.

SpaceX BTC Sell-Off and Evergrande Bankruptcy Cause Bitcoin to Lose $29k Support

After staying above the $29k mark that people thought would last longer and potentially push Bitcoin above its $30k resistance, BTC was hit negatively by two events pushing its value below $26.5k.

The first of the two events is bankruptcy filed by Evergrande, a leading property developer in China. New York Times reported that after a 2021 meltdown, Evergrande had filed a bankruptcy petition in the United States Bankruptcy Court. The property developer has total liabilities of $335 billion.

Another piece of news comes from Bloomberg, which highlighted the Wall Street Journal report that revealed SpaceX is selling off its Bitcoin holdings after writing down $373 million.

The resulting downturn of Bitcoin caused multiple tokens to fall, with Ethereum being one of them. While the hourly uptrend ETH has received is positive, investors still don’t know how long it would take for ETH to reclaim $1.8k.

Related

- Binance Coin Falls 5% – Market Follower Again

- SUI Price Prediction: SUI Dips 10% – Is it a Buying Opportunity

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage