Join Our Telegram channel to stay up to date on breaking news coverage

The crypto market was shaken at the start of the week as the US Securities Exchange Commission (SEC) took multiple enforcement actions that shifted attention to Decentralized Finance (DeFi) once more. The Maker DAO token was one of the beneficiaries rising as much as 15% on Monday to record a high of $790. The Maker price is currently at $740, up 7.75% on the day, making MKR the third biggest gainer on Tuesday.

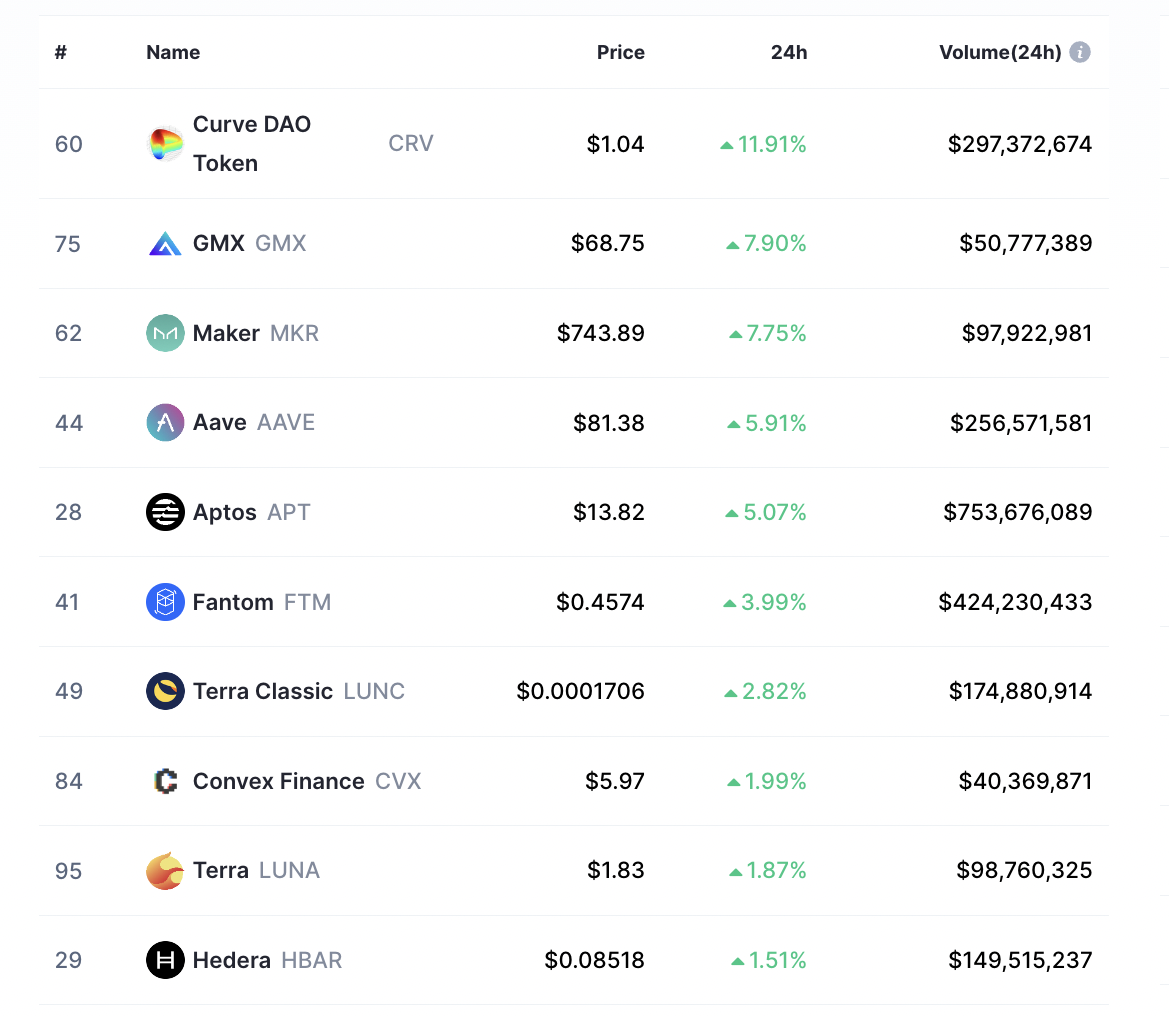

The gains are being led by the Curve DAO Token (CRV) which has raised 11.91% in the past 24 hours to trade at $1.04. This is followed by Gmx (GMX) which is up 7.90% since Monday to $68.75. Aave (AAVE) and Aptos (APT) close the top five with 5.91% and 5.07% daily gains respectively. The other DeFi token displaying impressive performance was Convex Finance (CVX) which had climbed 2% over the same period of time.

Top 10 Crypto Gainers February 14

The Maker DAO has been one of the DeFi tokens to benefit from the SEC’s regulatory actions regarding stablecoins which have led to significant FUD among crypto market players. Bringing legal action against Binance USD (USD) issuer Paxos reinforced the regulator’s determination to bring sanity to the sector.

🔥 What the FUD?!🔥

💰 $BUSD issuer @PaxosGlobal has been ordered to stop minting the stablecoin, reportedly faces lawsuit from @SECGov.

How will this affect @Binance users? @cz_binance responds 👀#BNB #Binance #BUSD https://t.co/CgTGyAEEJy

— BSCN (@BSCNews) February 13, 2023

According to a February 14 report on BSC.news, “BUSD issuer Paxos was ordered to stop minting the stablecoin and faces a potential suit from the U.S. SEC.”

In response to these developments, Binance CEO Changpeng “CZ” Zhao warned that it would have “profound impacts on crypto” saying, “the cessation of minting would cause BUSD’s market cap to decrease over time.”

2/ We were informed by Paxos they have been directed to cease minting new BUSD by the New York Department of Financial Services (NYDFS).

Paxos is regulated by NYDFS.

BUSD is a stablecoin wholly owned and managed by Paxos.

— CZ 🔶 BNB (@cz_binance) February 13, 2023

CZ assured users that BUSD funds were safe and said that the giant crypto exchange would continue to support BUSD for the foreseeable future. However, as users move away from BUSD, Binance would adjust its products with time moving away from using BUSD as the main trading pair.

This has once again drawn attention to the DeFi sector with the immediate beneficiaries being the decentralized stablecoins. MKR is the native token of the Maker Protocol, based on the Ethereum blockchain, that allows users to issue and manage the DAI stablecoin.

Maker Price Sits On Strong Support Downward

The Maker DAO token trades above a significant support zone stretching from $634 to $725, which was flipped from resistance during yesterday’s rally. Note that this is a battleground for buyers and sellers and whoever has the upper hand determines the direction the price takes. In September, the buyers were strong enough to lift MKR from this region, rising more than 81% to highs above $1,160.

The case was different at the end of 2022 when after consolidating within this area, the sellers had their way by pulling the Maker price 21% lower to set a swing low at $500 on January 3.

Noteworthy, the 50-day simple moving average (SMA) at $647 and the 100-day SMA at $640 sit within the said region. This means that the area between $634 and $725 is acting as a robust support that could cushion the MKR price from any selling pressure threatening to take it lower.

MKR/USD Daily Chart

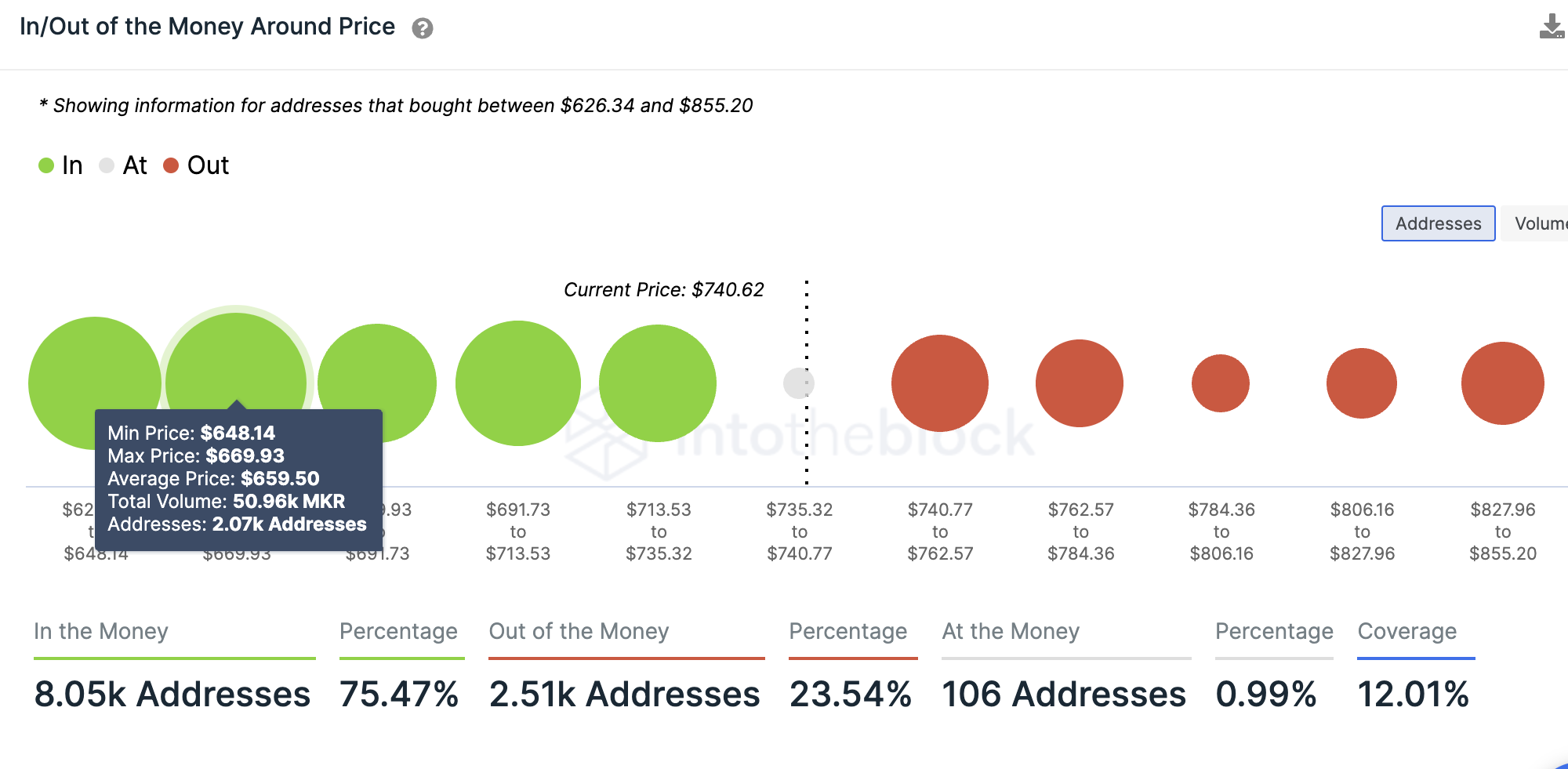

The robust support enjoyed by the Maker price on the downside is reinforced by on-chain data from IntoTheBlock’s In/Out of the Money Around Price (IOMAP) model. For example, the IOMAP chart below shows that the $648 to $699 price range, which sits within the demand zone defined above, is where roughly 50,960 MKR were previously bought by about 2,070 addresses.

Maker IOMAP Chart

The same IOMAP shows that the Maker DAO has relatively strong support downward as shown by the green circles, compared to the resistance depicted by the red circles. This suggests that the path with the least resistance is upward.

As such, increased buying pressure from the current levels could see the Maker price rise above the 200-day SMA at $755 to confront resistance from the $800 psychological level. Another barrier could emerge from the $835 local high and overcoming this would clear the way for a move up to the $$902 range high. This would bring the total gains to 21%.

Conversely, a daily candlestick close below the upper limit of the demand zone at $725 could pull back into the region where it could oscillate for some time with buyer congestion at the lower limit at $634 preventing any further drops.

Related News:

- TRON Transactions Hit 4.84M As $318M In Trading Volume Comes In – Is TRX Price Ready For $0.1?

- Meta Masters Guild — The Fastest Growing Play-to-Earn Guild of 2023 Is Close To Presale End – Don’t Miss Out!

- How to Buy Bitcoin

Join Our Telegram channel to stay up to date on breaking news coverage