Join Our Telegram channel to stay up to date on breaking news coverage

Today, we’re focusing on tokens making waves in the crypto market, like Synthetix, Axie Infinity, and MultiversX. This review will explore what sets them up as potential candidates for significant growth in the market. Additionally, Meme Kombat is gaining traction during its presale, raising over $7 million as investors closely monitor its progress.

Next Cryptocurrency to Explode

Synthetix has recently experienced a bullish breakout, surpassing its resistance level and increasing by almost 5%. On the other hand, the AXS cryptocurrency is showing clear signs of bearishness, with a downward trend below crucial support levels.

In addition, MultiversX has announced a distribution of 1,000,000 ITHEUM tokens to ecosystem builders. At the same time, Meme Kombat has allocated 50% of its total token supply for the MK presale, aiming for inclusivity among all participants.

1. Synthetix (SNX)

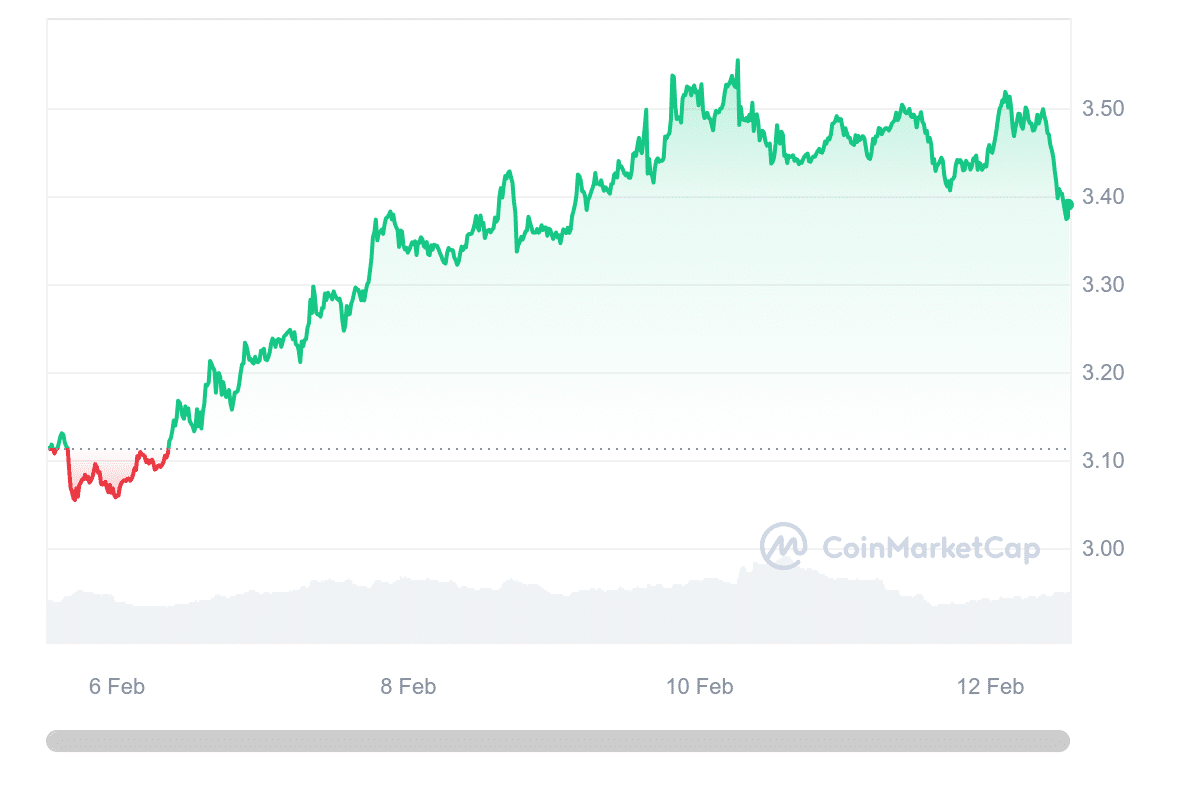

Synthetix has recently broken out bullishly, surpassing its resistance level and rising by nearly 5%. With the current price at $3.48, the market has positive sentiment, indicating potential upward movement soon.

In a recent tweet, the token announced that Synthetix Perpetuals, which utilize Pyth Network’s oracles, have surpassed $40 billion in trading volume. Lower fees and enhancements to the on-chain Perpetuals protocol supported this achievement.

Synthetix’s price chart today is going up, hitting $3.48, higher than expected. This rise is because many people are optimistic about it, as shown by the RSI value of 57.77, which means the market sentiment is balanced.

Furthermore, the Bollinger Bands support level at $3.48 suggests a level of price support where buying interest may strengthen, preventing further price decline. Conversely, the resistance level at $2.97 indicates a point where selling pressure might increase, potentially hindering price growth.

Synthetix Perps, leveraging @PythNetwork's oracles, have surpassed $40B in trading volume, thanks to lower fees and an enhanced onchain Perps protocol.

We're proud to be early users of Pyth Oracles and recipients of the Pyth Retrospective Airdrop.

👇https://t.co/SMFsrvCUXv1/4 pic.twitter.com/htYOZliwJh

— Synthetix ⚔️ (@synthetix_io) February 7, 2024

Considering these indicators, the coin’s price is likely trading within a range, with potential support near $3.48 and resistance near $2.97. Traders may seek confirmation signals, like price action patterns or volume analysis, to make informed decisions on entry or exit points.

However, Synthetix has been doing well lately. In just one week, it went up from $3.13 to $3.29, and its market value increased from $945 million to $1 billion. Also, it’s trading higher than its average prices for the last 21 and 50 days. However, this has excited experts, predicting it could reach $3.87 by March 2024.

2. Axie Infinity (AXS)

Axie Infinity, a popular gaming platform, has announced new updates to its Axie Builders Program Games, including Axie Quest and Sky Smash Axie: Reloaded. These updates bring new features like Part Evo utility, AXP updates, and integration with Atia’s Blessing and Mavis Store.

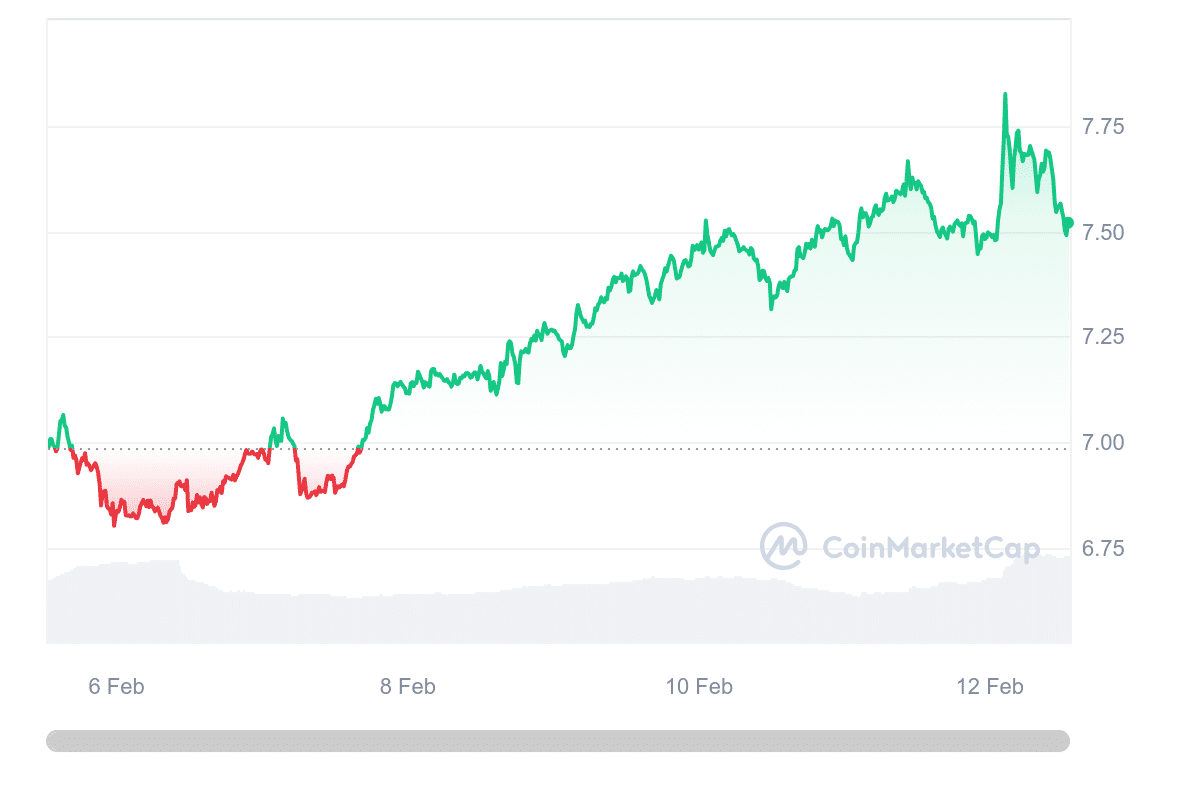

The AXS cryptocurrency shows signs of solid bearishness, with a downward trend below the critical support levels of the 20 and 50-day EMA bands. This downward movement is driven by increased selling pressure, suggesting a potentially significant price decline.

Furthermore, indicators like the MACD signal a bearish trend, with a recent bullish cross below the zero line. The MACD values, including -0.25 for the main line and -0.23 for the signal line, indicate a downward momentum that could widen the gap and further drive prices down.

1/ New Updates to Axie Builders Program Games@AxieQuest and @SkySmashAxie: Reloaded 🛠️

• New Part Evo utility

• Fresh AXP updates

• Atia’s Blessing and Mavis Store integration… and MOAR!

Check out the updates below 🧵👇 pic.twitter.com/nujqTGN1OG

— Axie Infinity (@AxieInfinity) February 12, 2024

The RSI, which measures momentum, is steadily decreasing, indicating weakening momentum and potential for further decline. The recent rejection from the 14-day SMA suggests downward pressure. The RSI curve is 40, while the 14-day SMA curve is 42.

Considering past price movements and current indicators, AXS is exhibiting a bearish outlook, with various signals indicating a potential for further decline. Recent performance metrics show a consistent downward trajectory, with 6.23% and 7.36% declines over the past week and month. However, this positions the coin as the next cryptocurrency to explode.

3. MultiversX (EGLD)

MultiversX recently announced that it will be offering 1,000,000 ITHEUM tokens to ecosystem builders. This initiative is part of the first xPand Grants Program, where ITHEUM will assist seven startups from the xDay Hackathon by providing support through its technology.

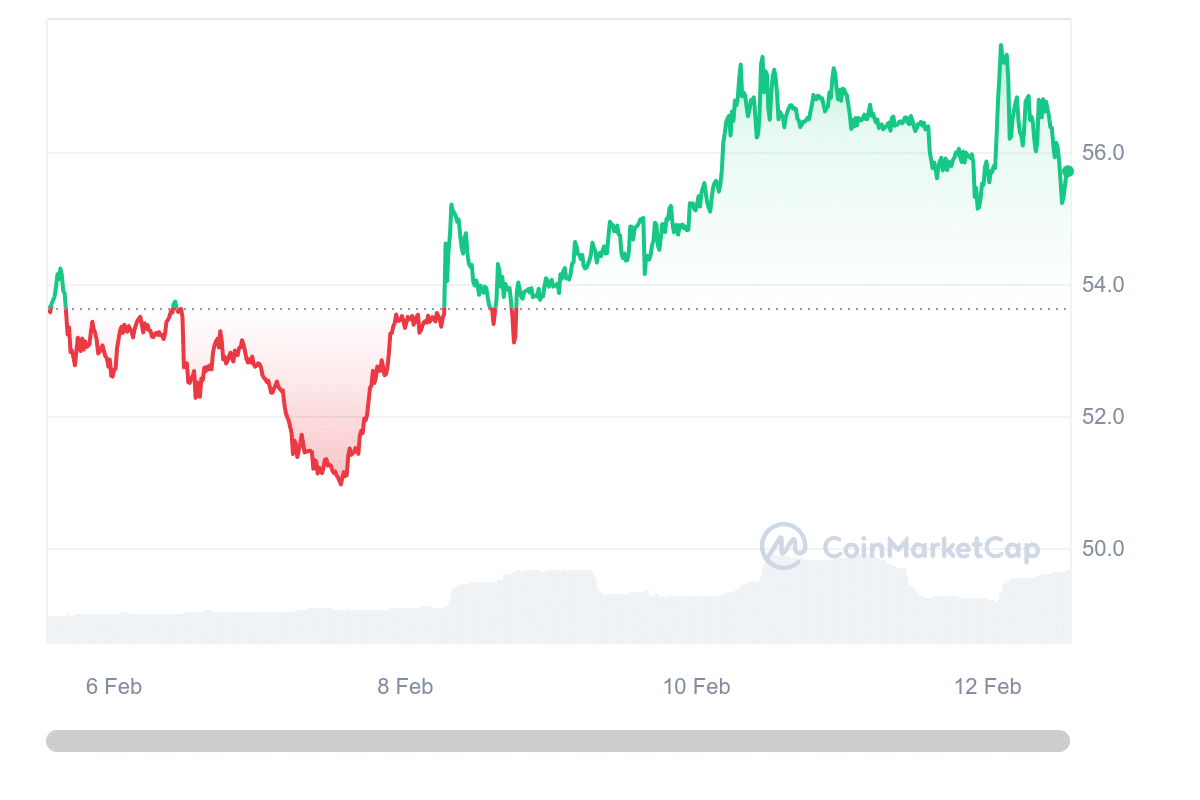

MultiversX has been hovering around the 50-day EMA for four to five weeks, attempting to find stability. In January, the cryptocurrency experienced a significant decline after buyers tried to push it above $75.

However, sellers struggled to lower the EGLD price, encountering resistance near the 50-day EMA. Buyers stepped in, preventing further downward momentum and establishing support near the 50-day EMA. Upon closer examination of the daily chart, an inverted head and shoulders pattern is evident, with the price currently forming the right shoulder of the pattern.

1,000,000 $ITHEUM for ecosystem builders 🛠️

For the first xPand Grants Program, @itheum will support 7 #xDay Hackathon startups using its tech.

The application process is already open for the 2nd session 💡https://t.co/8E8K15jrqq https://t.co/QCNi2ko8GH

— MultiversX (@MultiversX) February 12, 2024

Currently, EGLD is trading at $56.40, experiencing a 1.05% intraday loss. It has a market capitalization of $1.499 billion and ranks 51st among all cryptocurrencies. The volume-to-market cap ratio is 2.30%, indicating low volatility.

Analysts hold a positive outlook, anticipating a potential upside of over 22.4% by the end of February after the neckline breakout of the head and shoulders pattern. However, this could drive the price back to recent highs of $70 and $75. Conversely, bearish analysts speculate that the price might drop below $50, potentially reaching $45 and $40.

4. Meme Kombat (MK)

The current trend in the crypto market indicates a rising interest in GameFi projects, with many top-ranking tokens belonging to this category. At present, Meme Kombat is one of the noteworthy projects deserving of investors’ attention.

Currently, 35,843,313 MK tokens are staked, representing 80% of the total MK tokens available. Staking offers a competitive annual percentage yield (APY) of 110%. So far, 7,970,675 MK tokens have been awarded to stakers, with 11,701 participating in the staking program. These figures indicate strong investor interest and active involvement in the MK token, suggesting its potential for future growth.

We're 85% of the way there fighters!

LFG🫡 $8.5 million raised. pic.twitter.com/dNEYZ9YQ6u

— Meme Kombat (@Meme_Kombat) February 10, 2024

Moreover, Meme Kombat has allocated 50% of its total token supply for the MK presale, ensuring inclusivity for all participants. Additionally, 30% of the supply is dedicated to staking and battle rewards, fostering ecosystem support and equilibrium. Another 10% of the tokens will be paired with a liquidity pool on a decentralized exchange (DEX). Lastly, 10% of the tokens are earmarked for community rewards, highlighting the importance of community participation and engagement through exciting battles.

Nevertheless, investors are drawn to Meme Kombat due to its unique gaming attributes and the opportunity for passive earnings via staking. The innovative staking system combines on-chain and off-chain transactions to reduce user fees, offering users the choice between staking and deploying tokens for battles within the integrated gaming platform.

Furthermore, digital currencies are making a comeback, especially according to cryptocurrency analysts. The US Securities and Exchange Commission has finally given approval for Bitcoin exchange-traded funds (ETFs), albeit reluctantly, after pressure from the courts.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage