Join Our Telegram channel to stay up to date on breaking news coverage

XRP Price Prediction – October 22

XRP is making av attempt to keep its upward movement as the buyers are struggling to move the cryptocurrency to a new height.

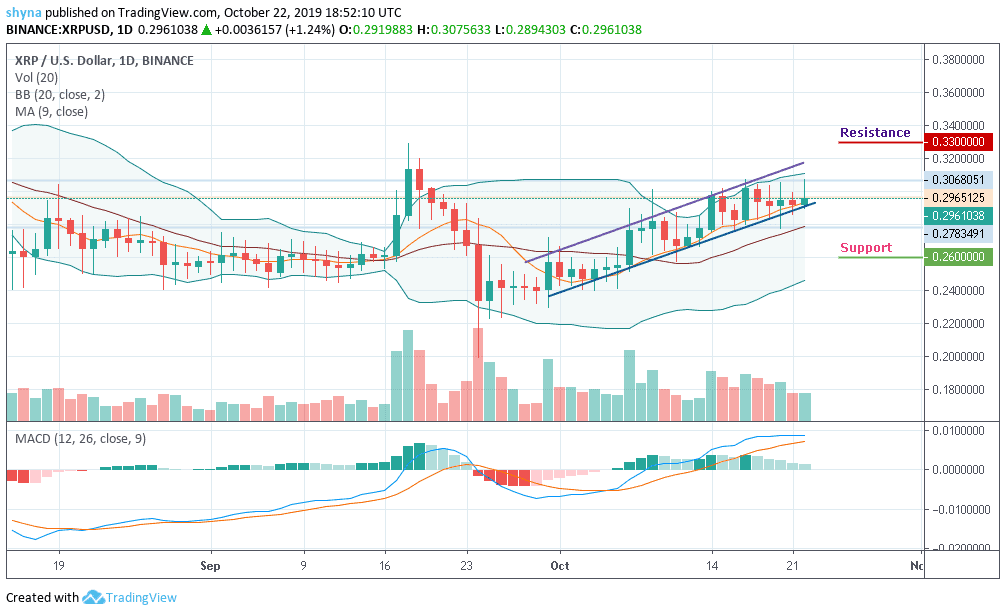

XRP/USD Market

Key Levels:

Resistance levels: $0.33, $0.35, $0.37

Support levels: $0.26, $0.24, $0.22

Against USD, Ripple (XRP) has been increasing slowly since September 30, earning around 1.38% during the negotiation today. Looking at the daily chart, Ripple (XRP) has been rising for a few weeks after a bullish rally. The bulls strongly control the market with a current movement above the 21-day MA near the upper boundary of the Bollinger bands, which is heading towards the resistance level of $32.

However, XRP remains the third-largest cryptocurrency with a market cap of $12.8 billion. The Ripple price has seen a slight increase in the market over the past 24 hours and it is currently trading around $0.296. For now, XRP/USD has been back on the rise since the start of October as it managed to surge by a total of around 20%.

Moreover, should in case the price breaks out of the ascending channel, then, the resistance levels of $0.33, $0.35 and $0.37 could be visited. Meanwhile, for a backward movement, the market can be supported at levels of $0.26 and $0.24 and if the price falls below the previous levels, another support is around $0.22. MACD has already climbed above the zero-level, although the Ripple (XRP) is still moving in sideways and this crossover has confirmed a robust bullish move for the market.

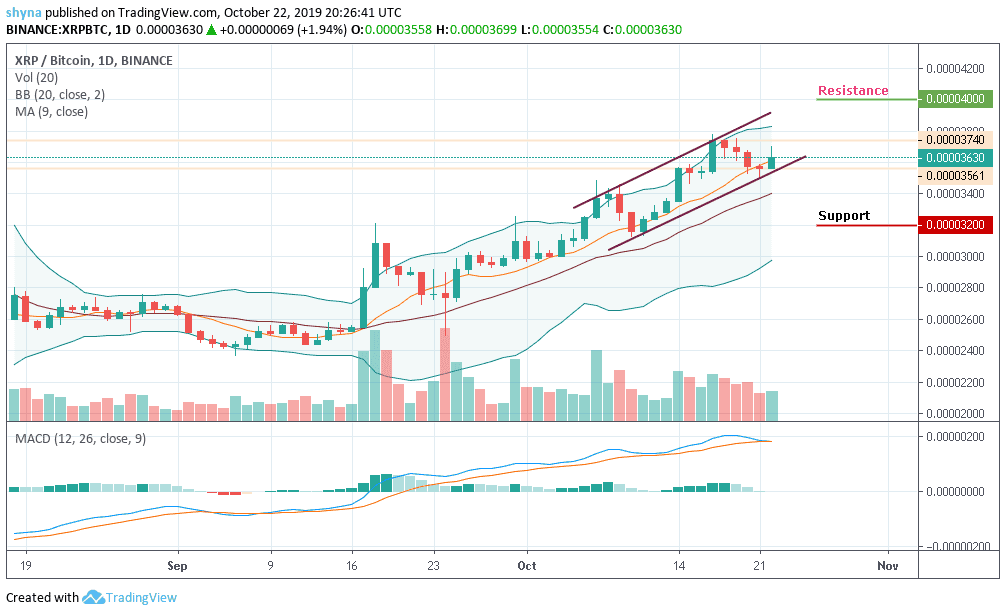

Against BTC, the coin has also been making some strong progress after being able to reverse at 3561 SAT and climbed as high as 3701 SAT during the early hours. More so, the trend of the pair is still looking bullish moving around the 21-day MA within the Bollinger bands and this may take the price to the resistance levels of 4000 SAT and 4200 SAT.

In addition, should in case the bulls failed to hold the price, then the market can fall below the ascending channel and more towards the lower boundary of the Bollinger bands to meet the nearest support levels at 3200 SAT and 3000 SAT respectively. The Moving Average Convergence/Divergence (MACD) reflects a sustained but decreasing bullish momentum.

Please note: Insidebitcoins.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Join Our Telegram channel to stay up to date on breaking news coverage