Join Our Telegram channel to stay up to date on breaking news coverage

XMR Price Analysis – August 20

Following a decent rise over the past few days, XMR now appears to be resuming bearish run.

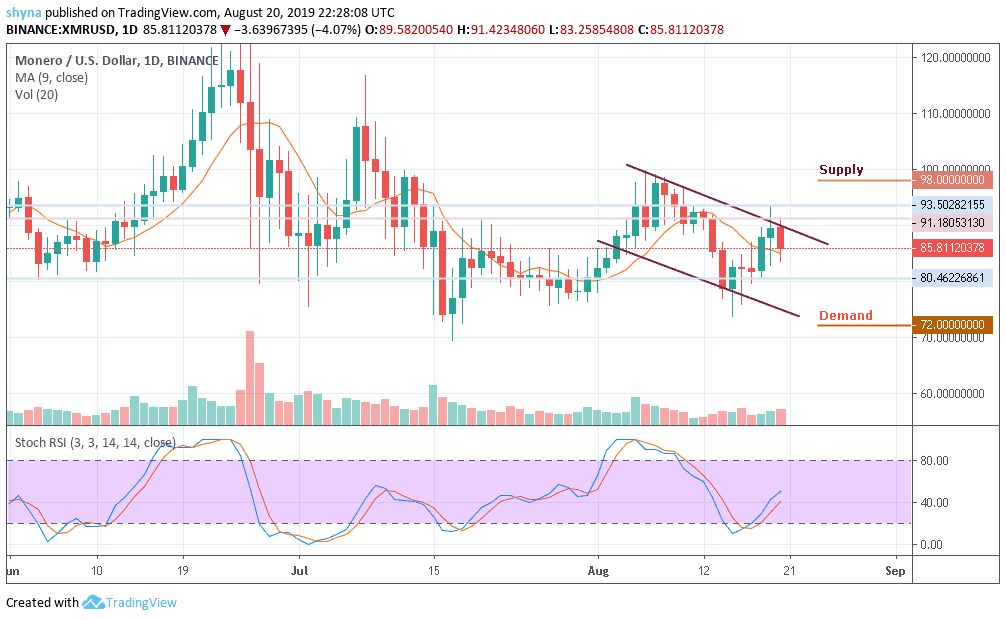

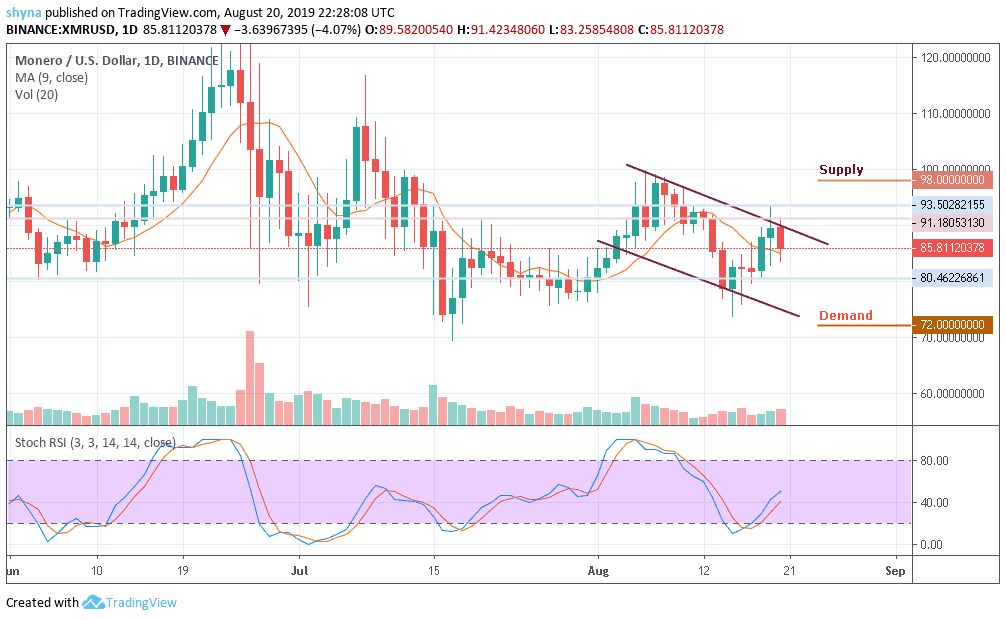

XMR/USD Market

Key Levels:

Supply levels: $98, $104, $109

Demand levels: $72, $67, $62

The price of XMR has gone down from $91 to $89 in the early hours of today. The bulls had taken the price up to $91.18 before the bears stepped back in and took it down to $89. Yesterday, the bears took control of the market took the price down from $88 to $82, where it found demand and bounced up to $89. The price is currently consolidating in a flag formation, looking to break out from the descending wedge channel.

Now, following a decent rise over the past few days, Monero (XMR) now appears to be resuming bearish run. The next level of demand may surface at $72 and then locate further key demand at $67 and $62 levels if the sell-off later becomes huge. Due to the sharp downward movement, the XMR/USD pair is seriously struggling to break out of the dominant bearish trend, especially the channel’s boundary. In case of a break, the key supply levels to watch out for are $98, $104, and $109. The stochastic RSI is moving above level 40 revealing some buy signals.

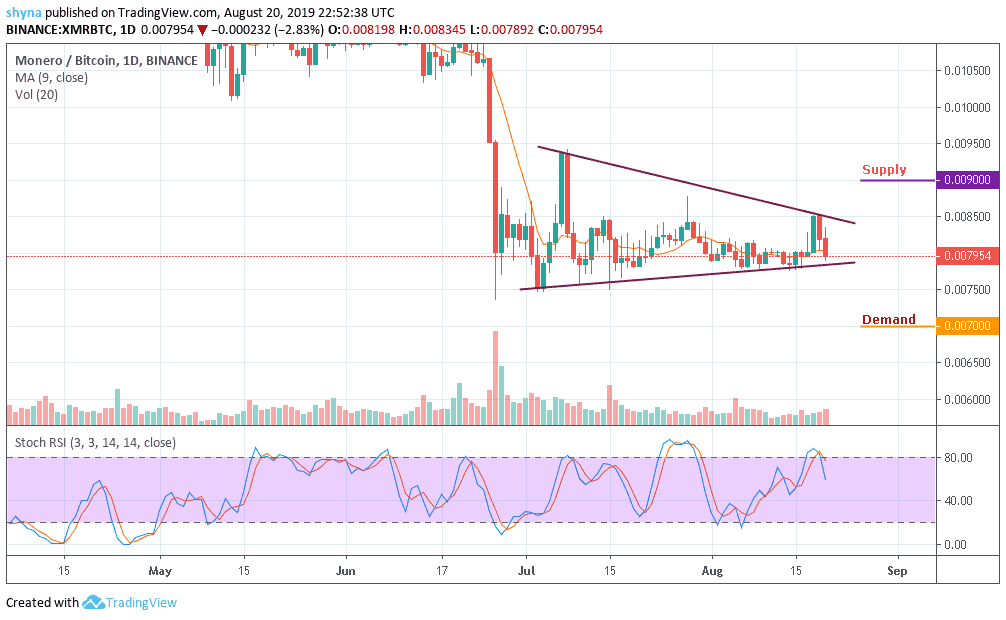

XMR/BTC Market

Against Bitcoin, the market price remained to range and trading within the symmetric triangle since July 2019. For now, it is trading at 0.0079BTC and expecting a break out from the channel. Looking at the chart, both the bulls and the bears are struggling on who will control the market.

However, should the market make attempt to fall below the channel, the next key demands could be at 0.0070BTC and below. Meanwhile, on the bullish side, a possible rise could bring the market to the supply levels of 0.0090BTC and 0.0090BTC. According to the stochastic RSI, the market recently touched the overbought area and is now coming down, which could trigger some bearish signals on the market soon.

Please note: insidebitcoins.com is not a financial advisor. Do your own research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

Join Our Telegram channel to stay up to date on breaking news coverage