Join Our Telegram channel to stay up to date on breaking news coverage

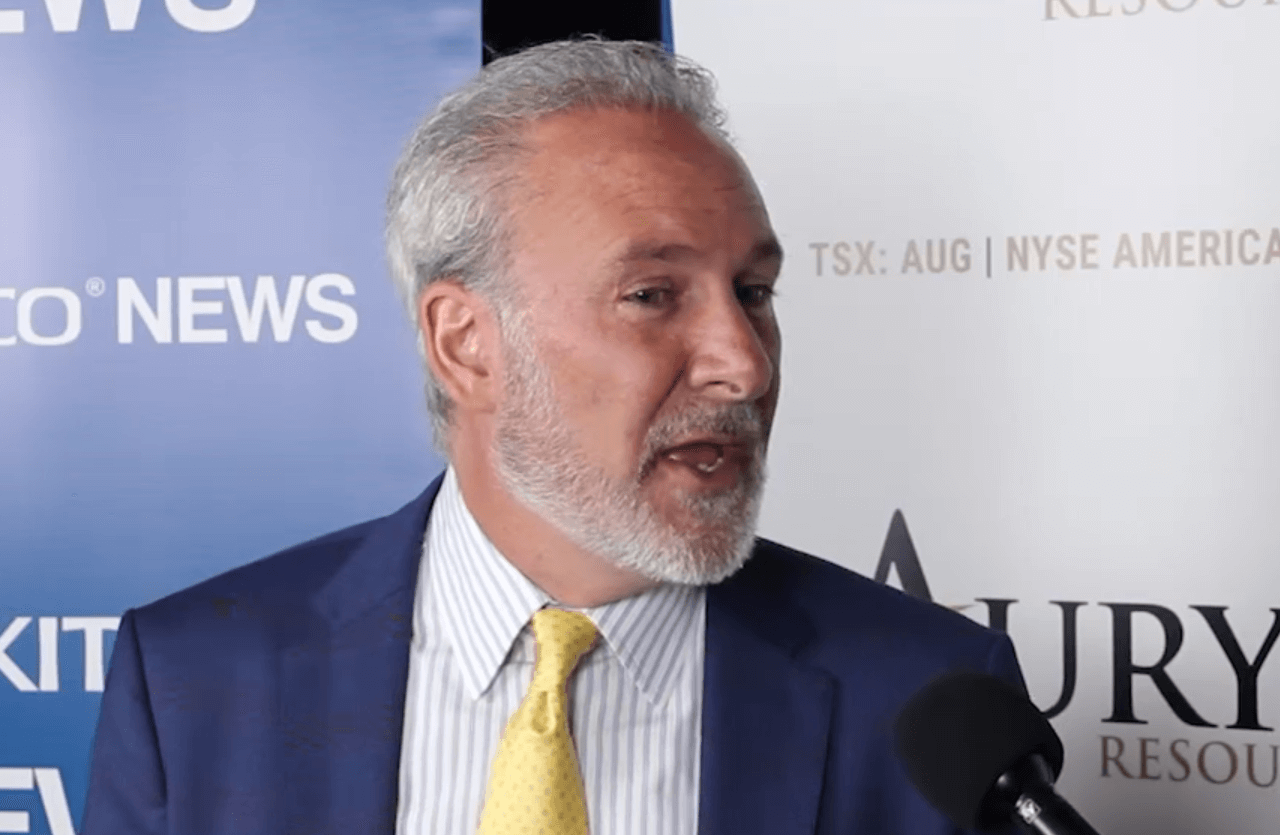

Peter Schiff is a top gold investor who has built a name for being one of the most high-profile crypto detractors. While he remains resolute in his disbelief in crypto’s potential to become a robust investment vehicle, he recently admitted to being wrong about a prediction.

“Shifting the Goalposts”

Over the weekend, Schiff had a Twitter exchange with Tyler Winklevoss, the co-founder at Gemini. The interaction began as Winklevoss pointed out that Bitcoin had found a new consolidation point, with the asset’s dips now comfortably above the $10,000 price point.

While Winklevoss explained that Bitcoin was consolidating for its next breakout, Schiff had a different take. Replying, the gold bug explained that the reverse could easily be the case. As Schiff pointed out, Bitcoin will get weaker as the $10,000 comfort point gets tested even more.

A Twitter user pointed out to Schiff that he had recently predicted Bitcoin to chip away at a resistance point just above $9,000. Sharing a screenshot from July, the user highlighted that Schiff had forecasted a drop in Bitcoin’s price — at a time when gold was hitting record levels.

Realizing his errors, Schiff quickly admitted that he was wrong about Bitcoin. However, he still bashed the asset, explaining that Bitcoin only managed to hit $12,000 because the asset had ridden on gold’s coattails and enjoyed a steep rise in institutional investors.

Bitcoin’s Gold Correlation and Future Concerns

Bitcoin and gold have had some price correlations in recent times. With traditional markets and stocks taking a hit due to the coronavirus pandemic, investors have rushed to alternative assets to hedge and wait out the storm.

This influx of investors led to both assets surging in simultaneous directions. In early August, data from Skew Markets showed that the one-month correlation between the two assets had reached 67.1 percent — the highest on record.

It’s also worth noting that the three-month correlation — a more widely used correlation coefficient — stood at about 15 percent at the time.

As for Schiff’s statements about Bitcoin returning to a bear market, there are fears that the asset could recede once again. Over the past week, Bitcoin shed 21 percent of its value and even plunged below $10,000 at some point. Most of those losses came on Thursday, when Bitcoin dropped by 7 percent — a move that liquidated almost $100 million worth of long positions in the asset.

The fall was more exacerbated by a seeming surge in the dollar’s value — especially against several of the world’s reserve currencies. Analysts expect the dollar to maintain its surge in the near term — a move that could put Bitcoin’s position in danger once more as investors begin to flock back to the greenback.

However, some analysts believe that Bitcoin should be able to hold the line. Michael van de Poppe, a trader at the Amsterdam Stock Exchange, said on Twitter that he expected Bitcoin to make a relief rally towards $11,200. The trader also predicted a rebound in several altcoins.

Bitcoin has managed to hold the line against the coronavirus. However, the coming weeks will be crucial in testing the asset’s long-term value.

Join Our Telegram channel to stay up to date on breaking news coverage