Join Our Telegram channel to stay up to date on breaking news coverage

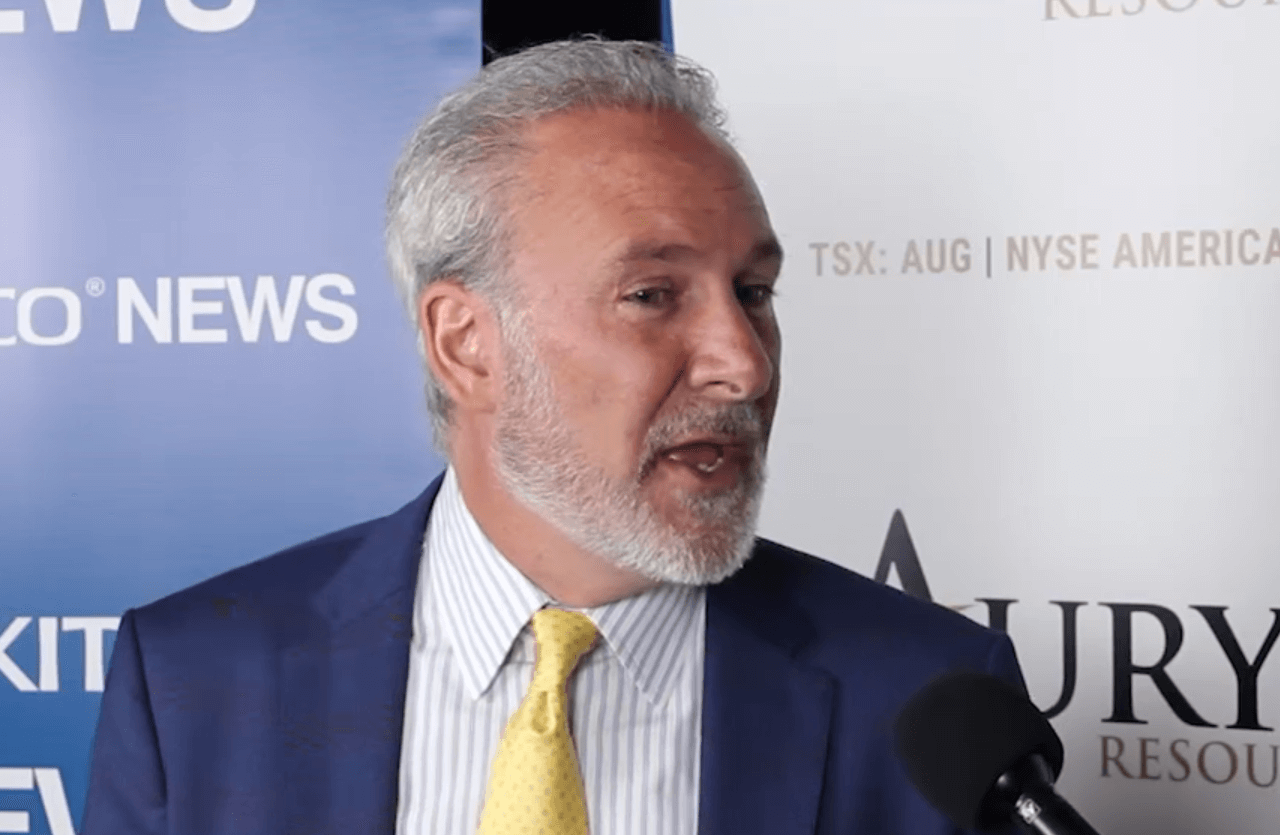

Peter Schiff, the gold bug, who has grown to become one of the most popular Bitcoin detractors, seems to be reining in his criticism of the top cryptocurrency.

The popular investor and stockbroker has taken just about every opportunity he has gotten to criticize Bitcoin, doubling down on multiple claims that making an investment in gold is much better than investing in Bitcoin. However, his most recent comment makes it seem like he’s starting to concede defeat.

Is Peter Warming Up to Bitcoin?

Earlier today, the investor took to his Twitter account to concede that Bitcoin has been a profitable investment over the past decade. Drawing on conclusions that we already know, he explained that Bitcoin investors- especially those who got in when the asset was still in infancy- have probably made a lot of money as its price has risen astronomically.

However, like every detractor looking to save face, he continued to criticize the top cryptocurrency as not being able to succeed without money. Concluding, he said, “I only said that Bitcoin would never succeed as money. Nothing that has happened over the past ten years has proven me wrong!”

Schiff’s tweet isn’t surprising. Bitcoin was able to beat out every other investment asset over the past decades, posting a 90,000 percent return on investment for every $1 invested in 2010, according to a ranking conducted by CNN. Also, despite starting 2019 in a desperate position, it was able to pull in almost 100 percent returns when the year came to an end- much better than Schiff’s preferred investment asset.

Regardless, the fact that it’s coming from Schiff is something. It’s also worth noting that he has clarified his stance viz a viz his latest tweet, as he explained further that his tweet was in no way an endorsement of Bitcoin.

“Some Bitcoin promoters are deliberately misrepresenting my concession that anyone who bought Bitcoin 10 years ago and sells now will make money as an endorsement of buying #Bitcoin today. It is not. Those who buy today and sell 10 years from now will likely do so at a loss,” he said.

A Common Pattern with Bitcoin Haters

Schiff was the subject of public spectacle across the Bitcoin community earlier this year, after he went on an untimely Twitter tirade about how Bitcoin was worthless because he suddenly lost his holdings. The entire debacle was eventually solved as he had mistaken his PIN for his password on his wallet app.

Even at that, he continued to criticize Bitcoin as not being able to serve as money. For now, it seems that a lot of people have started to back off the Bitcoin criticism a little bit. Another notable detractor, New York University professor Nouriel Roubini, made an appearance at the CC Forum 2019 conference in London last October. There, he was a panelist along with several notable crypto names, and to everyone’s shock, conceded that Bitcoin could act as a “partial store of value.”

Following the event, a popular crypto commentator and one of the event’s panelists, posted on twitter that Roubini’s concession represented baby steps towards what would become a change in his stance towards the asset class.

Join Our Telegram channel to stay up to date on breaking news coverage