Join Our Telegram channel to stay up to date on breaking news coverage

LDO, the native token for Lido Finance protocol and the ticker for the Lido DAO utility and governance token, is currently posting impressive gains after climbing 7% in the last 24 hours to $2.3.

The token has also recorded a 48% increase in trading volume over the same timeframe to $178.5 million. With such an active trading activity within such a brief timeframe, LDO’s market cap surged 8% on the day to $1.95 billion, catapulting it to the #34 position on CoinMarketCap.

The gains come as the liquid staking protocol continues to record improved fundamentals while building upon the ongoing short-term recovery in the crypto market.

LDO Bulls Remain Greedy Despite Criticism Against The Lido DAO Proposal

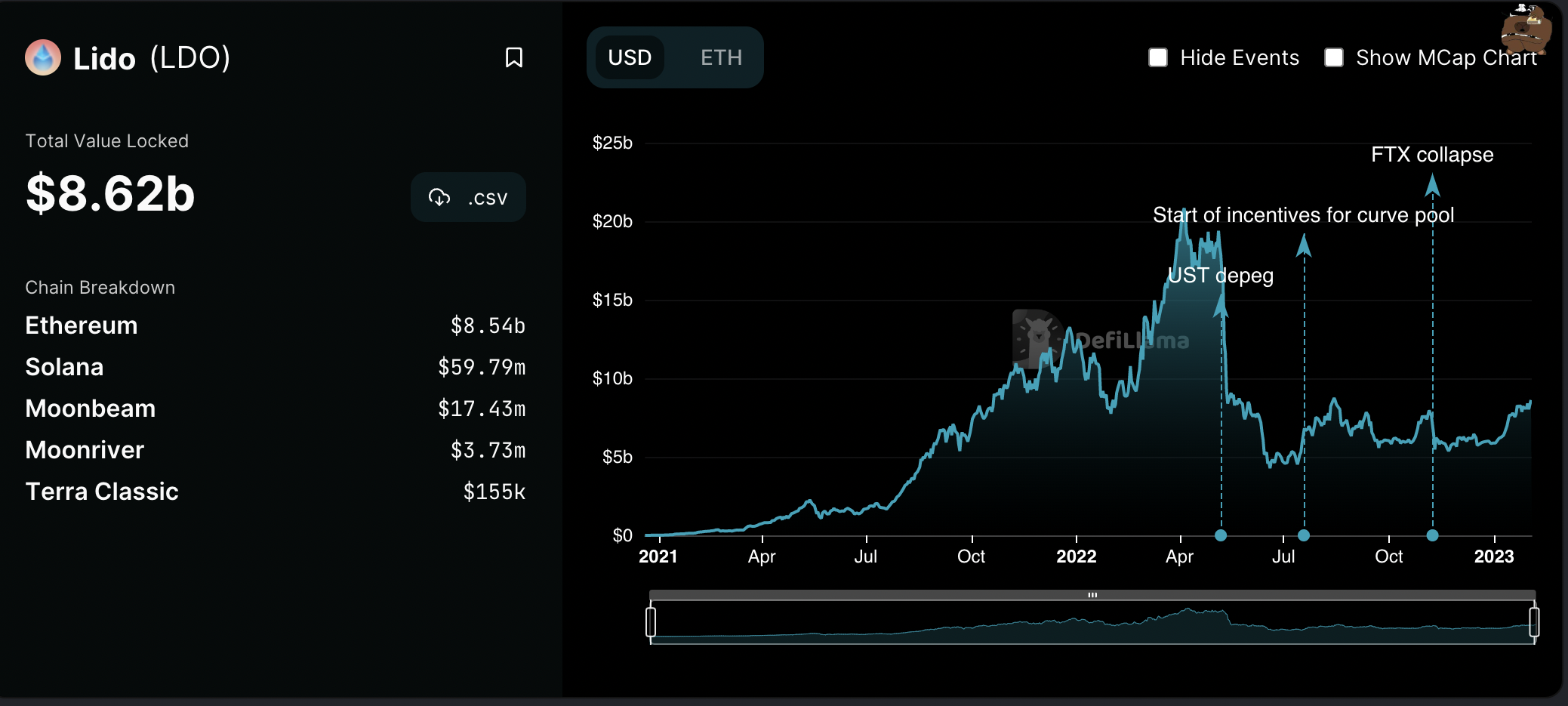

Lido Finance started the year by displacing MakerDAO as the leading decentralized finance (DeFi) protocol with the highest total value locked (TVL). Based on DefiLlama data, it maintains the apex spot with a live TVL of $8.56 billion.

The reason for the skyrocketing TVL is not far-fetched, revolving around Ethereum’s Shanghai upgrade slated for March. The Lido DAO liquid-staking platform has recorded a surge in the number of staked deposits on its platform.

LIDO DAO’s Total Value Locked

Lido DAO, the organization behind Ethereum’s liquid staking token (stETH), is working on a proposal to allow for withdrawal from stETH. The preparation comes as Ethereum’s Shanghai fork draws closer, which is also expected to deliver the same outcome- allow for the withdrawal of staked Ether.

Extrinsically, the Lido DAO proposal appears to be a routine procedure while simultaneously delivering what is expected from the Shanghai hard fork. To withdraw the stETH, users must send a withdrawal request to a smart contract christened “WithdrawalQueue,” expected to reserve the amount of Ether needed to redeem and calculate the redemption rate before withdrawals are processed in the same order that they came in.

According to Leeor Shimron on Twitter, the Shanghai upgrade could cause a drop in selling pressure as more tokens would be staked than withdrawn.

Opening withdrawals may lead to a higher number of tokens staked and reduce sell pressure, as it could assuage would-be stakers that their tokens are freely redeemable and no longer locked for an indeterminable amount of time

— leeor.btc (@LeeorShimron) January 25, 2023

If Shimron’s analysis is accurate, against the market expectation, Ethereum (ETH) and Lido DAO (LDO) prices could record a positive action.

Although the proposal has not been presented before the decentralized autonomous organization (DAO) for voting purposes, it is already the subject of criticism, with Galaxy Digital calling it out pre-actualization while highlighting some issues that could lead to a few worst-case scenarios.

https://twitter.com/Terse_tech/status/1620619922907795456

Nevertheless, the criticism has not affected the LDO token, which has soared almost 20% in the last two weeks and 93% in the last 30 days. Crypto Fear and Greed Index shows Lido Dao at 80, suggesting intense greed for the LDO token among investors, which explains the ongoing rally.

https://twitter.com/CryptoFGI/status/1621102546734415876

The greed index, at 80, shows that more and more traders of Ethereum liquid staking protocol Lido DAO (LDO) are looking to accumulate LDO. The growth in user activity on Lido Finance has fueled a rally in the value of the LDO token. On a year-to-date basis, LDO’s price has gone up by 13%.

Is The 35% Target Attainable For Lido Price?

The Lido price recorded higher lows for most of January, leading to the formation of an ascending trendline as shown on the daily chart below. The token price attempted a breakout on January 23, but the move was premature and faced rejection from the $2.68 supply zone, sending it down 27% to $1.97 on January 30.

In the last three days, bulls have been in the lead and raised the price by 18% to the current price of $2.3. An increase in buying pressure from the current level could see the LDO price rise to breach the immediate resistance at $2.5. A daily candlestick close above this level could be the start of another bull rally for the LDO price.

In such a case, the price could retest the local high at $2.84 and, in highly ambitious cases, surge higher to tag the $3.10 swing high. Such a move would signify a 35% increase from the current level.

LDO/USD Daily Chart

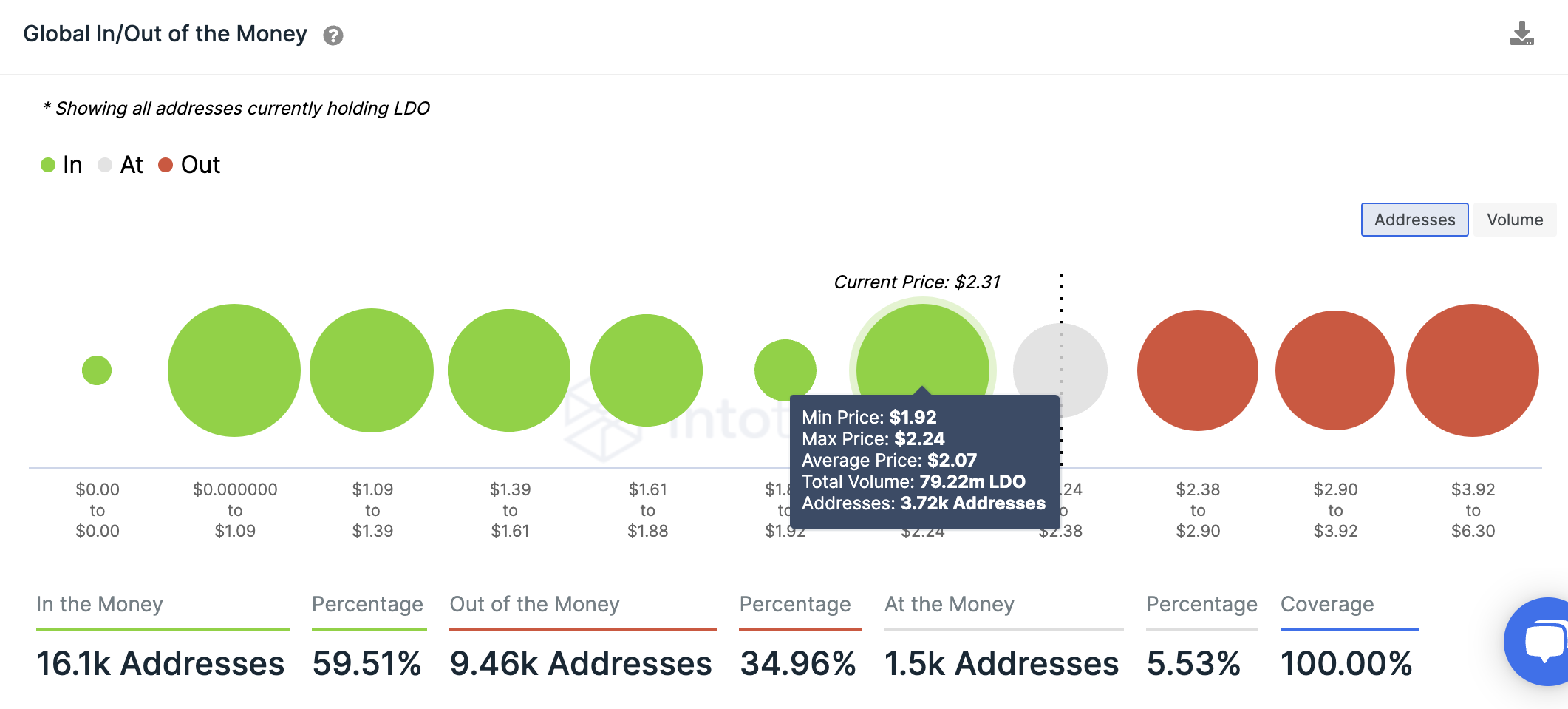

The LDO price was sitting on a major support area around $2.0, making it the most logical level for bulls to regroup and reorganize another attempt towards higher prices. It is highly likely that this was the most important support area for LDO price as on-chain metrics from IntoTheBlock’s Global In/Out of the Money (GIOM) model showed.

This demand zone is found within the $1.92 and $2.24 price range where roughly 79.22 million LDO are being held by about 3,720 addresses. Any attempts to pull the price below this area would be met by buying pressure from this group of investors who may wish to increase their profits. The ensuing demand pressure would cause the Synthetix token to rise even higher.

LDO GIOM Chart

Notice that the bulls’ position was also reinforced by strong support offered by the 200-day Simple Moving Average (SMA), 50-day SMA, and 100-day SMA at $1.66, $1.65, and $1.45 respectively.

There was also a pending bullish cross, which could occur in the near future once the fast-moving average (50-day SMA) crossed above the slow-moving average (100-day SMA). Such a move would mark the beginning of another uptrend, credence to the bullish outlook for the LDO price.

On the downside, if selling pressure increases and the price closes the day below the major support at $2.0, the LDO price could tread lower revising all the other support levels, including the SMAs, the support at $1.5, and ultimately the one at $1.0. In the worst-case scenario, it could retest the $0.4 all-time low.

The moving average convergence divergence was tipping downwards while the histograms flashed red, signifying more sellers than buyers populated the LDO market.

Alternatives With Better Risk-Reward Ratio

While LDO bulls and bears walk on a very thin line, consider Fight Out, a Move-to-Earn (M2E) platform that helps users exercise, be it in a gym or from the comfort of their room. The project employs a new smart technology that measures user exercises, tailoring them to individual users’ abilities and goals.

The native token of Fight Out, FGHT, is currently in the presale stage and has raised $3.67m in just weeks since its debut. This would be an excellent place to start if you were looking for a project with a good risk-reward ratio.

Read More:

- dYdX Price Analysis: DYDX Rises To Outperform The Crypto Market, What’s Next?

- Jim Crypto Reviews Meta Masters Guild – New Play-to-Earn Crypto Presale

- Synthetix Price Is Up 15% To $2.6, Reasons To Buy SNX

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage