Join Our Telegram channel to stay up to date on breaking news coverage

With the exception of brief volatility caused by Tether (USDT), Bitcoin has made a name for itself as a stable asset in recent months – what could shift the status quo?

Bitcoin More Stable Than Nasdaq

As 2018 rolls on, investors are eyeing multiple possible catalysts that could send prices soaring across cryptocurrency markets.

The desire is real; since mid-September, Bitcoin 00 managed to beat Nasdaq’s volatility record to form an unusually safe haven.

Leading the way are institutional traders, their accompanying billions of dollars and an increasingly formalized stance on the industry from US regulators.

Wall Street Dips Toes Into Bitcoin

It’s not secret that the long-awaited opening up of crypto to Wall Street is about to go live. While investors had a taste of the effect last December with the first Bitcoin futures contracts, few major products have hit the market in the meantime.

Now, Intercontinental Exchange looks set to kick off a domino effect of Bitcoin investment products, confirming plans to launch its Bakkt physical Bitcoin futures December 12 (subject to getting the nod from regulators).

In the offing are also competitors Goldman Sachs, Morgan Stanley, and Citigroup, all of which claim to be responding to customer demand for crypto.

Fidelity Investments, announcing its own entry this month, focused on solving the issue of regulated custody, an achievement Galaxy Digital’s Mike Novogratz has publicly acclaimed.

Bitcoin ETF on the Horizon

Despite the round of rejections Bitcoin exchange-traded funds (ETFs) received from the US Securities and Exchange Commission (SEC) in August, the matter is far from settled.

A mediation process continued this week after applicants met with the regulator to discuss concerns – and in the case of VanEck, explain that these were no longer areas of contention in their offering.

A green light for ETFs to begin trading would spark a price increase, commentators have long claimed, but such an eventuality is only expected next year at the earliest.

Fundamentals

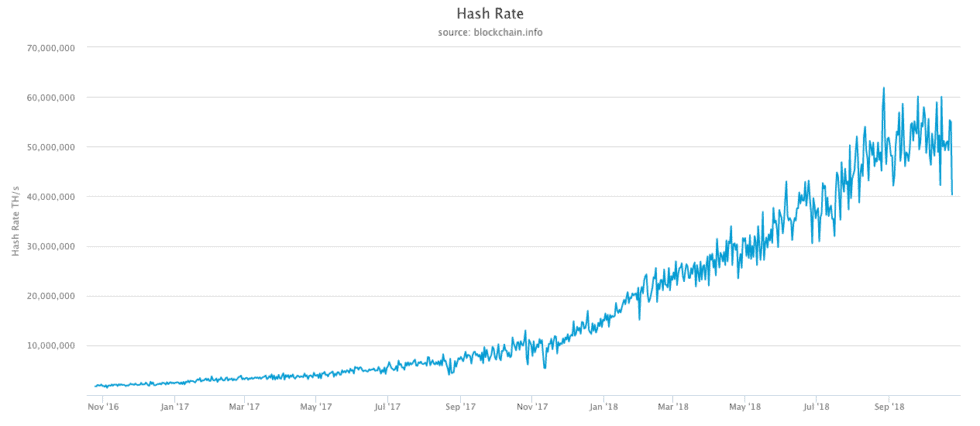

Beyond speculative market activity, the underlying health of Bitcoin has only increased during its lengthy price climbdown from last December’s all-time highs amid a record high network hashrate, which market analyst Max Keiser says is followed by price.

Dedicated research on the topic has concluded that while there remains some room for more downside in the short term, the network is ready to sustain a U-turn.

It’s sentiment shared by analysts such as Tom Lee, who this week suggested it was unlikely that prices would fall below a “floor” of $6000.

“Where can the surprise take place? I know a lot of people think Bitcoin’s price will collapse to $3000,” he told Bloomberg.

“I think what’s more probable a surprise is that we have a very explosive increase in price.”

What do you think about factors to make Bitcoin hit new highs? Let us know in the comments below!

Images courtesy of Shutterstock, Blockchain.info

The post More Stable Than NASDAQ: 3 Factors That Could Wake Up Bitcoin Price appeared first on Bitcoinist.com.

Join Our Telegram channel to stay up to date on breaking news coverage