Join Our Telegram channel to stay up to date on breaking news coverage

Polygon (MATIC) has experienced a decline, breaching the $0.53 support level.

Despite the activity from users, the price of MATIC has persisted in its downward trajectory, plummeting to its lowest point since June 10.

While large wallet investors have been active, they have not managed to elicit any significant impact on MATIC’s price.

As of 6:55 a.m. EST, MATIC is trading at $0.50, showing a 4% drop in the past 24 hours. However, its daily trading volume still sparks optimism among investors, indicating a 32% increase, reaching $167 million.

MATIC Breaks Below Descending Triangle

MATIC appears to have broken the $0.53 support level after enduring a series of declines since February 2023

The price trades within a falling channel, indicating a possible continuation of the bearish trend below the significant support of $0.53.

Despite the persistent efforts of the bulls to raise the price, the bears have maintained control, pushing it down from the $0.88 peak to its current price of $0.50

The potential for a bullish surge is not by chance, as forming a descending triangle pattern within the falling channel has given way to the bearish trend continuation below its lower boundary.

The 50-day and 200-day moving averages, currently positioned above the current price at $0.61 and $0.85, respectively, suggest that market trends favor downward pressure on MATIC’s price.

Although the Relative Strength Index (RSI) is trading below the oversold territory of the 30 mark, it is currently at 26, suggesting that the selling pressure remains significant. Therefore, the bulls must add more effort to push the RSI above 30.

MATIC’s price is under intense selling pressure, supported by the descending triangle pattern within the falling channel and the moving averages. Key support levels to watch are at $0.32 and $0.14.

On the flip side, if the bears are not resilient enough, bulls might take the opportunity to recover their losses in the short term. In this scenario, the critical level to watch would be $0.63.

Bitcoin BSC (BTCBSC) has emerged as a compelling alternative for MATIC investors. The token’s presale phase offers an enticing opportunity for potentially significant returns. Additionally, it features a staking mechanism that allows investors to generate passive income.

BTCBSC Crosses $1 Million Mark, Poised for 200x

BTCBSC distinguishes itself from other Bitcoin forks by presenting a unique expansion strategy and competitive features.

Bitcoin BSC is a fusion of Bitcoin’s value and BNB Chain’s technology, offering an intriguing crypto opportunity reminiscent of Bitcoin’s early rapid growth. This makes it a notable choice, especially given Bitcoin’s recent challenges.

BTCBSC’s presale began on September 5, and it has already raised over $1 million, offering tokens at the current price of $0.99, equivalent to Bitcoin’s price in April 2011. The presale has attracted significant attention within the crypto community, with some analysts speculating on the potential for substantial profits, possibly reaching 200x the initial investment.

https://twitter.com/Bitcoinbsctoken/status/1701145442904404340?s=20

Bitcoin BSC combines the enduring value of Bitcoin with the efficiency of the Binance Smart Chain (BSC), aiming to reshape the perception and utilization of token-based rewards. Bitcoin BSC operates as a BEP-20 token on the Binance Smart Chain, prioritizing staking as an alternative to traditional mining.

BTCBSC Passive Income

BTCBSC Holders can generate passive income through staking, with rewards intricately tied to the number of tokens staked, a mechanism reminiscent of Bitcoin’s original block reward system.

In the ongoing presale, the team is making an initial 4 million tokens available, with an additional 2.125 million in reserve in case of a rapid sell-out. The project’s hard cap will reach $6.125 million if all tokens are sold.

https://twitter.com/Bitcoinbsctoken/status/1700902012005629992?s=20

The staking rewards are directly proportional to the number of tokens staked and are distributed at ten-minute intervals. A substantial 69% of the total BTCBSC token supply has been allocated for staking rewards, ensuring an abundant supply of tokens for rewarding investors for an impressive 120 years.

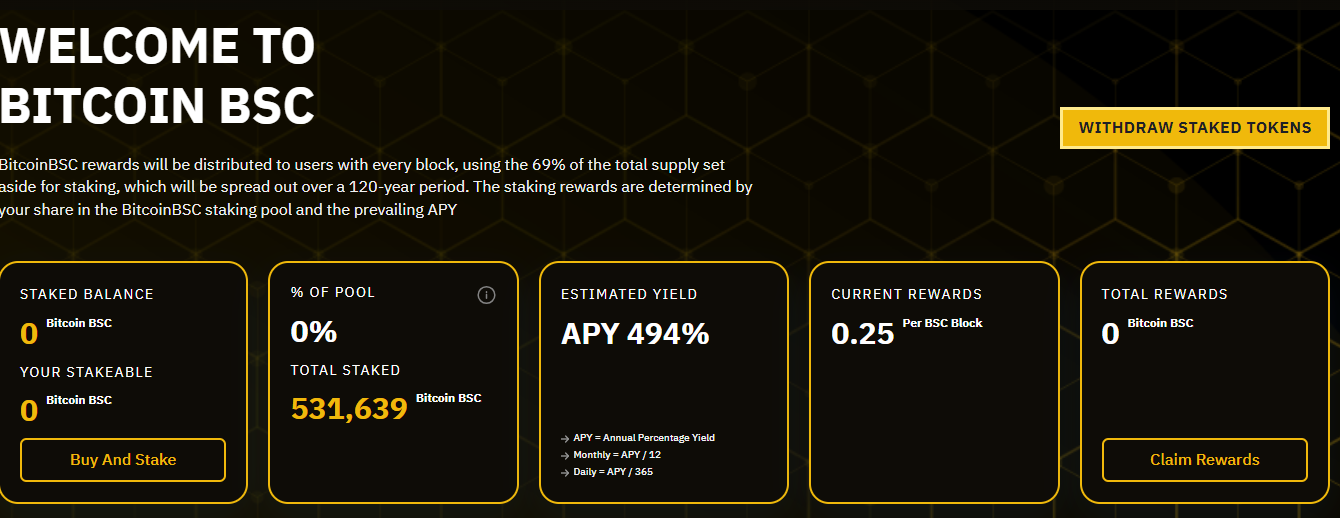

The staking pool is already operational, offering 0.25 BSC per reward block. With 531,639 Bitcoin BSC tokens actively staked, the estimated annual percentage yield (APY) stands at 494%. This substantial yield reflects the project’s dedication to rewarding and incentivizing its loyal community of investors and stackers.

BTCBSC can be acquired through the official website, which offers multiple payment options. These options include ETH or USDT (ERC-20), BNB or USDT (BEP-20), or card payments via Wert.

Once the presale phase concludes, all purchases made through the ETH contract will be seamlessly transferred to the BNB presale contract.

Token claims will be processed using the BSC network. It’s important to note that BNB will still be required to cover gas fees during the claiming process if a user purchases with ETH.

Related News

- ARK Invest’s Cathie Wood Says Bitcoin And AI Convergence Is Sparking “Explosive Growth“

- Terra Luna Classic (LUNC) Price Prediction: LUNC’s Orbit Predicts a Stellar 25% Rise?

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage