Join Our Telegram channel to stay up to date on breaking news coverage

MicroStrategy’s 300% premium over the value of its Bitcoin holdings cannot be sustained, with the launch of spot Bitcoin ETFs (exchange-traded funds), and options trading on them, reducing the incentive to invest in MSTR stock, says Steno Research.

“The availability of ETF options, increasing global regulatory clarity—especially under a likely Trump administration—and rising Bitcoin prices putting additional buying pressure on MicroStrategy, we expect the premium to fall below 200%, similar to what occurred during the 2021 bull market,’’ said analyst Mads Eberhardt in an Oct. 25 research note.

In recent months, MicroStrategy's stock price has been on a substantial upward trajectory, while the value of its Bitcoin holdings has only increased slightly.

In other words, MicroStrategy's premium to Bitcoin is now trading at a much higher level than it did for much of 2021. pic.twitter.com/rQaRjJ1HGK

— Mads Eberhardt (@MadsEberhardt) October 28, 2024

MicroStrategy is the biggest corporate holder of Bitcoin with a stash of 252,220 BTC worth about $17.3 billion. But Steno says the launch of spot BTC ETFs and options trading on them means investors now have cheaper, more direct ways of gaining exposure to BTC.

“With money growth already back in most countries and more in the pipeline, direct Bitcoin investments through ETFs might be a simpler choice for investors,” said Andreas Steno Larsen, CEO of Steno Research.

Steno notes that the 300% premium on MSTR is much higher than in previous bull markets and could be tested as Bitcoin’s price continues to climb. To maintain the premium, MicroStrategy will need even more buying pressure, it said.

US Investors Have Bought 930,000 Bitcoin Via Spot BTC ETFs In 10 Months

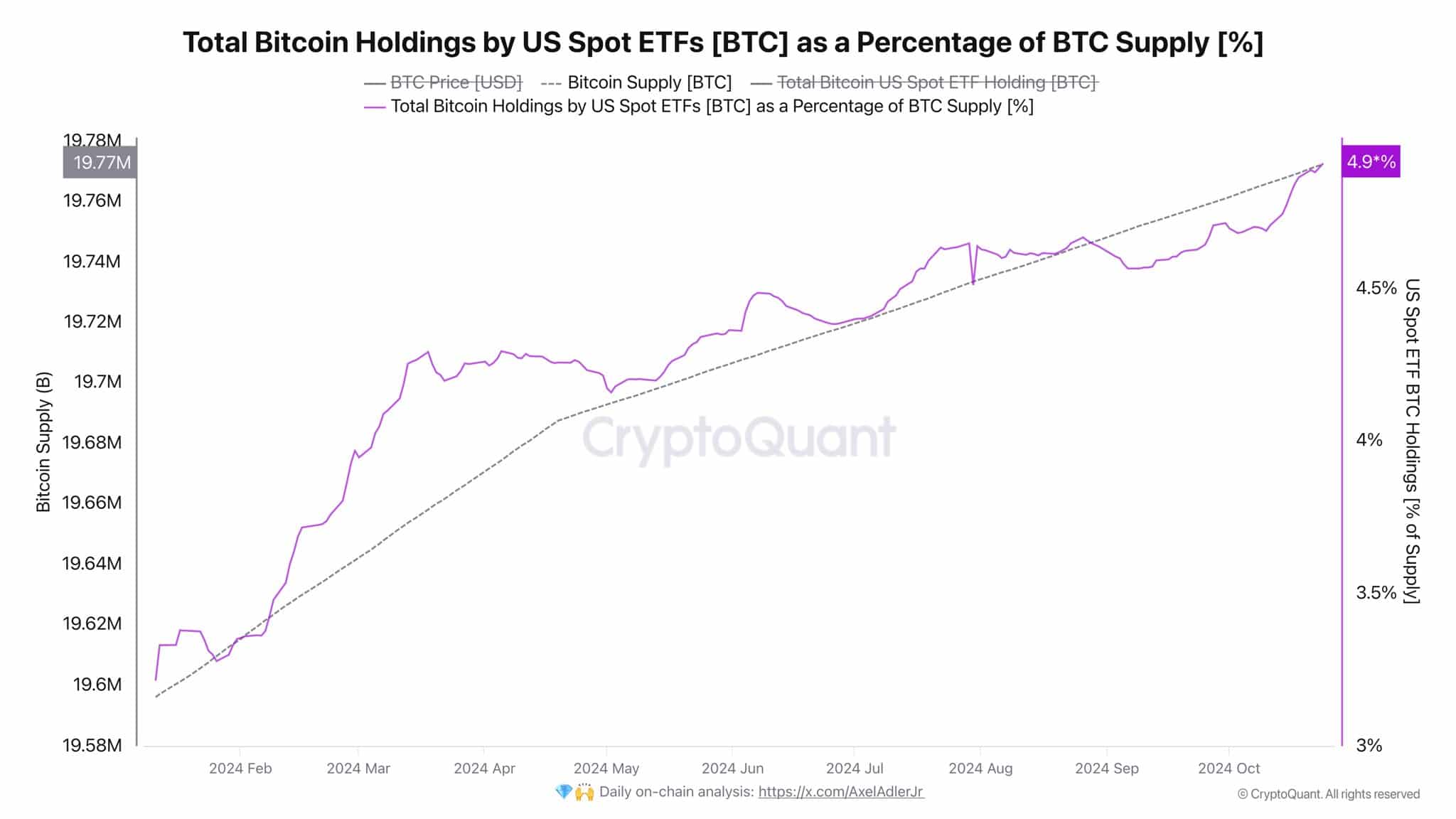

Meanwhile, data from CryptoQuant shows that US investors hold about 930,000 BTC through spot BTC ETFs, or 4.9% of the total supply. The report suggests this trend will continue, further challenging MSTR’s premium as investors opt for more direct and cost-effective exposure to Bitcoin through ETFs rather than potentially overvalued shares.

The BTC price surged by 2.3% in the last 24 hours to trade at $68,871 as of 08:33 a.m. EST per CoinGecko data.

Related Articles

- Rich Bitcoin Investors List – Famous Crypto Investors Who Own Bitcoin

- How to Buy BTC with Debit Card

- Donald Trump Presidency Could Bring “Prolonged Bear Market” For Meme Coins

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage