Join Our Telegram channel to stay up to date on breaking news coverage

Amidst the ongoing halt in negotiations to raise the United States government’s debt limit of $31.4 trillion, market uncertainty persists, and a faction of analysts is diverging from the consensus by cautioning about potential repercussions for the cryptocurrency market.

Debt Limit Deadlock – Cryptocurrency Market Braces for Uncertain Times

The U.S. reached its statutory debt limit on January 19, prompting the Treasury to take extraordinary measures and deplete its Treasury General Account (TGA) balance to sustain government operations.

This strategy aimed to prevent a government default and mitigate concerns over the Federal Reserve’s continuous interest rate hikes, thereby maintaining demand for assets such as bitcoin, which are sensitive to fluctuations in U.S. dollar liquidity.

According to MacroMicro, the TGA balance has declined from approximately $500 billion at the beginning of February to $68 billion as of last week. Goldman Sachs predicts that the Treasury’s cash balance will likely dip to the minimum required $30 billion by early June, necessitating a debt deal before that time to avert what some perceive as a catastrophic default.

Once the debt limit is increased, the Treasury will seek to replenish its cash balance by issuing government bonds. This move could drain liquidity from the system and exert upward pressure on bond yields. As increased bond issuance typically drives prices down and yields up. Bitcoin, which has exhibited an inverse relationship with bond yields, may be adversely affected.

Consequently, although a potential deal might eliminate substantial economic uncertainty, assets like cryptocurrencies, which lack ties to the real economy and heavily rely on fiat liquidity, could experience adverse consequences.

Noelle Acheson, author of the Crypto Is Macro Now newsletter, noted that the issuance of debt to replenish the Treasury’s coffers would likely result in money flowing out of cash and risk assets and into U.S. government bonds.

This trend would be exacerbated as yields on these instruments rise to offset the increased supply. Acheson added that this scenario could be unfavourable for Bitcoin and gold, which typically decline in price when yields rise.

Market consensus thus far has suggested that a default would trigger panic selling and a worldwide scramble for cash, similar to the events witnessed during the crash caused by the COVID-19 pandemic in March 2020 when Bitcoin’s value plummeted by over 50%. Conversely, a successful debt deal is expected to spur a more risk-on environment.

Challenging this prevailing outlook is Satyakam Gautam, a rates trader at India-based ICICI Bank, who anticipates that the Treasury will likely issue $700 billion in bonds over the next few months, leading to widespread risk aversion.

Gautam asserts that this outcome would result in a scarcity of USD funding immediately following the successful negotiation of the debt ceiling, making it challenging for corporate bond markets and private credit to refinance existing maturities.

Consequently, a real crash could occur in the commercial real estate assets funding sector or among low-quality bond issuers. Gautam believes this crash could be the long-awaited event that has been anticipated in U.S. rate markets.

In such a scenario, there could be a subsequent decline in long-term rates and a significant steepening of U.S. rates. This development, according to Gautam, would bode well for safe-haven currencies like the Japanese yen (JPY) and the Swiss franc (CHF).

The current stalemate in debt limit negotiations has made the market uncertain, leading some analysts to differ in opinion and raise concerns about how it could negatively affect the cryptocurrency market.

While a resolution may alleviate economic uncertainty, the issuance of additional government debt could redirect funds away from risk assets like Bitcoin, negatively impacting their value. Conversely, a default scenario is anticipated to trigger a rush for cash, akin to past market crashes, while a successful debt deal is expected to promote a more risk-on environment.

Varying viewpoints continue to exist, as certain experts foresee risk aversion and possible consequences for commercial real estate and issuers of low-quality bonds when the debt ceiling is increased.

Janet Yellen’s Dire Warning – Impending Treasury Crisis Threatens Economy and Crypto Markets

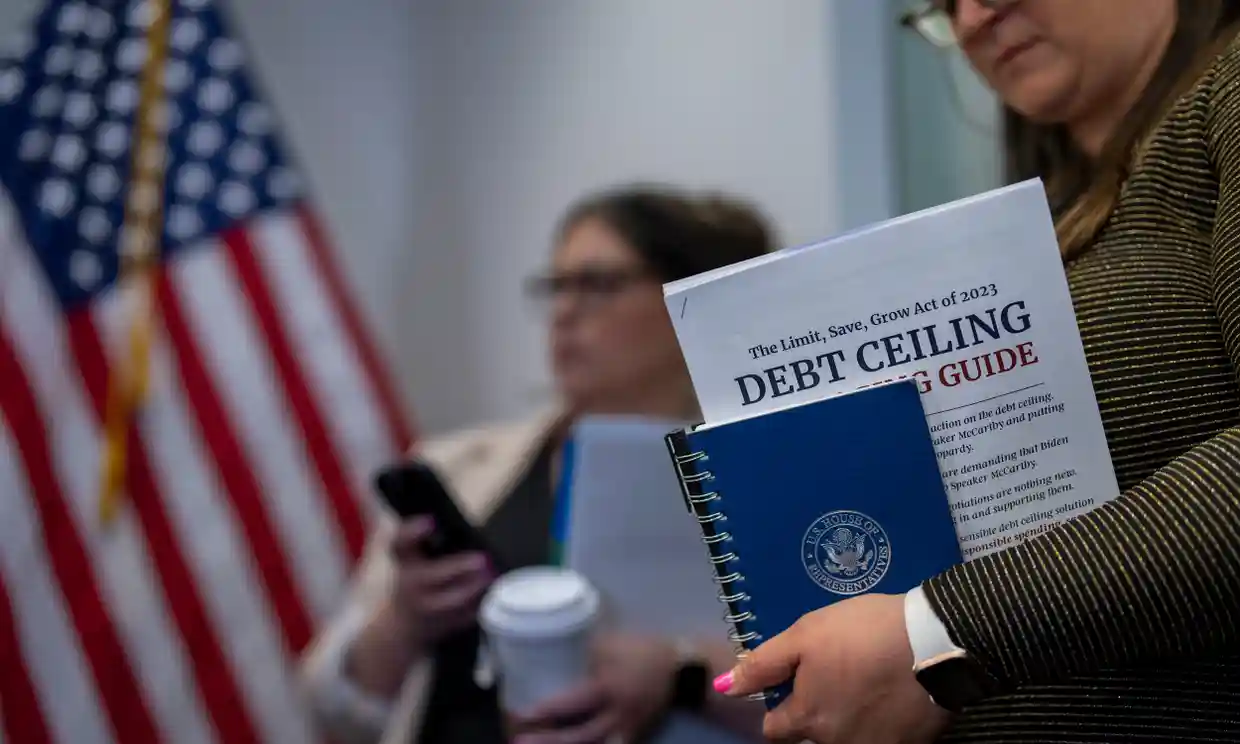

In a communication to the House of Representatives on May 22, Janet Yellen issued a cautionary statement indicating that the Treasury is highly unlikely to fulfill its governmental obligations in the coming month.

This warning stems from the approaching debt ceiling or debt limit of the U.S. economy. The debt ceiling acts as a legal restriction on the total amount of national debt that the Treasury can accumulate.

Essentially, it imposes a cap on the extent to which the federal government can pay for its expenses by further borrowing money against the existing debt.

President Joe Biden and House Speaker Kevin McCarthy concluded their discussions on May 22 without reaching an agreement on raising the debt ceiling.

Yellen’s assessment paints a bleak picture, emphasizing that a failure to increase the debt ceiling would have catastrophic consequences for the economy.

“Based on the latest information available, I am writing to convey our estimation that, if Congress does not take action to raise or suspend the debt limit by early June, and potentially as early as June 1, the Treasury will likely be unable to fulfill all of the government’s obligations,” Yellen stated in her letter.

She further highlighted the detrimental effects of waiting until the last minute to suspend or raise the debt limit. These consequences include negative impacts on business and consumer confidence, increased borrowing costs in the short term, and potential downgrades in U.S. credit ratings.

Representatives from various political factions have been devising proposals to curtail federal spending and reduce the deficit.

Joe Biden recently stated his opposition to a deal that would safeguard wealthy tax evaders and cryptocurrency traders, among others.

Given the recent correlation between crypto markets and stock markets, the outcome is unlikely to be favourable.

As the deadline approaches, Wall Street bank strategists are expressing concerns about stock market volatility. Matthew Miskin, co-chief investment strategist at John Hancock Investment Management, cautioned, “As we enter this week, the market appears more vulnerable to volatility surrounding the debt ceiling.”

Timeline of the last Debt Ceiling Crisis back in 2011.

Times are different etc etc, but here's a little overview to the way things played out.

We had the debt limit reached 3 months prior to the agreement being signed.

The market puked -17% in the 5 days AFTER the agreement. pic.twitter.com/l2DCCCtdlM

— Cold Blooded Shiller (@ColdBloodShill) May 23, 2023

On May 23, crypto analyst “Cold Blooded Shiller” drew attention to the events that transpired during the previous instance of reaching the debt limit in 2011. The debt limit was reached three months before an agreement was reached, and stock markets experienced a decline the week after the agreement was signed.

Read More:

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage