Join Our Telegram channel to stay up to date on breaking news coverage

Wondering why bitcoin lost 50% of its value in less than a week – blame it on crypto derivatives, or at least partly.

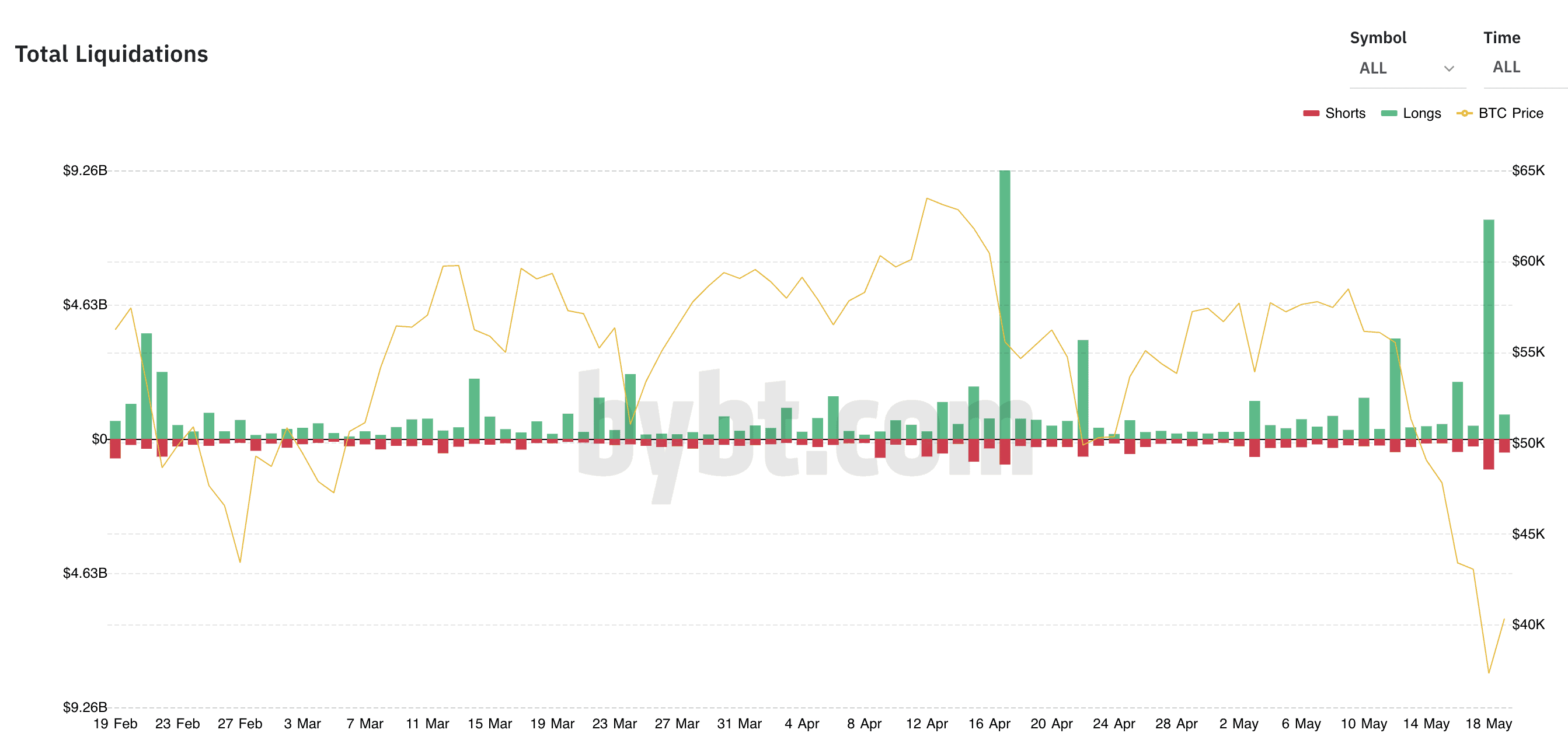

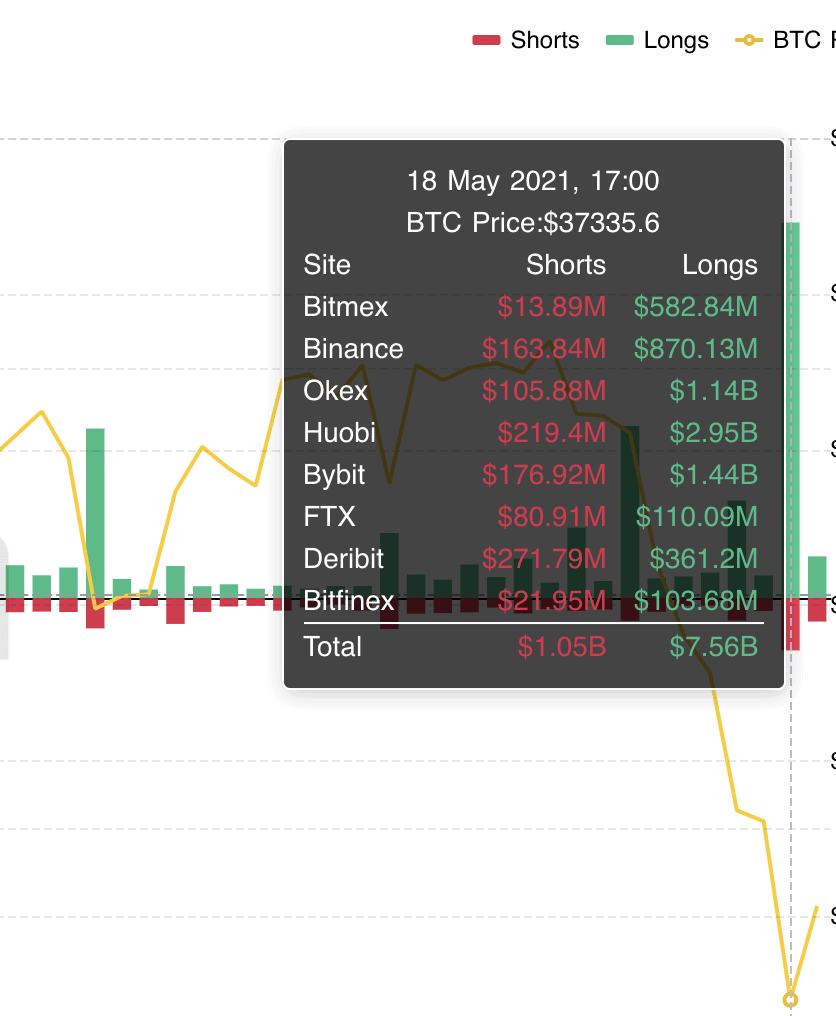

Data from the top crypto derivatives trading venues shows that on 18 May liquidations amounting to $8.61 billion. As you would expect, the vast majority of those liquidations were longs ($7.56 billion v $1.05 billion shorts, by value).

Traders’ positions are automatically closed when a margin call cannot be met, which is what makes playing in the crypto futures market such a high-risk endeavour, due to the outsized volatility of price movements.

Back in the day the prospect of crypto derivatives products being launched – regulated and unregulated – had crypto traders salivating and more staid observers touting the emergence of such products as an indication of a maturing sector.

Just to remind the uninitiated, crypto derivatives trading on margin magnifies your gains – but it is also the mother of nose-bleeding losses.

Crypto derivatives ‘exacerbated’ meltdown

Joel Edgerton, chief operating officer of crypto exchange bitFlyer, concurs regarding the role played by the derivatives markets, in remarks made available to insidebitcoins: “This meltdown is exacerbated by the high leverage used in unregulated exchanges and the liquidations we are seeing in the market.

“Any buying into the drops is like catching a falling knife, which moves the buyers to the sidelines to wait for a bottom. We will need to find a bottom and consolidate the price before we see stability.”

Is $30k or $40k the bottom for bitcoin?

Bitcoin and the wider crypto market are bouncing back today, in moves that aspire to be as dramatic as the brutal downdraft. Bitcoin is up 16% at $41,800 at the time of writing.

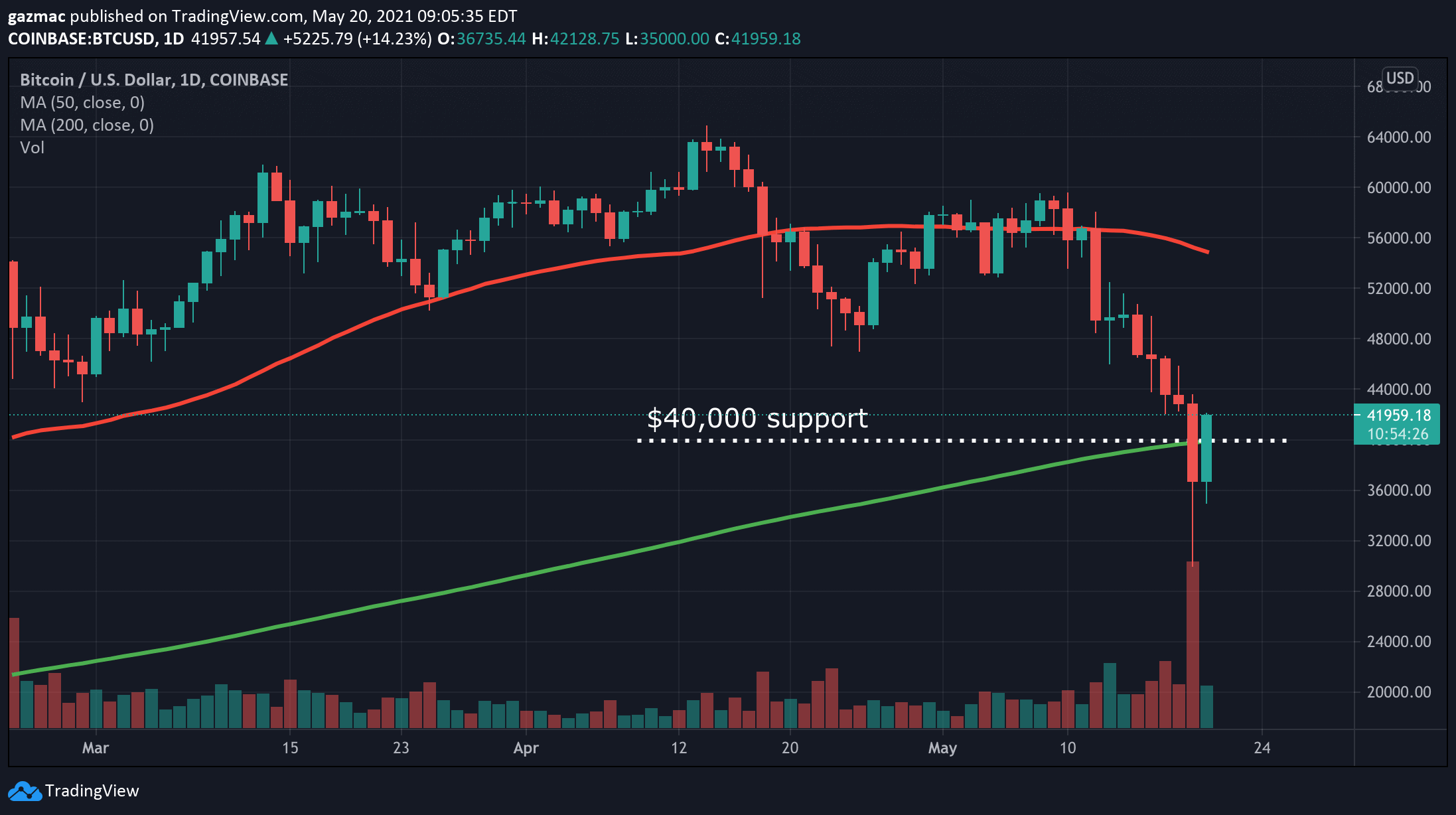

The leading crypto asset has traded as low as $30,000 and that could be the real bottom and not $40,000 currently being hoped for, although bitcoin, as mentioned, has recovered impressively from yesterday’s visits to the $30k resistance line.

However, the 200-day moving average at $40,000 (green line in chart below) could yet be the new lower band for a period of (wide) rangebound trading. Traders are currently looking for the price to hold above $42,000 today for confirmation that a bottom could be in, but as Edgerton intimates, you would be playing Russian Roulette placing your buy bitcoin chips on those hopes.

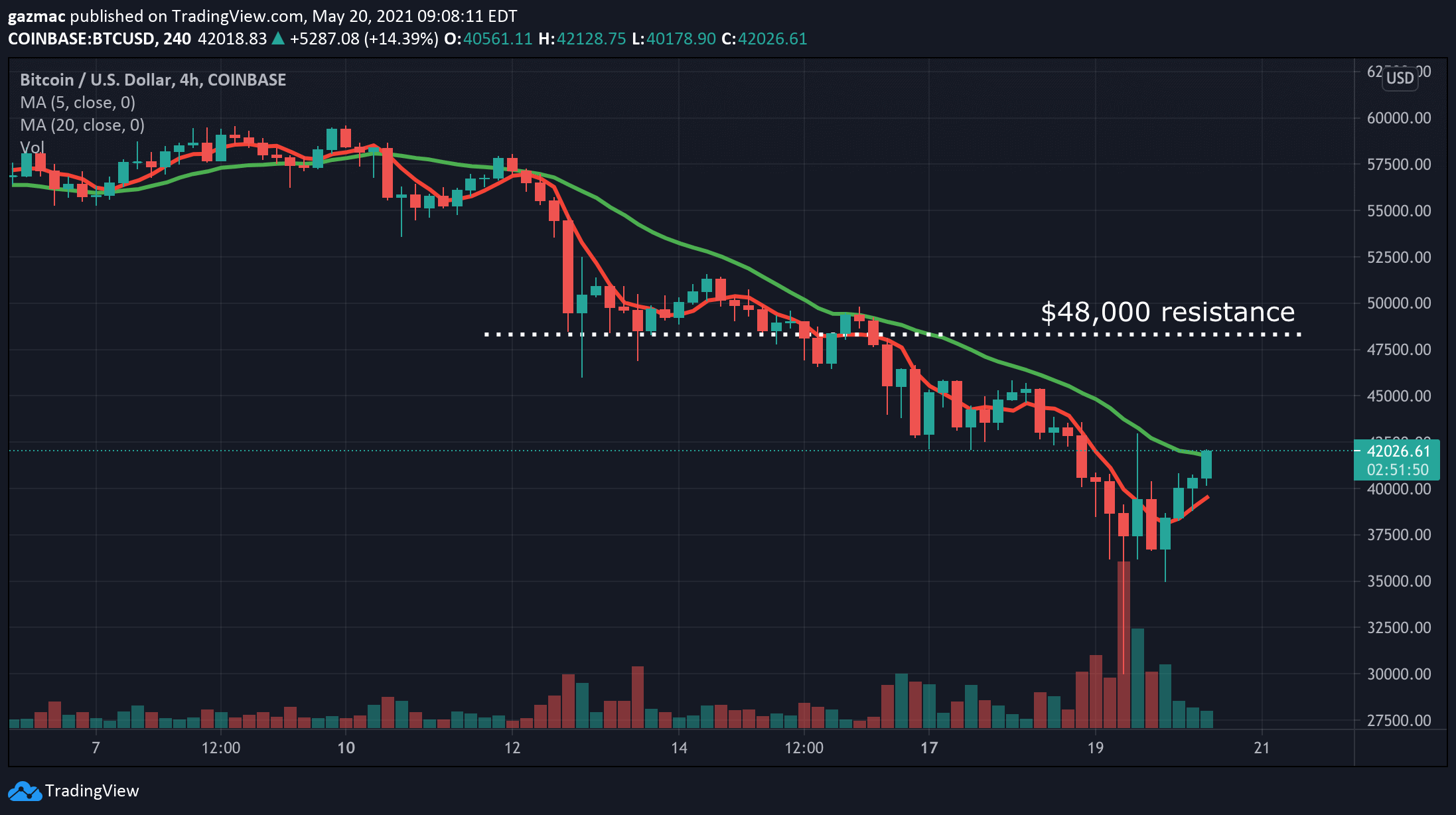

If the bitcoin price can tee-up to challenge $48,000 (see chart below) in the next few days, then the drop to $30,000 can be laid to rest as a bad memory not to be revisited.

But relying on the charts alone to divine the next price moves for those looking to buy bitcoin is not a full-spectrum approach.

As Edgerton reminds us, we got here because of negative news flow in addition to factors such as the US tax season and the perennial doubts surrounding the collateralisation of Tether (USDT).

“A perfect storm of negative stories (Elon going negative on BTC, Binance facing possible US regulatory penalties, tax season selling, USDT asset backing is riskier than expected) is swamping crypto and generating severe fear, particularly among retail traders,” says Edgerton.

Crypto derivatives blow up: understanding gamma hedging and other intricacies of crypto derivatives

But let’s dig a bit deeper into the derivatives data. The leverage on the longs is straightforward to grasp for those unfamiliar with derivatives trading. But there are some other accelerants in the mix that stem from the strategies sophisticated pro derivatives traders use as a matter of course when playing the markets.

Shane Ai, Head of Product R&D at crypto derivatives exchange Bybit, has shined light on the matter: “This week’s rapid correction resulted from a perfect storm of the following: leveraged long liquidations, option dealer put gamma hedging, and spot selling from cash and carry unwinds.”

If your eyes glaze over when letters of the Greek alphabet appear in financial speak, we are here to help.

The gamma hedging Ai refers to is simply the practice of controlling for large movements in the underlying asset of an option. Put options are used to short a position, sometimes in order to hedge a long. Also, price volatility tends to increase the closer a contract gets to expiry, so gamma hedging finds a role in such circumstances too.

Cash and Carry unwinds: when crypto arbitraging turns bad

Cash and carry refers to strategies that seek to arbitrage the price difference between a derivative and the underlying asset it is based upon.

The strategy is usually constructed by taking a long position in the asset and a derivative in the opposite direction. But when bitcoin crashed, the profit on the price arbitrage would have disappeared, with losses on the spot far greater than the gains on the short position in the derivatives market.

So the drama of the past few days isn’t all on Elon Musk and the regulators in China and the US.

Taproot: keep an eye on bitcoin fundamentals

But zooming out from the market shenanigans, the last word should take us back to the relative sanity of the fundamentals, lest we forget what bitcoin is meant to be about, which is value storage and transfer in the digital realm (as opposed to a purely speculative asset).

On the subject of the fundamentals, it’s over to Edgerton at Japan-based crypto exchange Bitflyer: “Bitcoin the technology is moving forward with miners increasingly moving toward the Taproot upgrades which adds more value to the network.”

The operative phrase there is ‘moving forward’. Pound-cost average in. Accumulate. Hodl.

Looking to buy or trade Bitcoin (BTC) now? Invest at eToro!

75% of retail investor accounts lose money when trading CFDs with this provider

Join Our Telegram channel to stay up to date on breaking news coverage