Join Our Telegram channel to stay up to date on breaking news coverage

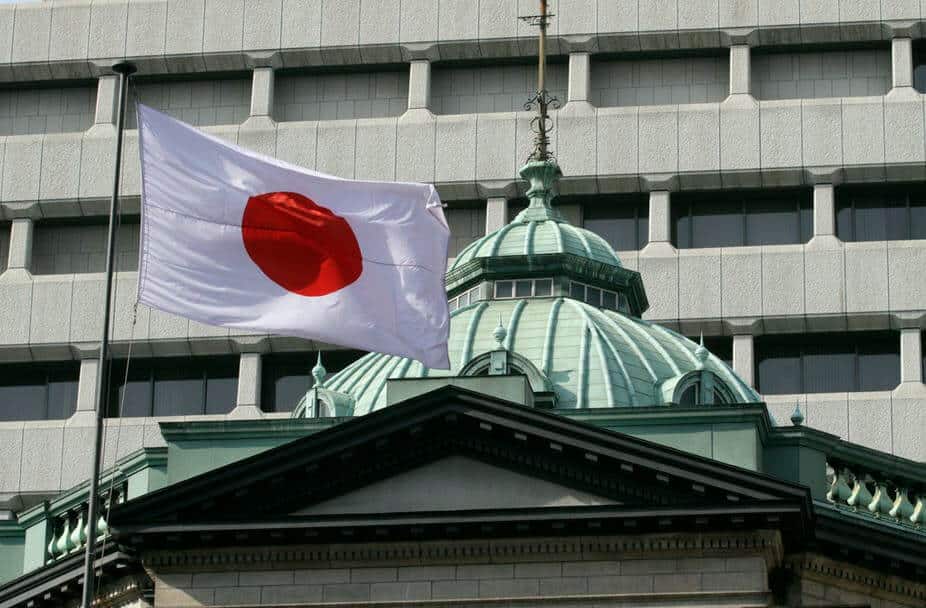

The prospect of issuing a Central Bank Digital Currency (CBDC) is one that several countries of the world have been mulling for some time now.

This January at the World Economic Forum, a consortium of Central Banks, including that of Japan and Canada, committed to sharing research materials and collaborating on a study to show the potential benefits and risks posed by issuing state-backed assets, as the prospects of these assets improving their financial system efficiencies have become more glaring.

Threats from Big Tech Firms are Arising

However, while Japan itself appears to be on the fast track to developing one of these assets, a new report is showing why the country might want to double up on its efforts.

Day 452

Japan becomes third major country that has joined the race to create its own Crypto (CBDC)!

China

US

JapanThree major economies are now in the race for Crypto dominance

How can India not be serious about Crypto?

Indians have the crypto josh 💪🇮🇳#IndiaWantsCrypto pic.twitter.com/r9QHLxaWAe

— Nischal (Shardeum) 🔼 (@NischalShetty) January 27, 2020

In a recent interview with Cointelegraph Japan, Kozo Yamamoto, Liberal Democratic Party (LDP) Member of the House of Representatives and a former official at the Ministry of Finance, argued that the government would need to establish a working CBDC structure quickly, as the threat of losing monetary authority to private firms looms large.

In the interview, Yamamoto pointed to three main functions of money – a unit of account, a means of exchange, and a store of value. As he sees things, there is already a possibility of large companies like Facebook issuing tokens that will be able to serve as stores of value and exchange media. However, the function of a unit of account will need to stay with the government, and it is essential for Tokyo to understand this and act expeditiously.

Time to Move and Preserve the People’s Faith

He further explained that by dragging its heels on this issue, the government risks eroded faith in fiat currency among people. With a digital yen, he explains, the government will be able to serve as a bridge between the traditional fiat and any other digital currencies that could be developed by large tech firms such as Facebook and Google, if they choose to delve into the space in the future.

New: Powell told Congress today that the Federal Reserve is exploring whether it makes sense to issue its own digital currency that could be used by households and businesses pic.twitter.com/lH3pnSLkiV

— Zach Warmbrodt (@Zachary) November 20, 2019

If that happens, then these tech firms will be forced to operate within a constraint and not have the interoperability that they need to replace fiat.

“We must protect it (the role of a unit of account) no matter what. If Japan doesn’t issue a digital currency and people in the world use other digital currencies, the Japanese yen will be forgotten and lose its sovereignty,” he added.

In all fairness, the government of Japan has understood the urgency of developing a digital asset – so much so that it seems to be moving ahead regardless of what the other countries in its consortium think. However, the reason for its urgency might not entirely be because of a big tech revolution; rather, it’s to stop China.

Last month, the country’s top financial minds came together for a meeting in which they improved on their CBDC plans. There, Norihiro Nakayama, the Vice-Minister for Foreign Affairs in Japan, reportedly tried to court the assistance of the United States Federal Reserve, pointing to the fact that Uncle Sam risks losing global financial dominance if it allows China to become the global standard for government digital currencies.

Join Our Telegram channel to stay up to date on breaking news coverage