Join Our Telegram channel to stay up to date on breaking news coverage

Litecoin (LTC) Price Analysis – August 26

The Litecoin price chart from 1st August appears bearish and it shows how its price range has stepped down below $80.

LTC/USD Market

Key Levels:

Resistance levels: $85, $90, $95

Support levels: $60, $55, $50

Looking at the chart, the LTC/USD pair is maintaining a downward trend as the bears come together to increase selling pressure in the market. As we can see now, the drop in prices brought trading to $73.08. Now that the market is consolidating and moving below the 9-day and 21-day moving averages, we can expect close supports at $60, $55 and $50. This is the case if a bearish pursuit occurs.

In addition, as shown in the daily chart, Litecoin (LTC) trading volume is low due to the bear’s dominance since the beginning of this month. However, if the market could return to Bull’s control, a reversal of the trend would likely result in immediate resistance at $85, $90, and $95. The stochastic RSI moves above level 40, revealing a potential rise.

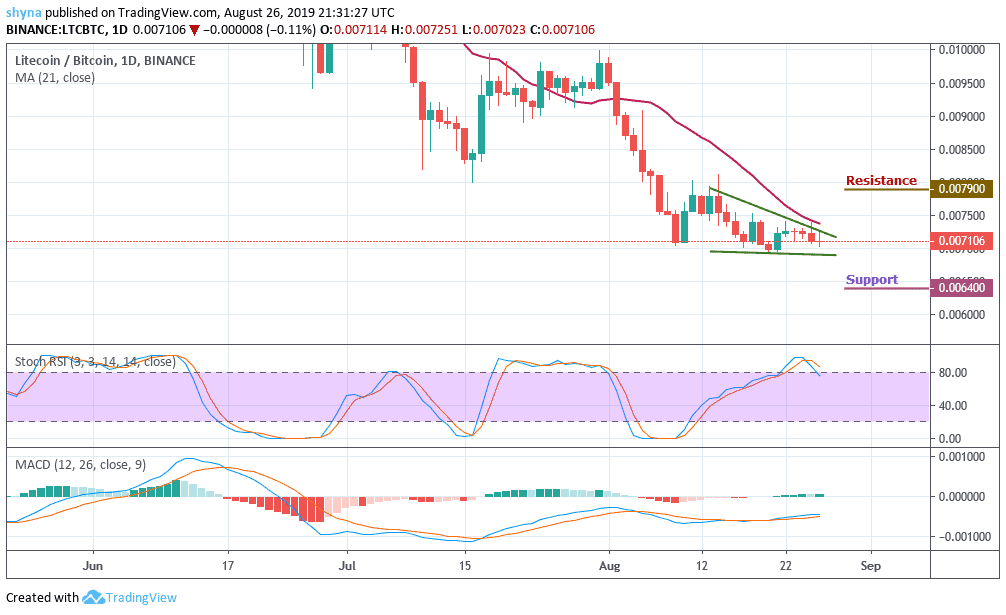

LTC/BTC Market

Litecoin price has continued to follow a bearish sentiment since the beginning of this month as the coin suffers a serious downtrend pressure from Bitcoin. If the bulls attempt to gain momentum, the bears are likely to keep releasing a huge pressure on the market. Currently, LTC is changing hands at 0.00712BTC but may likely find support around 0.0066BTC level.

Looking at the chart, the closest resistance level is now at 0.0079BTC and above while the nearest level of support is 0.0064BTC. Below this, additional support is found at 0.0062BTC and 0.0060BTC. The MACD signal lines are still at the negative side while stochastic RSI faces down from the overbought zone, which may suggest that the recent recession could probably continue to fall.

Please note: insidebitcoins.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Join Our Telegram channel to stay up to date on breaking news coverage