Join Our Telegram channel to stay up to date on breaking news coverage

The San Francisco Federal Reserve Bank is seeking a Senior Crypto Architect for its upcoming CBDC project.

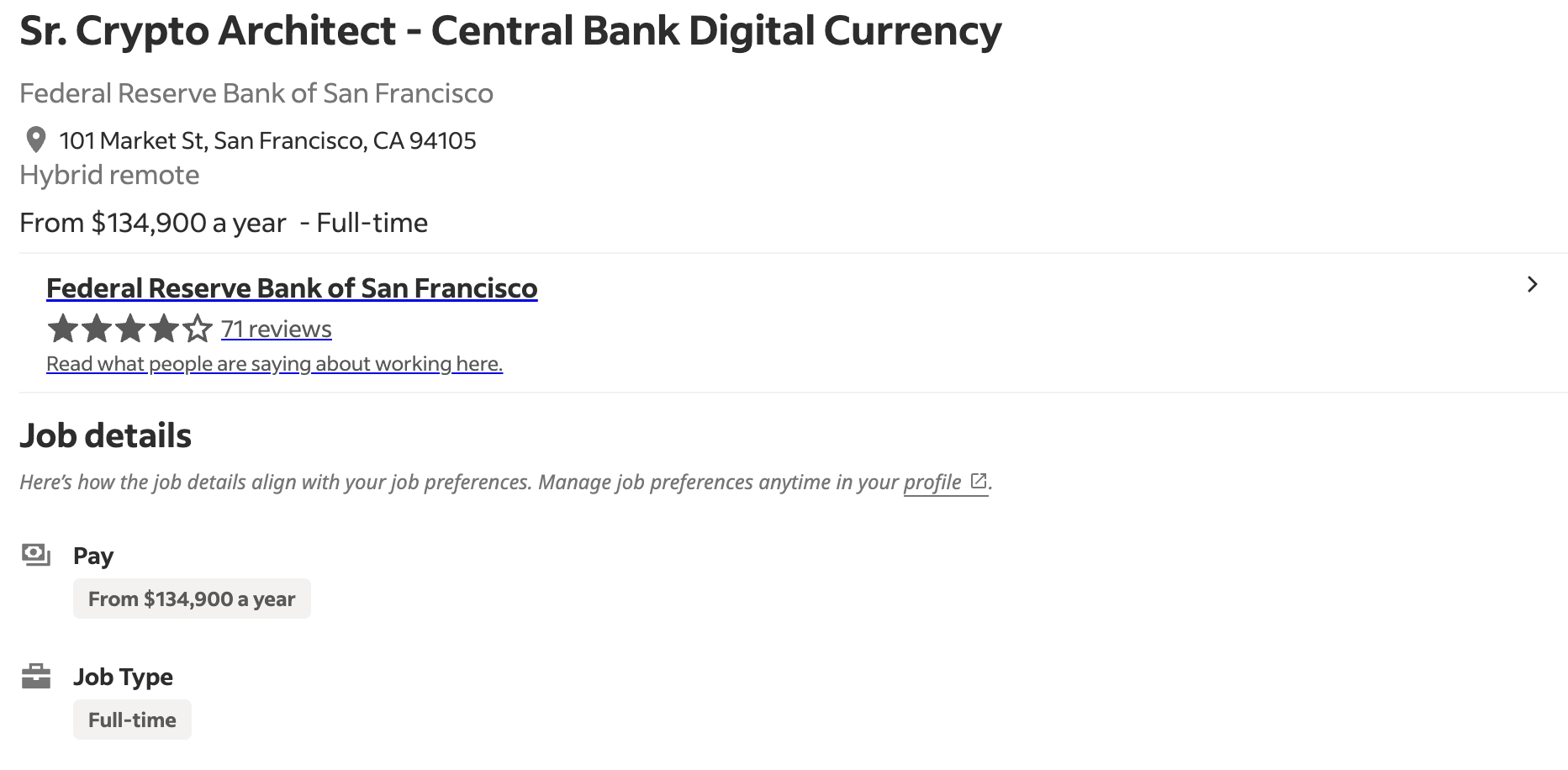

Indeed.com has posted a job opening for a lead application developer responsible for implementing CBDC-related example systems.

The job application seeks a developer responsible for engaging with management, development teams, and vendors to support the Federal Reserve in designing technology for a Central Bank Digital Currency (CBDC).

San Francisco Fed Has been Looking for Someone Since February 2023

The San Francisco Fed is mirroring the actions of its New York counterpart, seeking to hire a lead application developer for CBDC in February 2023.

The Fed adopts a hybrid work model, requiring developers to be in the office 2 to 3 days per week on average but offering flexibility to work entirely from home on certain weeks to cater to the modern desire for remote work.

The Federal Reserve System (FRS) is seeking a technologist to conduct research and development for central bank digital currency (CBDC) as part of its mission for safe, accessible, and efficient systems for dollar transactions, according to the job posting.

The San Francisco Fed views this position as an ‘excellent opportunity to join a cutting-edge team in technology and research for Central Bank Digital Currency (CBDC).’

The Fed offers a full-time position with a starting salary of $134,900, reflecting the significance of the task and encompassing multiple responsibilities.

From Implementing Novel Systems to Researching Standard Methodologies

The job posting provides comprehensive details about the responsibilities of the lead application developer or “senior crypto architect.”

Selected candidates will be tasked with implementing a novel CBDC system, translating design requirements into working prototypes.

The additional tasks will involve team communication and cutting-edge technology to develop innovative solutions.

FedNow Sparks CBDC Fears Among People

Despite being posted for some time, the application has received minimal attention until recently, with an influx of applications now being filed. This development highlights the Federal Reserve’s strong push for a Central Digital Dollar, a notion that has already been widely acknowledged in the cryptocurrency community.

Amidst speculations, the latest development of FedNow, an instant payment service, is seen as a potential groundwork for a CBDC.

The Fed has refuted claims through a tweet, stating that the FedNow service is unrelated to digital currency.

The FedNow Service, similar to other Federal Reserve services like Fedwire and FedACH, is not a form of currency and does not aim to eliminate any payment method, including cash.

#FedFAQ: Is the FedNow Service replacing cash? Is it a central bank digital currency?

Learn more about the #FedNow Service:https://t.co/ACBjfEhR4A https://t.co/IXF8dyy46S pic.twitter.com/7CUaYZYyM9

— Federal Reserve (@federalreserve) July 19, 2023

The response to this has been far from lukewarm, with extreme sentiments seen in tweets like writer Cory Bates claiming that the “Federal Reserve is the Biggest Scam in American History.”

The Federal Reserve is the biggest scam in American history. No one wants your FedNow service.

— Cory Bates (@corybates1895) July 19, 2023

Related

- Couple Accused of Laundering Bitfinex Funds Agree Plea Deal

- India to Launch a CBDC, Proposes to Ban Private Cryptocurrencies

- US Lawmakers Pile Pressure on SEC to Change its Approach to Crypto Regulation

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage