Join Our Telegram channel to stay up to date on breaking news coverage

NEO Price Analysis – July 18

NEO has been very reliable since its inception and the coin is proving itself to traders every day, maintaining a steady trend throughout the week. It increases every other day and gives small benefits on daily trading.

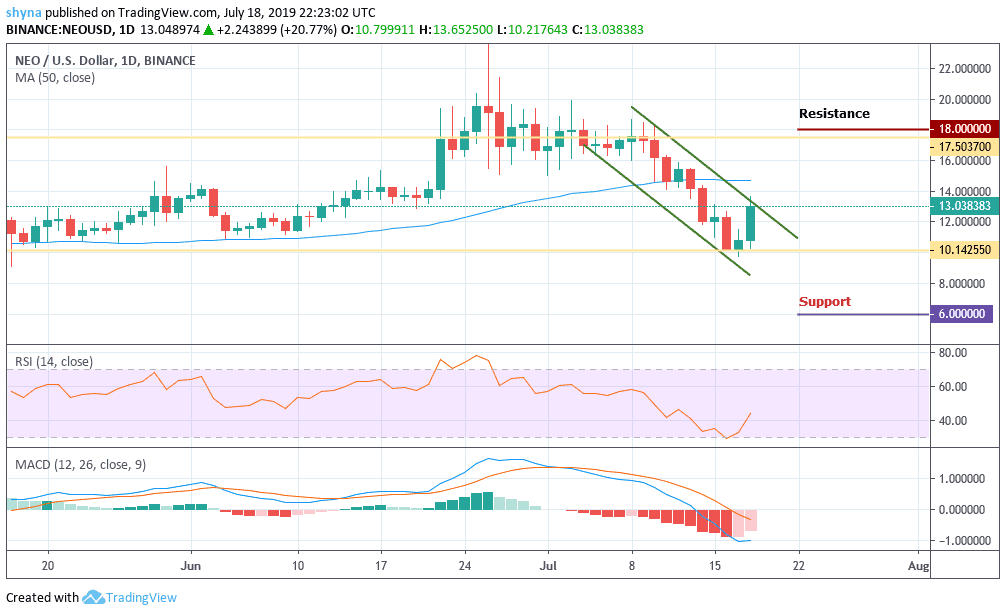

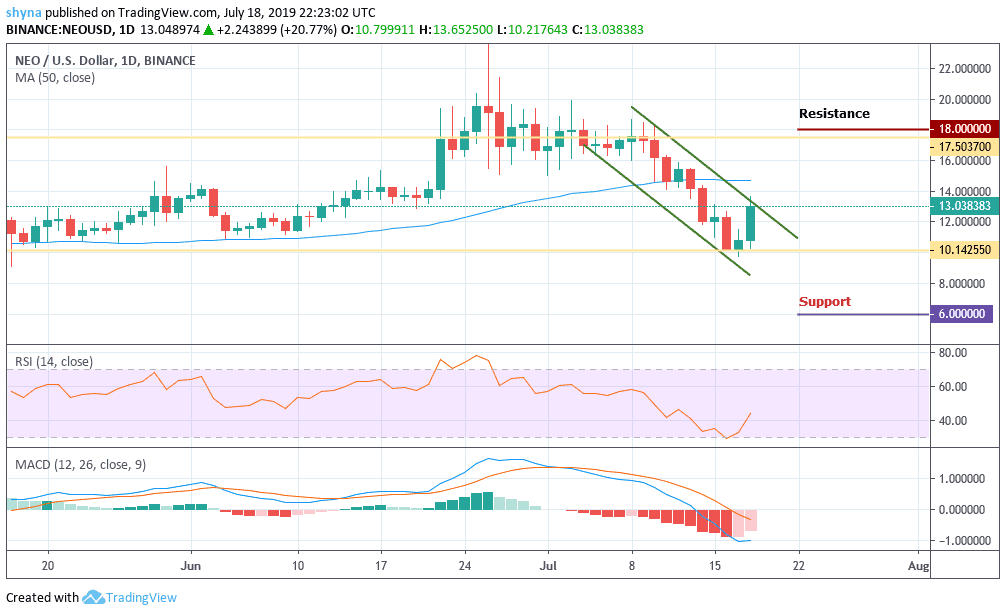

NEO/USD Market

Key Levels:

Supply levels: $18, $20, $22

Demand levels: $6, $4, $2

NEO has recorded more than 15% surge since yesterday after the price rose from $10.14 to its current value at $13.04 as on July 18, 2019. The coin started trading today at $10.79 and quickly picked up the pace to rise as high as $13. This is a better trend than yesterday when the coin started at $10.14, surged up to $10.47 and started dropping down fast to hit $9.75 support level.

Similarly, it was only after the NEO coin reached $9.75 that it started moving in the upward direction again. The correction above $13 is needed for the buyers to focus on the $14 resistance level. Besides, the support above $10 will safeguard the path towards the resistance levels of $18, $20 and $22. Other key support levels to look out for include $6, $4 and $2. Meanwhile, RSI (14) is moving above the 40-level while the MACD signal lines have crossed to the negative side.

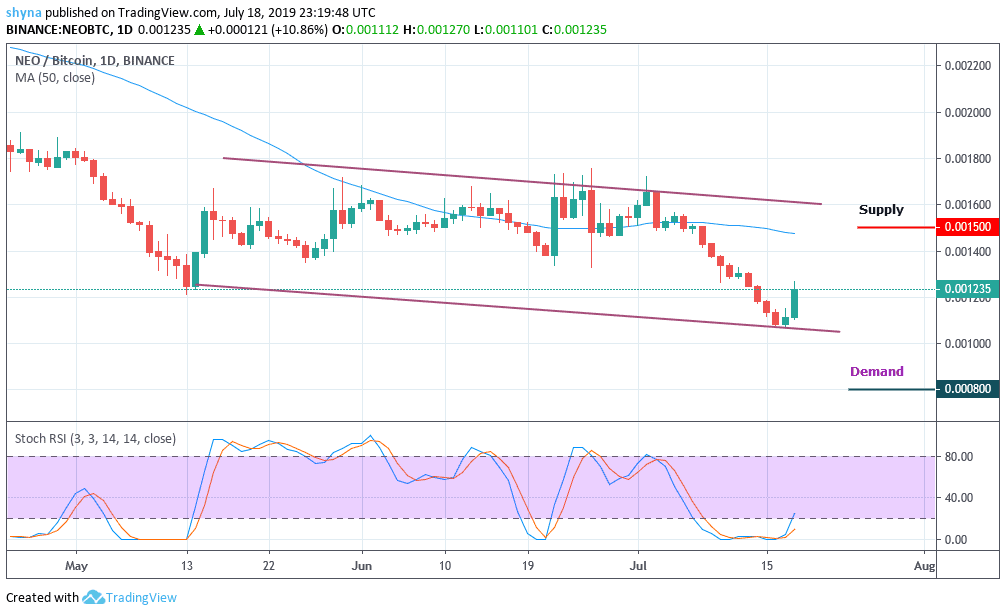

NEO/BTC Market

Looking at the daily chart, NEOBTC is bearish. The price formed a descending channel on the chart. It is at the lower support line of the channel consolidating. The bulls have started pushing the price upward since yesterday July 17 but if they are able to maintain their stand, the price may likely hit the supply levels at 1500SAT and above.

When we look at the current Stochastic RSI on the daily chart, it appeared that the bulls are gaining momentum as the market is trying to recover from the overbought condition. If the bulls miss this opportunity, NEO price may drop to the demand levels of 800SAT, 600SAT, and 400SAT, crossing the lower part of the wedge. However, should the market continues the uptrend movement as it is currently, NEO may swing high and still remain the dominant of the market.

Please note: insidebitcoins.com is not a financial advisor. Do your own research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Join Our Telegram channel to stay up to date on breaking news coverage