Join Our Telegram channel to stay up to date on breaking news coverage

Legal experts laud the proposed “Digital Asset Market Structure” bill for addressing regulatory loopholes in the US crypto market, providing a pathway to compliance through decentralization. Clarity on regulations remains crucial for the industry, amidst divided opinions on SEC’s statements.

Praise for Proposed Republican Crypto Bill and Efforts to Address Regulatory Gaps in the United States

Ryan Selkis, the CEO of Messari, expressed high praise for a newly proposed Republican bill related to cryptocurrency. According to Selkis, this bill represents a significant advancement, surpassing all previously introduced crypto bills in the United States Congress.

On June 1, a bill called the “Digital Asset Market Structure” (DAMS) was brought forward with the aim of creating a comprehensive framework to bridge regulatory loopholes related to crypto-assets between the U.S. Commodity Futures Trading Commission and the Securities Exchange Commission.

During a Twitter Spaces event hosted by Coinbase on June 7, Selkis highlighted the work of U.S. Representatives Patrick McHenry and Glenn Thompson. They have formulated a pathway in the bill that enables tokens to achieve compliance through decentralization, without triggering immediate securities laws.

Selkis posed a rhetorical question, emphasizing the challenge of tokens in their early stages complying with securities laws temporarily until they become adequately decentralized.

Furthermore, Selkis acknowledged the previous efforts of Hester Pierce, the former Chair of the U.S. Securities Exchange Commission, who proposed a “Safe Harbor” plan in February 2020. He noted that elements from her proposal have influenced the legislative text of the new bill.

Selkis concluded by stating that this new bill represents a significant improvement, possibly ten times better than anything seen thus far.

The last notable crypto bill introduced in Congress was the Digital Commodities Consumer Protection Act, which aimed to enhance oversight of the crypto industry following the collapse of FTX.

TuongVy Le, the head of regulatory and policy at Bain Capital Crypto, echoed Selkis’ sentiments. Le emphasized that DAMS offers token issuers a viable path to compliance, acknowledging that token projects require time to work towards decentralization.

Le highlighted the issue of the SEC potentially taking enforcement action against token issuers before they achieve decentralization and expressed hope that DAMS would resolve this problem effectively.

Paul Grewal, the chief legal officer at Coinbase, also recognized the challenges faced by token issuers. He noted the absence of a reasonable pathway under current law for assets initially categorized as securities to evolve and become decentralized in a manner recognized by the law.

Experts Question Regulatory Authority as Legal Uncertainties Surround Cryptocurrencies

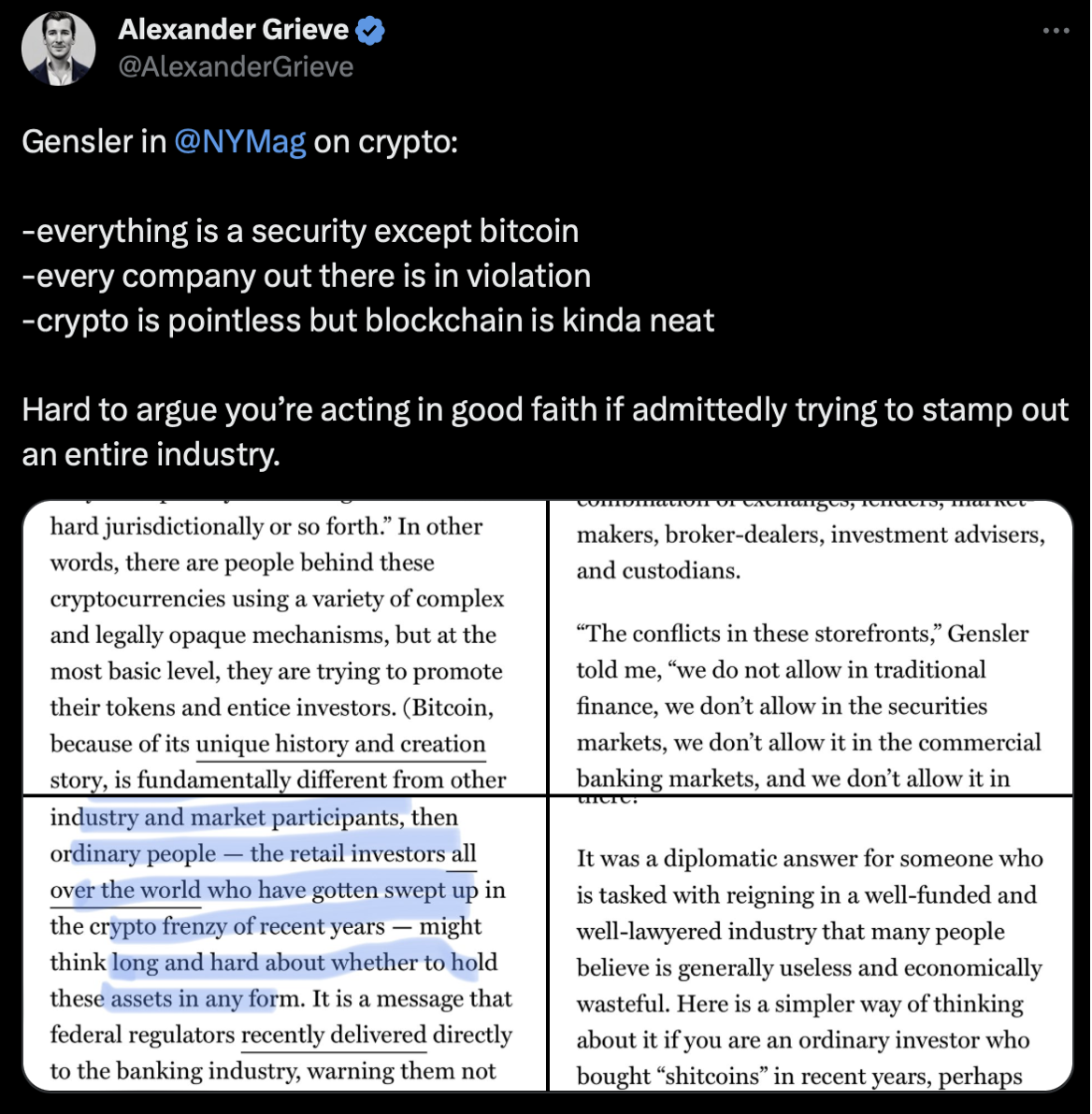

Legal experts specializing in cryptocurrency have responded to statements made by Gary Gensler, the Chairman of the Securities and Exchange Commission (SEC), regarding the regulatory authority of the agency over cryptocurrencies.

During an interview with New York Magazine, Gensler expressed the view that, with the exception of Bitcoin, all other cryptocurrencies fall within the classification of securities within the SEC’s scope.

Expressing apprehension towards Gensler’s remarks, Jason Brett, the policy lead at the Bitcoin Policy Institute, highlighted the need to view them with caution instead of applause. Brett underscored the importance of exploring alternative methods of regulating cryptocurrencies rather than solely relying on a regulatory moat.

Gabriel Shapiro, the general counsel at Delphi Labs, outlined the significant enforcement challenges the SEC would face if it were to pursue regulatory actions against the industry.

Drawing attention to Gensler’s assertion, Shapiro emphasized that a staggering number of tokens, exceeding 12,300 in total and valued at around $663 billion, are categorized as unregistered securities. He noted the significant challenge that the SEC would face in pursuing legal action against each token creator individually, a task that appears daunting and unworkable.

The legal uncertainties surrounding the classification and regulation of cryptocurrencies have created a sense of unease within the industry. With billions of dollars at stake, the path forward for regulatory clarity remains uncertain, and the industry is eagerly awaiting a more comprehensive and practical plan from regulators.

Related Articles

- Best Altcoins to Buy

- CFTC, Coinbase, and Robinhood to Testify Before Congress Today on Recently Introduced Crypto Law

- SEC Lawsuits Impact Net Worth of Coinbase and Binance CEOs

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage