Join Our Telegram channel to stay up to date on breaking news coverage

The global cryptocurrency market continues to show resilience, with its market cap reaching $1.04 trillion, marking a 0.27% increase in the past 24 hours.

In addition to the increased market cap, the total crypto market volume for the last 24 hours surged to $24.24 billion, a notable 0.78% uptick. Within this volume, the decentralized finance sector contributed significantly, with a total volume of $2.28 billion, constituting 9.39% of the entire crypto market’s 24-hour trading volume.

Furthermore, stablecoins played a dominant role in the market, with their volume reaching $23.39 billion, representing a substantial 96.47% share of the total crypto market 24-hour volume.

While still significant at 48.25%, Bitcoin’s dominance experienced a slight dip of 0.02% for the day. Crypto enthusiasts are closely monitoring these trends as the market remains dynamic.

Early on Wednesday, Asian stock markets experienced a decline following concerns over sluggish economic growth in both China and Europe. Simultaneously, the U.S. dollar strengthened as investors deliberated on the Federal Reserve’s interest rate projections.

Next Cryptocurrency to Explode

As trading began, London and U.S. markets indicated a lower opening, with FTSE futures down by 0.42% and E-mini futures for the S&P 500 index showing a 0.13% decline at 0520GMT.

Investor confidence was tempered by a private-sector survey released on Tuesday, revealing that China’s services sector had its slowest expansion in eight months during August, primarily due to weakened demand.

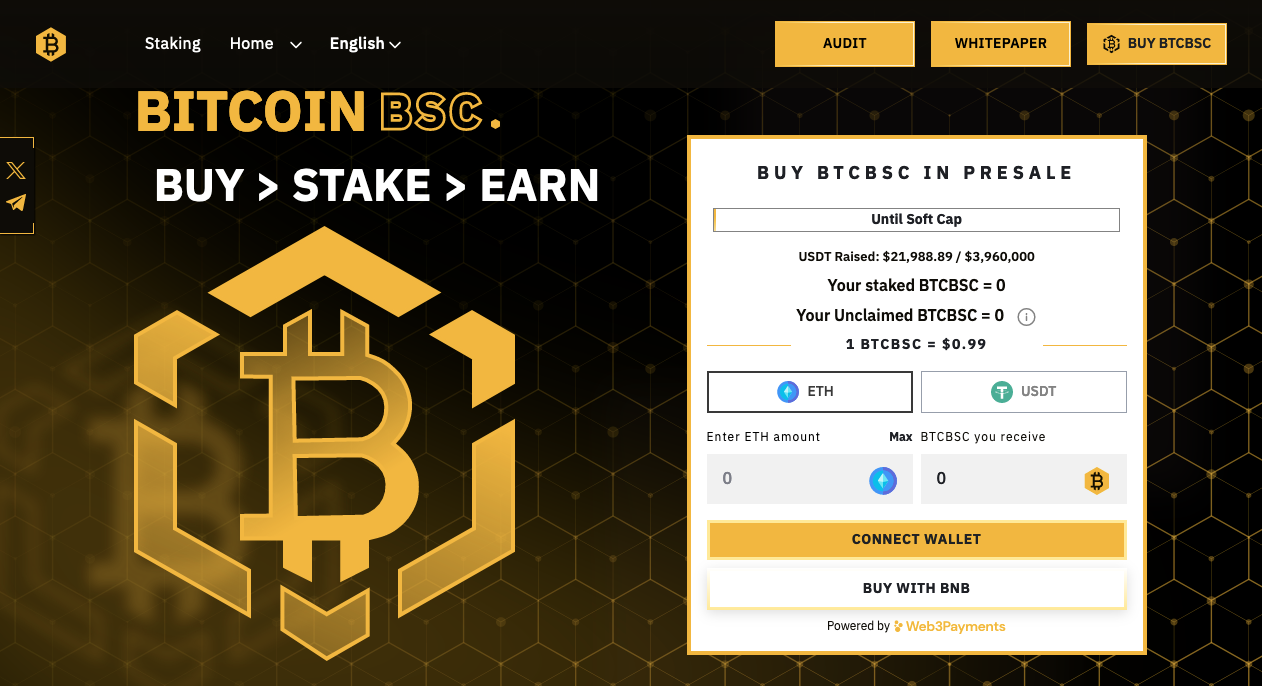

1. Bitcoin BSC (BTCBSC)

Bitcoin BSC (BTCBSC) has become a high-potential proof-of-stake token, allowing users to earn rewards every 10 minutes. Built on the Binance Smart Chain, BTCBSC draws inspiration from the early days of Bitcoin, specifically in April 2011, when Bitcoin was priced at a humble $0.99, and its circulating supply hovered around 6 million.

What sets BTCBSC apart from purchasing BTC in 2023 is the substantial price difference, the enticing staking rewards, and the remarkable growth potential. This novel concept follows in the footsteps of BTC20, a similar project launched earlier this year on Ethereum. BTC20’s presale, amounting to $6 million, sold out within two weeks, yielding extraordinary gains of 600% post-launch. Industry analysts are cautiously optimistic that BTCBSC could replicate this success when it launches in the coming weeks.

The official website, bitcoinbsc.io, presents a unique proposition for cryptocurrency investors—an opportunity to purchase Bitcoin at its April 2011 price, with additional perks. In its presale phase, BTCBSC is priced at an inviting $0.99, with 6.125 million tokens available, mirroring the circulating BTC supply from that era.

However, BTCBSC diverges from Bitcoin’s proof-of-work (PoW) consensus mechanism, operating on a more efficient proof-of-stake (PoS) system. This PoS mechanism enhances efficiency and enables users to lock their tokens in a staking pool, generating rewards.

https://twitter.com/Bitcoinbsctoken/status/1699000085290369232?s=20

BTCBSC offers generous rewards of 0.25 BTCBSC per BSC block, distributed at ten-minute intervals. Currently, the project estimates an astonishing annualized yield percentage of 166,540%. Notably, this percentage may adjust as more tokens join the staking pool, with plans to include 14.5 million tokens.

In comparison to other notable PoS tokens such as Ethereum (typically 4-5%), Solana (6-7%), and Cardano (5-10%), BTCBSC’s rewards are anticipated to surpass them substantially.

Following Bitcoin’s enduring model, BTCBSC implements a 120-year unlocking schedule, ensuring long-term sustainability. With a maximum supply of 21 million tokens, BTCBSC closely mirrors Bitcoin.

In the spirit of Bitcoin’s early days, 6.125 million tokens are allocated to the presale, comprising 29% of the total supply, without any vesting period. After the presale concludes, an additional 420,000 (2%) of pre-mined tokens will be set aside for a future launch on decentralized exchanges.

The presale is open, allowing buyers to participate using BNB, ETH, or USDT. Don’t miss this opportunity to engage with BTCBSC, a unique and potentially lucrative addition to cryptocurrency.

Visit Bitcoin BSC.

2. Synthetix (SNX)

Contrary to the broader cryptocurrency market trend, the SNX token has displayed notable resilience this week, surging by over 16.5% to surpass the $2.40 mark. Subsequently, it has moderated some of its gains and is presently trading at $2.47, indicating an 11.34% increase over the past 24 hours, with a trading volume of $96.6 million.

Ranked 52nd in the cryptocurrency hierarchy, SNX boasts a market capitalization of $662.4 million. It has exhibited impressive growth, rising by 9.2% in the past week and 6.4% over the past fortnight. However, its performance over the last month reflects a decline of 12.7%.

SNX is the native token for Synthetix, a decentralized synthetic asset issuance protocol. In the year 2023, Synthetix has experienced a remarkable surge of over 53%, although it has encountered a decline of approximately 24% over the past year.

The token reached its peak value of $28.53 on February 14, 2021, subsequently depreciating by 92.25%. This zenith followed a $12 million funding round in which notable entities like Coinbase Ventures, Paradigm Capital, and IOSG Ventures directly acquired SNX tokens from the platform’s treasury.

This year, Synthetix introduced its trading protocol’s latest iteration, Synthetix Perps. This decentralized trading protocol offers a versatile backend infrastructure that can be seamlessly integrated with various protocols. Notably, it provides 50x leverage on over 40 assets. Perps V2 achieved a significant milestone in the second quarter of 2023, surpassing a total trading volume of $15 billion since its launch at the end of the previous year.

Currently, all eyes are on the forthcoming deployment of Synthetix V3. This version has been developing for two years and is positioned as the liquidity foundation for Decentralized Finance. Notable enhancements in this upgrade to Perps V2 include multi-collateral support, enabling any synth as collateral and native cross-margin functionality for users. These developments are poised to reshape the DeFi landscape significantly.

3. Chainlink (LINK)

Chainlink (LINK) has embarked on a bold initiative to enhance its platform’s capabilities and reinforce its community ties. The introduction of Chainlink (LINK) Stake v0.2 comes with an exciting and competitive public code testing competition hosted on the Code4Rena platform.

Spanning 18 days, this contest rigorously evaluates the latest Chainlink (LINK) release, offering participants an opportunity to vie for a portion of the generous $250,000 prize pool. This move seamlessly aligns with Chainlink’s (LINK) core principles of innovation and community engagement. It showcases Chainlink’s unwavering dedication to cultivating a vibrant ecosystem, actively inviting its user base to play an integral role in its ongoing development.

Interestingly, the response to these developments hasn’t translated into immediate market gains, as the Chainlink price experienced a 3.4% decline over the past week. Beginning at $6.25 on August 23, LINK saw a dip to $6.04 by August 30.

Despite this short-term fluctuation, market analysts maintain an optimistic Chainlink price prediction. There is a prevailing confidence that the Chainlink price will transcend its current challenges and ascend beyond the $6.5 threshold. These developments underscore Chainlink’s unwavering commitment to innovation and community collaboration, factors that continue to shape its promising future.

4. Conflux (CFX)

Conflux is on the brink of a significant hard fork upgrade as the Conflux Network (CFX) prepares for a crucial transformation. The hard fork is slated to take place at Conflux’s epoch 79,050,000, with the notable point that it won’t lead to the creation of new tokens.

In a noteworthy development, the prominent cryptocurrency exchange Binance has announced its full support for this network upgrade. Binance has managed all technical aspects for users holding CFX in their Binance accounts. Consequently, the ability to deposit and withdraw CFX tokens will be temporarily suspended, beginning around September 7 at 4:00 p.m. (UTC).

Binance has assured its users that it will restore the deposit and withdrawal services for CFX once it determines that the upgraded network has achieved stability. Any further notifications to users regarding this matter may not be necessary.

In a detailed blog post, Conflux provides insights into the v2.3.0 release, which introduces this significant hard fork. To prepare adequately for this event, Conflux strongly advises all nodes to complete their upgrades before the epoch number reaches 79,050,000, which is anticipated to occur on September 7. As this milestone is reached, several Conflux Improvement Proposals (CIPs) will come into play.

For example, CIP-112 will be activated once the epoch number reaches 79,050,000 or around September 7. Subsequently, CIP-107, CIP-118, and CIP-119 will be enabled when the block number reaches 188,900,000, with an estimated activation date of September 9. CIP-113 will follow suit, becoming effective when the PoS block number hits 766,200, also projected for September 9.

Delving into the specifics of these CIPs, Conflux explains that CIP-107 introduces a “storage point,” a mechanism designed for burning storage collateral. CIP-112, on the other hand, addresses issues related to the encoding and decoding implementation of the custom field within block headers.

CIP-113 takes steps to accelerate the PoS finalization process by shortening the PoS consensus round time and the wait time for pivot decision signing. Meanwhile, CIP-118 introduces an internal contract interface, facilitating the query of unused storage points. These developments reflect Conflux’s ongoing commitment to enhancing its network and advancing its capabilities.

Read More.

Best Wallet - Diversify Your Crypto Portfolio

Join Our Telegram channel to stay up to date on breaking news coverage