Join Our Telegram channel to stay up to date on breaking news coverage

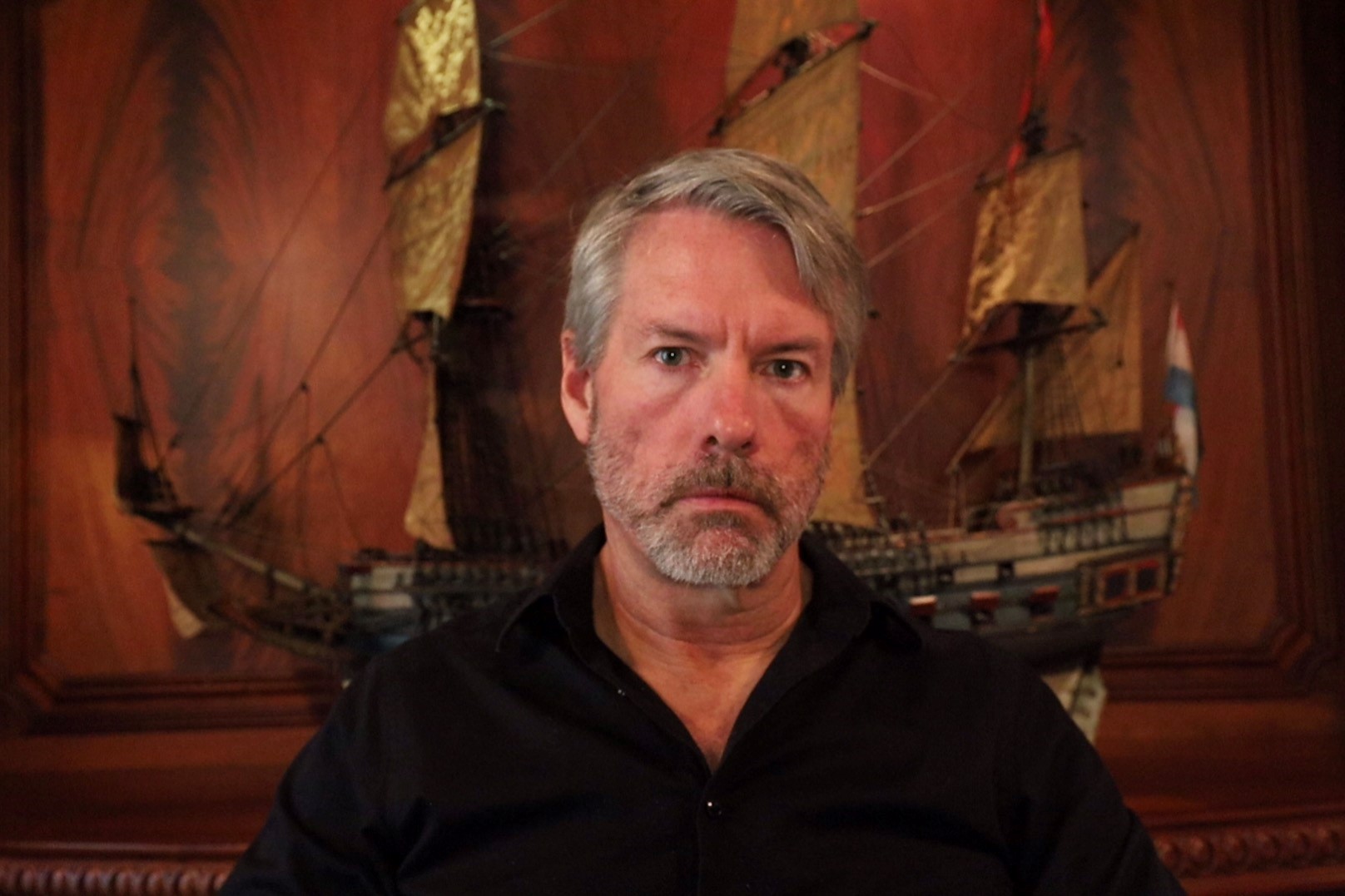

The co-founder and executive chairman of MicroStrategy, Michael Saylor, has shared his thoughts about a US central bank digital currency (CBDC). According to Saylor, the launch of a digital dollar would turn out to be good for Bitcoin.

Michael Saylor says a US CBDC is good for Bitcoin

While speaking at a recent interview with Valuetainment, Saylor said he was concerned about the possible negative effects of the digital dollar. The US CBDC has been criticized by many because of an increased likelihood of being used by the government to conduct mass surveillance on people’s spending habits.

According to Saylor, these concerns would drive interest in Bitcoin. The MicroStrategy chair also said that the interest in CBDCs promoted awareness. Bitcoin will continue to grow as people become more aware of the need for something that is not a sovereign store of value.

Saylor said,

I’m sure the overwhelming majority of the population is adamantly against [CBDCs], and I would say a decent majority of politicians are against it. But there is a fringe wing that wants to impose control over everybody and they don’t trust anybody. Heck, at some point they would probably like to see how you spend $50. And that’s the control freaks in the political sphere.

Saylor, a known Bitcoin maximalist, has also said that politicians are less likely to reach a consensus about a US CBDC in the short term. He also anticipates that the Congress will be conflicted on the matter.

CBDCs will give the government control over spending

CBDCs are close to becoming a reality, and Saylor believes that people will start to recognize the ability of the government and the private sector to control cash and make it challenging for people to spend their capital freely.

Unlike gold and cash, the MicroStrategy executive chairman opines that Bitcoin cannot be controlled. Traveling with a large amount of gold or cash is impossible without being flagged. However, Bitcoin operates in a manner that any government cannot control, and those who own it get to use it without seeking permission from others.

Saylor added that the future of the financial system was not in cash, gold, or silver coins but in Bitcoin. He also criticized the reliability of the banking industry. In Nigeria, the central bank had limited withdrawals to $42, triggering a massive demand for Bitcoin. On the other hand, some banks in the US have collapsed amid a lack of confidence in the banking industry’s health.

MicroStrategy recently held the Bitcoin and Lightning for Corporations event, where Saylor promoted the use of the Bitcoin Lightning network to settle transactions in a more cost-friendly and fast way. The Binance exchange recently announced that it would integrate the Lightning network to increase transaction speeds for the Bitcoin network.

I had the chance to do a live interview with @saylor at @MicroStrategy's #Bitcoin and #Lightning For Corporations.

We discuss:

– What is Lightning and how will businesses use it?

– Why is Bitcoin critical for national cybersecurity?

– Bitcoin & #AI Truthhttps://t.co/GBz9MGixj4 pic.twitter.com/3OjCsHTa4F— Natalie Brunell ⚡️ (@natbrunell) May 8, 2023

MicroStrategy is one of the few public companies that have added BTC to their balance sheet. In April, the company purchased an additional 1,045 BTC for $23.9 million, according to a filing with the US Securities and Exchange Commission.

Related

- CBDCs might “revolutionize” the world’s financial systems

- Michael Saylor Net Worth, Crypto and NFT Investments

- MicroStrategy whistleblower gives startling insights about Michael Saylor in $25M tax fraud lawsuit

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage