Join Our Telegram channel to stay up to date on breaking news coverage

China has been making concerted efforts to surpass the United States as the world’s leading economy in recent years. Nonetheless, strategists maintain that even if the Yuan does manage to usurp the dollar, its reign may be short-lived, given the dollar’s historical resilience and strength.

By 2030, China is projected to have overtaken the United States as the largest economy in the world, according to the Centre for Economics and Business Research (CEBR), one of the top economics consultancies in the United Kingdom.

Naturally, the world expects the US dollar to no longer be the currency leading the global reserve. For this reason, some countries have even begun to trade their dollars for other currencies they anticipate will retain or increase in value.

The US Dollar – Rooted in History

On the contrary, JPMorgan strategists said that even if China overtakes the U.S. economy, the USD is unlikely to suddenly lose its position as the world’s reserve currency, as reported by Business Insider.

Based on their analysis, historical evidence suggests that any transition would be slow and is likely to take several years.

“While the U.S. surpassed Great Britain as the world’s largest economy in the latter part of the 19th century, the U.S. dollar is commonly perceived to have overtaken the British pound as the world’s foremost reserve currency only by the end of WWII,” the JPMorgan strategists wrote.

“Historical experience thus suggests that if China were to overtake the U.S. as the world’s largest economy around 2030, dollar dominance may persist even into the second half of the 21st century,” they added.

JPMorgan believes that China is the only nation that, in the long run, might displace the dollar and the American economy. However, the strategists at the international investment bank, also believe that the probability is very small due to the US’ advantages in terms of economy, technology, demographics, and geography.

A factor that will make it more probable is China’s ability to loosen capital controls which will determine how much the Chinese Yuan can grow. This is because Allowing a currency to trade freely is essential for global status and Beijing’s influence over the yuan is seen as an obstacle.

Even with that possibility, the experts emphasized that the process of dethroning the dollar will be very difficult and is likely to take years. “You can buy yen, euro, or Aussie to diversify but I don’t think they can truly replace the dollar as a reserve,” said Kerry Craig, strategist at JPMorgan Asset Management in Melbourne.

De-dollarization Is Impending

Among the things that would accelerate the Yuan, or an alternative currency takeover is either a decline in faith in the U.S. dollar or favorable occurrences elsewhere that increase the legitimacy of the alternative currency.

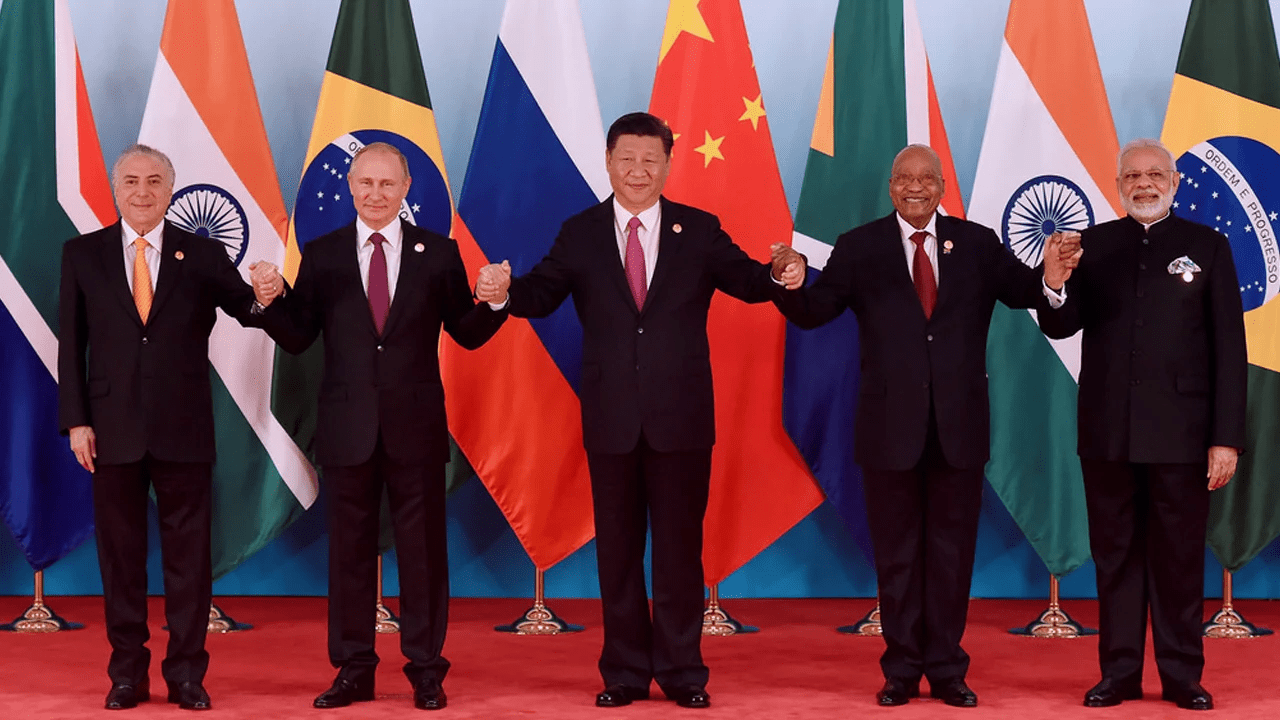

Despite the assurance that the process will take a while, the transition of the global economy from the dollar is said to have already begun. There are several currencies that have been stated to hold the potential to take over, including the common BRICS currency which entails Brazil, Russia, India, China, and South Africa.

However, the one that most experts believe will dethrone the dollar is the Chinese Yuan. For instance, according to the chairman of Russia’s second-largest bank, the yuan will overtake the dollar as the primary reserve and settlement currency “as early as the next decade.”

Additionally, a senior economist at TD, a financial services company, stated that the euro and the Chinese yuan are currently the biggest threats to the dollar.

On the other hand, former managing director of Morgan Stanley and economist, Stephen Jen, predicts that the globe will transition “from a unipolar reserve currency world to a multipolar world,” with the Chinese yuan, the euro, and the U.S. dollar establishing a “tripolar” reserve currency configuration.

Does China’s Yuan Have a Chance In Dethroning US Dollar?

Aside from these predictions, there are signs supporting the rise of the Yuan. For a long time, commodities such as oil and coal have only been bought in the dollar, a practice that has strengthened the currency’s position.

However, China has defied the norm and used the yuan to buy about $88 billion worth of Russian oil, coal, and metals. Moreover, in March, the Chinese national oil company and France’s TotalEnergies completed their first yuan-settled Liquefied Natural Gas(LNG) trade.

Based on statistics by the Bank for International Settlements (BIS), the yuan’s percentage of global over-the-counter forex transactions increased from nearly nothing 15 years ago to 7%. This serves as an indicator of how steadily the yuan is rising to the global peak.

Related articles

- Best AI Crypto Coins to Buy – Invest in Artificial Intelligence

- LPX: Penny Crypto Making Waves with a Million-Dollar Surge – Could This Be the Next 100x Hidden Gem?

- Elon Musk Faces Legal Battle Over Alleged Dogecoin Scheme and Denies Ownership of Wallets

- Controversy Surrounds SEC Chair Gensler’s Crypto Regulations – Prometheum’s Favoritism and Skepticism

Join Our Telegram channel to stay up to date on breaking news coverage