Join Our Telegram channel to stay up to date on breaking news coverage

It is looking more like every country is committing resources to study the potential of launching a Central Bank Digital Currency (CBDC). Once thought to be a crypto holdout, Russia has joined the CBDC train as the country takes the first step towards currency digitization.

Making the Digital Ruble Work

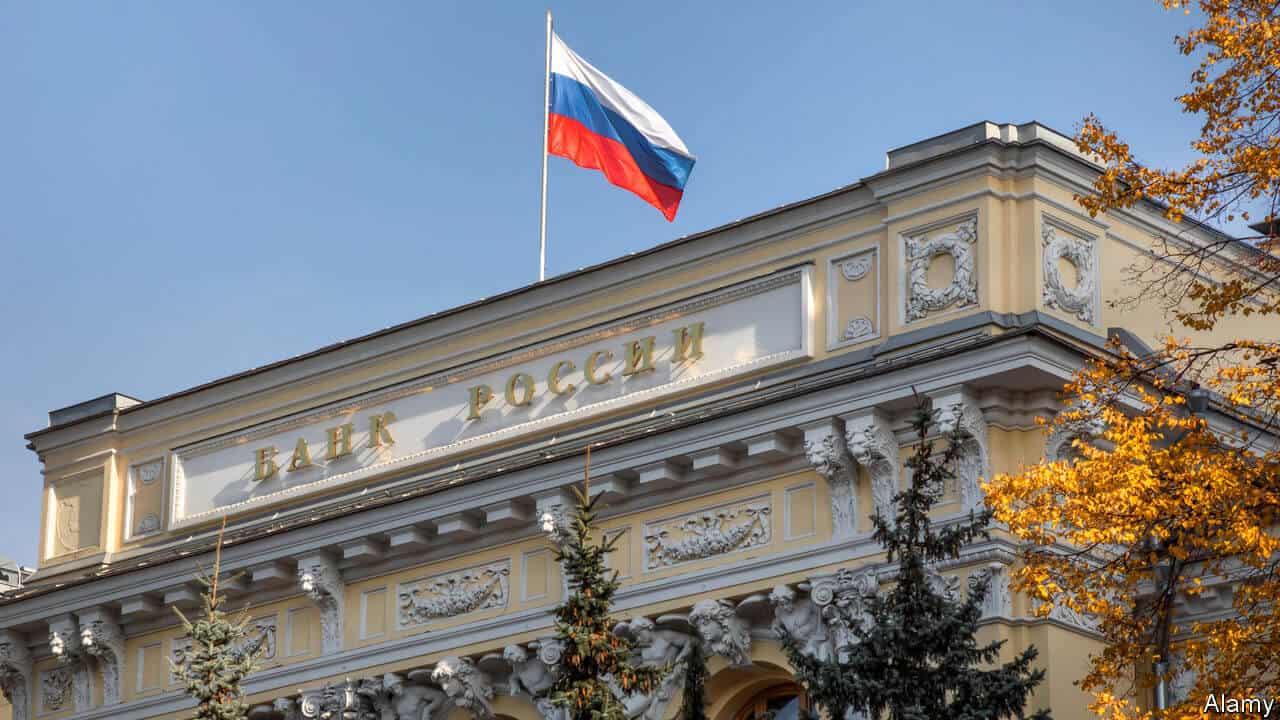

Earlier today, the Bank of Russia officially released a consultation paper where it sought opinions on the potential of a CBDC. According to the document, the central bank strongly believes that a robust CBDC system can provide citizens with an alternative payment system complementing both cash and existing digital payment structures.

The bank explained that creating a CBDC will require an entirely different payment infrastructure, which the bank has to develop first. While it is yet to determine a timeline for the asset, it plans to launch something with all the properties and functions of real money. The bank focuses primarily on bolstering its payment service, with an asset that will improve payment security and speed while reducing costs.

“The national digital currency will also limit the risk of reallocation of funds into foreign digital currencies, contributing to macroeconomic and financial stability,” the consultation paper reads.

In its paper, the bank also confirmed that it would make the asset available online and offline, with citizens able to access it through digital wallets and their mobile phones.

Also, another prominent feature of the digital ruble is availability to everyone. This is a primary departure from France, which is currently working on a CBDC that will only be accessible to institutional users.

The Bank of France announced successful tests for the digital euro in May, explaining in an official announcement that it was working towards a module for even more widespread testing. However, as the statement reads, the asset will only be available for wholesale use at the initial stages. This means that only companies like hedge funds and banks will be able to have access to it.

France’s central bank didn’t confirm whether it would eventually expand its asset to meet retail customers’ needs. However, it seems almost inevitable, given that the country has been clamoring for a digitized currency both on the national and international scale.

Catching Up With the Trends

The news of the digital ruble is continuing Russia’s sudden acceptance of cryptocurrencies. The Eastern European giant has been on the fence towards crypto adoption for years, although it made progress months back when it announced the passing of a pro-crypto bill, “On Digital Financial Assets,” into law.

Since then, regulators and institutions in the country have taken different measures to structure the country’s crypto space. While regulators have banned several services from operating in the country – including to crypto exchange Binance – companies are also accepting crypto in their numbers.

With a potential CBDC on its way, Russia shows that it doesn’t want to get left behind by other parts of the developed world.

Join Our Telegram channel to stay up to date on breaking news coverage