Join Our Telegram channel to stay up to date on breaking news coverage

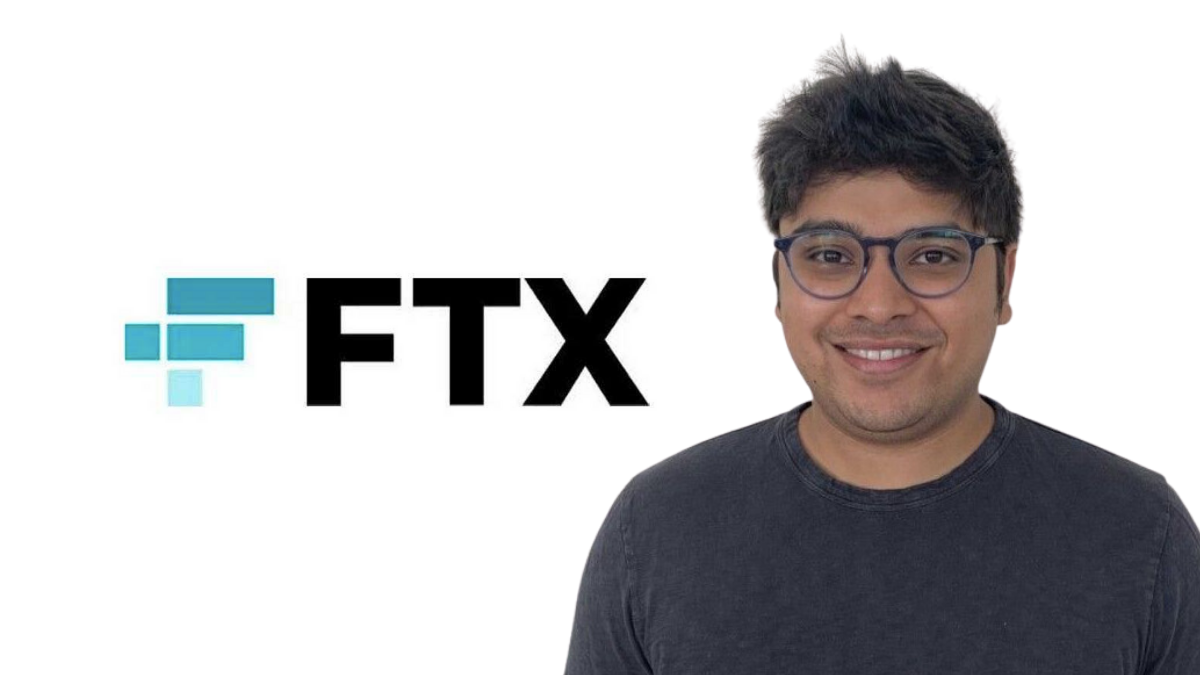

Former FTX executive Nishad Singh said yesterday that he found an $8 billion hole in the cyrptocurrency exchange’s accounts in September last year but continued to approve transactions he knew were funded with customer deposits

Singh, former head of engineering at the bankrupt exchange, made the revelation while testifying in the trial of FTX founder Sam Bankman-Fried on charges of fraud and conspiracy.

Singh, who had worked at affiliate Alameda Research before FTX’s inception, said that he knew Alameda’s bank accounts were used to store FTX customer funds right from the beginning.

Nishad Singh takes the stand as SBF looks on (by: me) pic.twitter.com/8xii8f6be1

— Brady Dale (@BradyDale) October 16, 2023

FTX User Deposits Routed to Alameda

He detailed his role in routing FTX user deposits into Alameda bank accounts and how he personally added wire instructions to FTX’s website, directing funds into Alameda-controlled accounts.

He also explained how he had implemented a feature giving Alameda “special privileges,” enabling it to borrow and withdraw FTX funds beyond their balance and collateral limits.

This led to Alameda owing billions of dollars in user funds and an $11 billion financial gap in FTX’s balance sheet.

Singh described how Bankman-Fried often disregarded objections from his team and pursued substantial investments aimed at establishing connections with influential figures, including celebrities and politicians.

FTX Founder’s Donations

The FTX founder made substantial donations to political candidates and high-profile investments. Singh testified that these donations were made in his name, even though the recipients knew he was not the real donor.

Bankman-Fried was linked to influential figures such as Hillary Clinton, Orlando Bloom, Kate Hudson, Kamala Harris’ husband, and Leonardo DiCaprio, Singh testified.

Large sums were channeled into donations and endorsements, including multi-million-dollar contributions to stars like Steph Curry, Kevin O’Leary, and Tom Brady.

They're back.

Judge: Let's proceed.

AUSA: Let's talk about real estate. Here is the exhibit…

Singh: There's the Orchid penthouse, $30 million… Old Ford Bay, I think that's the one Joe Bankman lived in, $9 million

[Note: Joe Bankman was on the Small Group Chat]— Inner City Press (@innercitypress) October 16, 2023

One notable highlight was a $200 million investment in K5 Global, a venture firm led by businessman Michael Kives.

Singh recalled his concerns regarding this investment and how he advised that it should be financed by Bankman-Fried personally, rather than FTX.

It didn’t change his former boss’s mind. Prosecutors introduced evidence indicating that the investment went through Alameda’s venture arm rather than Bankman-Fried’s personal funds.

Singh also said that Bankman-Fried had requested moving Serum (SRM) tokens onto Alameda’s balance sheet to mislead the U.S. Commodity Futures Trading Commission. Singh said he refused to complete the transaction, citing ethical concerns.

Admiration For FTX Boss Turned to Shame

Singh concluded his testimony by recounting his initial admiration for Bankman-Fried as a “formidable” and “brilliant” leader. But over time, he said, his admiration turned to “shame” when he discovered the misuse of customer funds.

Singh has pleaded guilty to charges involving fraud and campaign finance violations and is cooperating with the prosecution,

Related Articles

- FTX Founder Sam Bankman-Fried On Trial: The Big Three Witnesses Expected To Testify Against Him

- Sam Bankman-Fried Accused of Using $100 Million In Stolen Funds for Political Donations

- Gary Wang Says He And Sam Bankman-Fried Committed Financial Crimes, ”Lied About” Alameda Research Funding

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage