Join Our Telegram channel to stay up to date on breaking news coverage

XMR Price Analysis – August 3

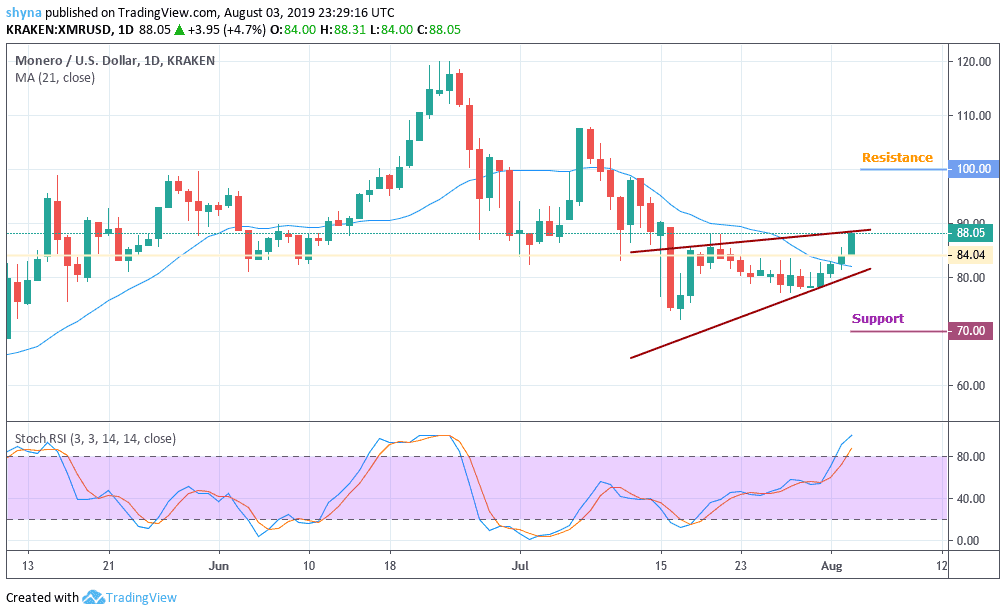

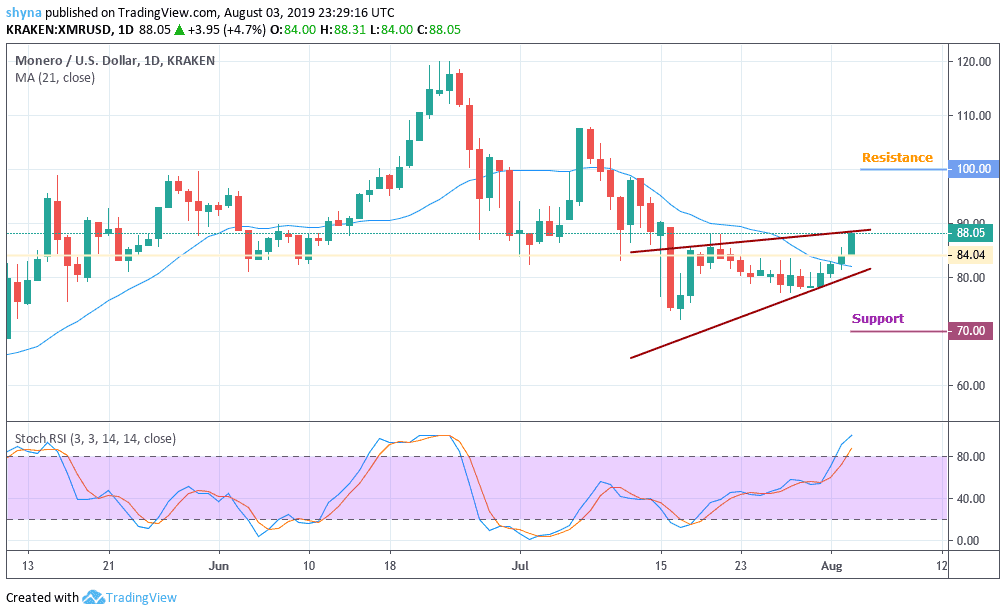

Monero keeps the intraday gains as bulls retreat. XMR/USD explores higher levels towards $100 from $70 primary support.

XMR/USD Market

Key Levels:

Supply levels: $100, $105, $110

Demand levels: $70, $65, $60

Monero is green in the middle of a sea of red. The cryptocurrency market corrects itself after the huge gains made on Friday during Asian hours. Like Bitcoin, which exceeded $10,800, Monero made a slight increase in the opening price from $84.04 to a peak at $88.05. Monero is one of the few digital currencies that keep intraday gains.

At the time of writing, Monero is now hovering at $88.04 after rising 4.41%. Looking north, the immediate resistance is $95, which may allow a new retest at $82. A correction above the 21-day moving average will pave the way for gains in resistance levels of $100, $105 and $110. On the downside, immediate support is $78. It is important to note that $75 is a key level of support, while the main support levels are $70, $65 and $60, but the stochastic RSI is already in the overbought zone, indicating an upward trend.

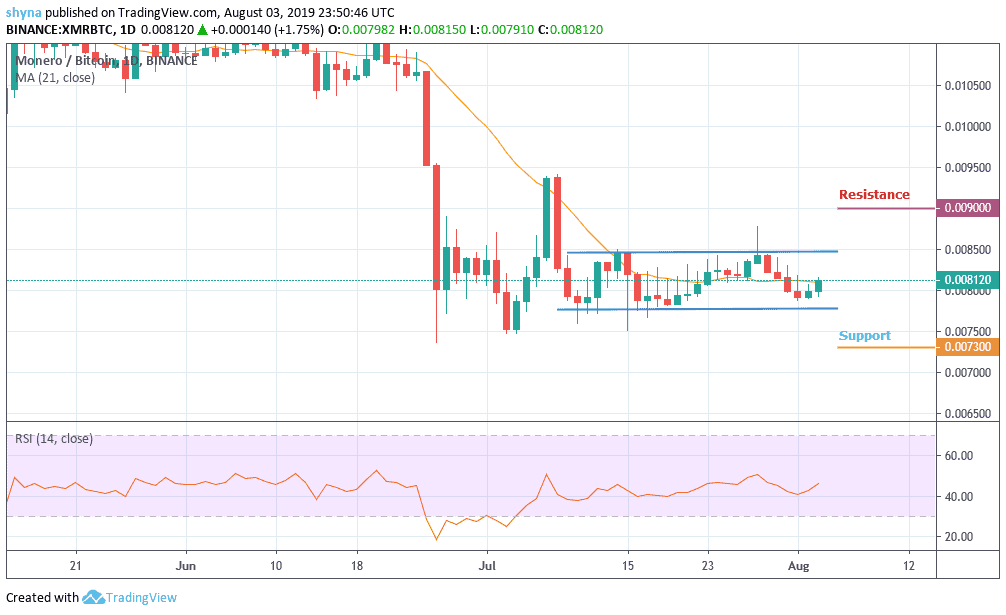

XMR/BTC Market

Comparing with BTC, the market price remained and trading within the channel for more than three weeks now, currently trading at 8120SAT and expecting a break out below the 21-Day Moving Average. Looking at the chart, we can see that both the bears and the bulls are fighting on who will control the market.

However, if the market drops, the next key supports will likely be at 7300SAT and below. On the bullish side, a possible rise could bring the market to resistance levels of 9000SAT and 9100SAT. According to the daily RSI, the market is moving in sideways and above level 40, which could trigger a buy on the market soon.

Please note: insidebitcoins.com is not a financial advisor. Do your own research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Join Our Telegram channel to stay up to date on breaking news coverage