The non-fungible token market has continued to record negative gains now for the past several months. The NFT market downturn started escalating sometime mid-year, leaving many NFTs nearly worthless. In this article, we have gone deep down to explore what went wrong.

NFT Sales Are Down 34% This October

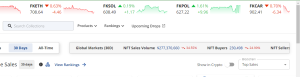

Data compiled by CryptoSlam.io, an on-chain crypto market data aggregator, indicated that the global market has fallen 34% in the past 30 days. This is the fifth month the NFT market has recorded a negative gain since earlier this year. The NFT market has also fallen short on the number of users trading in the ecosystem.

The NFT market initially began developing notable market cracks sometime in the mid-last year after major crypto market platforms such as Terra and LUNA collapsed. Late in the year, the crypto and NFT market suffered another big blow after the collapse of the crypto exchange FTX.

Fortunately, the NFT market retested market hype earlier in the year following the introduction of new forms of NFTs like Bitcoin Ordinals, drawing back attention from meme coins and shitcoins, which somewhat dominated the market. Let’s dive deeper and explore what went wrong and how the issue can be fixed.

From the beginning of the year, crypto traders, collectors, and industry experts thought that non-fungible token creators’ royalties, platform fees, and more advanced tools would be the deciding factors for another NFT market bull run. Unfortunately, despite applying all these factors, the market has instead moved in a downward spiral.

What Went Wrong?

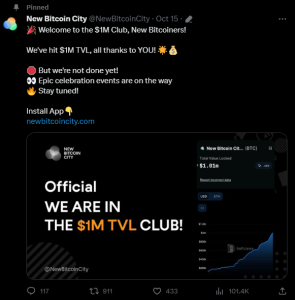

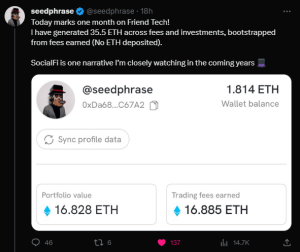

The crypto and NFT community didn’t foresee the establishment of brand new protocols and tech that would steal the same traders away and pull their attention away from NFTs. SoFi platforms such as FriendTech, Stars Arena, and New Bitcoin City are trying their best to take traders to the cutting edge of finance and technology.

It’s worth noting that the Blur NFT market platform launched its native token “$BLUR” and non-fungible token reward program to incentivize traders participating on its market platform earlier this year. As the $BLUR crypto token price declined and more opportunities to earn the platform’s points increased, traders began looking elsewhere for rewards on the blockchain.

FriendTech was primed to win over these traders when it launched on August 10, giving users shared fees each time traders bought and sold access keys to chat with them. The crypto-based platform also promises future rewards early next year in the form of $ETH. The social media platform has gained traction among crypto and NFT traders.

New Hope For NFTs

Interestingly, the NFT Marketplace Blur is now attempting to attract traders back by announcing the end date for Season 2 farming on November 20, 2023. More importantly, one of their investors submitted a proposal to the Blur Foundation, suggesting a 1% fee is added to all trades on blur.io.

Even though the proposed fees may sound counterproductive, the ultimate goal will be to buy $BLUR with those earnings and burn the token. As the supply decreases, this should drive up the price of $BLUR. However, the strategy will be effective if many traders haven’t already felt burned and decided to leave for better opportunities.

Initial reaction to the proposal has been tried and tested positive, leading to a drastic 85% increase in wash trading last week and over $31.3 million in wash sales volume. The Wash transactions saw a similar increase from 28,208 in the first week of October, climbing 75% to 132,281 last week.

The New Flooring Protocol

Flooring Protocol is a new disruptive non-fungible token market platform drawing back NFT collectors from the SoFi platform with its fractionalized digital collectibles. Since its inception earlier this week, the market platform has seen over 489 ETH traded in and out of fractionalized Azuki Elementals, y00ts, and Pudgy Penguins NFTs.

It is an NFT fragmentation protocol that you can put your 1/1 NFTs in.

The non-fungibles remain non-fungible.@flooringproto pic.twitter.com/6cPxu0fgJU

— FreeLunchCapital (@FLC_FlooringLab) October 18, 2023

Since these fractionalized collectibles being traded are fungible tokens and not non-fungible tokens, they offer traders a new way to get liquidity and collectors a chance for exposure to some of the world’s most expensive NFTs for just low value. The new Flooring Protocol has a strong potential of gaining mainstream adoption.

In related reports, Hyperspace, a multi-chain, non-fungible token marketplace, has launched an ambitious multi-million $AVAX NFT incentive program in partnership with Avalanche. The new NFT incentive program has received a warm reception, seeing more than 15,000 user sign-ups in its first week. If more crypto initiatives continue landing on the NFT ecosystem, the NFT market might boom again.

NFT SZN is in full swing on Avalanche!

In collaboration with @Hyperspaceavax, Avalanche is launching an ambitious multi-million $AVAX NFT incentive program.

🔍 NFT SZN Incentives

Hyperspace recently announced its innovative Rewards Program, which has already seen 15k+ user… pic.twitter.com/C6XY8vBzBN

— Avalanche 🔺 (@avax) October 17, 2023

Related NFT News:

- Hyperspace & Avalanche Join To Launch A Multi-Million NFT Incentive Program

- Top Selling NFTs This Week – Winds Of Yawanawa NFTs Rise In Rankings

- NFTs Start The New Week Up 29% – Ethereum NFT Sales Pump 60% In The Past 24 Hrs

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users