Join Our Telegram channel to stay up to date on breaking news coverage

Institutional investors who purchased Bitcoin this year have seen significant benefits as the asset’s price continues to rise. However, some early believers in the asset have also continued to pump money into the asset, hoping to make more gains.

Dumping Cash Gradually

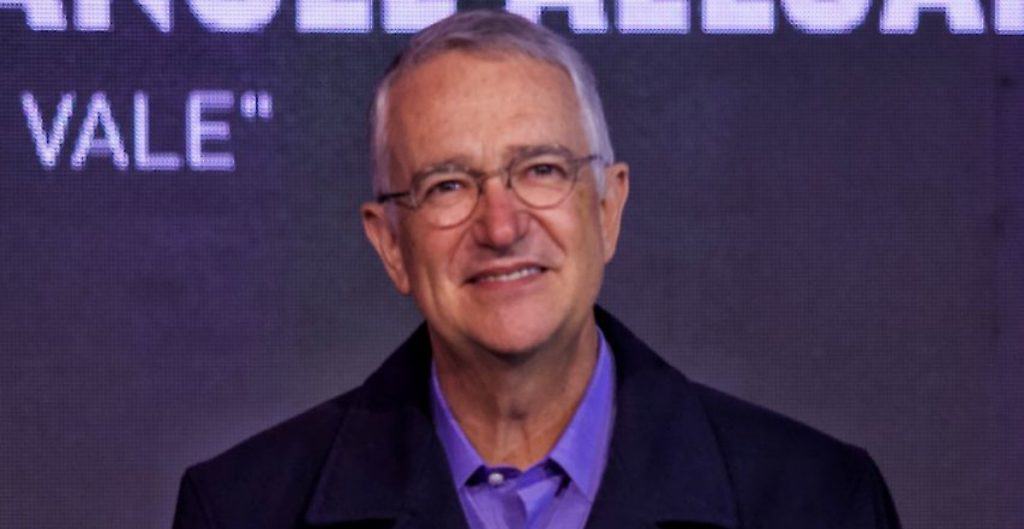

Ricardo Salinas Pliego, a Mexican business magnate, and industrialist, has come out to double down on his support for Bitcoin amid the asset’s price rally. The businessman, who is worth an estimated $11.8 billion, is Mexico’s second-richest man and the world’s 166th wealthiest man In a tweet from earlier today, he declared his support for Bitcoin, advising his followers to dump cash.

Pliego exhibited his support in a video showing banks dumping cash into dumpsters. The businessman asserted that cash is worthless, adding that people would need to quickly diversify into digital assets. A translated version of his caption explained:

“Today I recommend THE BITCOIN PATTERN, this book is the best and most important to understand bItcoin. Bitcoin protects the citizens from government expropriation. Many people ask me if I have Bitcoins, YES. I have 10% of my liquid portfolio invested.”

Responding to Kraken’s Dan Held, Pliego added that he had the remaining 90 percent of his assets in precious metals. The billionaire appears to be done with cash, joining the ranks of institutional investors to seek out safety in digital assets.

Pliego’s stance isn’t new. Many have called the efficacy of cash into question for a while now. However, the skepticism over the asset has intensified in 2020. Earlier this year, Ray Dalio, a fellow billionaire and the founder of Bridgewater Associates, told CNBC that investors would need to diversify their portfolios.

Speaking at the World Economic Forum, the hedge fund billionaire explained that “cash is trash,” explaining that the asset was losing its allure by the day. When host Andrew Ross Sorkin asked him about Bitcoin’s potential, however, Dalio cast doubts on the asset. As he explained, Bitcoin hadn’t shown itself to be a reliable currency.

“There are two purposes of money; a medium of exchange and storehold of wealth. Bitcoin is not effective in either of those cases now,” he asserted.

Whether true or not, Bitcoin has been the most reliable hedge against economic uncertainty this year. Dalio can’t argue against that point.

A Good Time for Crypto Investors

This isn’t Pliego’s first foray into the Bitcoin market. He got exposed to the leading cryptocurrency in 2016, purchasing units in Grayscale’s Bitcoin Investment Trust when the asset only traded at $800. Depending on how much he bought and sold since then, the businessman would have already made some sizable returns.

And what a time it is for early Bitcoin investors. After shrugging off a dull first half, Bitcoin has been on a tear in the last quarter of the year and is now on its way to the record highs of December 2017. Currently trading above $18,000 at pres time, Bitcoin is on track to end the year above the $20,000 price peg. Any institutions that haven’t put their wealth into this asset at this point would be kicking themselves.

Join Our Telegram channel to stay up to date on breaking news coverage