Join Our Telegram channel to stay up to date on breaking news coverage

GBPJPY Price Analysis – June 04

The pair is carrying out a pullback. In case the Bulls defend $137 level the price may reverse at that level. Further increase in the Bears’ pressure may lead to a further decrease in the GBPJPY price that will target the $134 level.

GBP/JPY Market

Key levels:

Supply levels: $137, $139, $141

Demand levels: $134, $130, $126

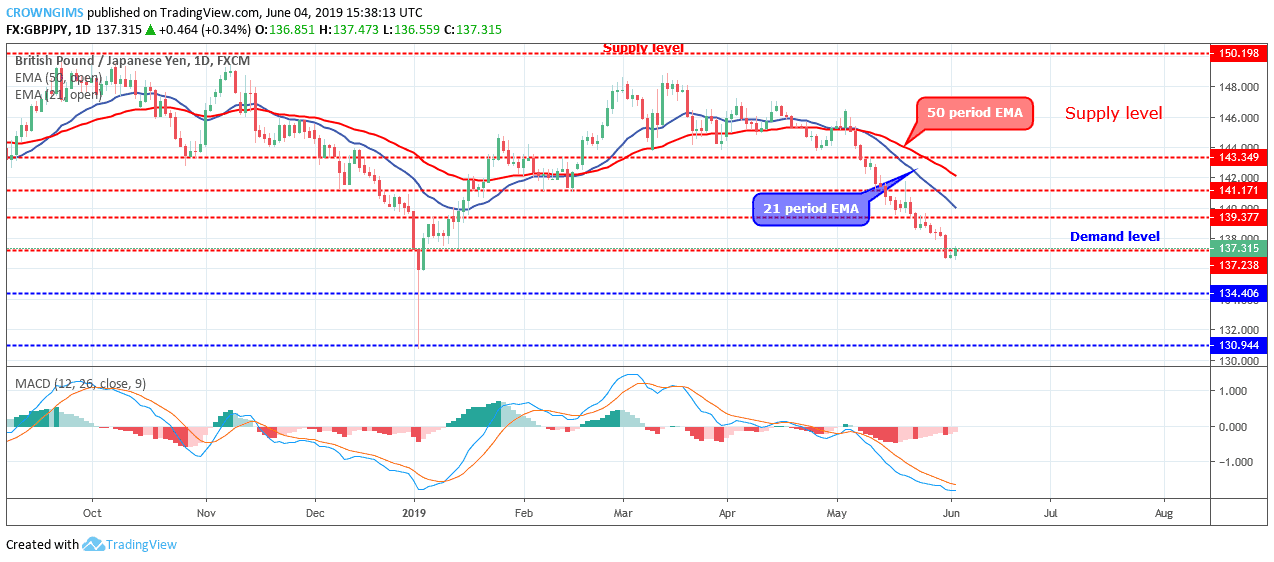

GBPJPY Long-term trend: Bearish

On the long-term outlook, GBPJPY is bearish. GBPJPY is under a bearish pressure for more than twenty days. As the bearish pressure increases gradually every day so also the GBPJPY price decreases. The Bearish momentum extended towards the former demand level of $137, the level could not hold, the sellers break down the $137 level. As at the moment, the price is consolidating at $137 level.

The pair is carrying out a pullback. In case the Bulls defend $137 level the price may reverse at that level. Further increase in the Bears’ pressure may lead to a further decrease in the GBPJPY price that will target the $134 level.

GBPJPY continue its trading below 21 periods EMA and 50 periods EMA, with an increase in the distance between the pair and the EMAs which is a sign of the sellers’ power. The histogram of the Moving Average Convergence Divergence period 12 is below zero levels and its signal lines point down to indicates sell signal.

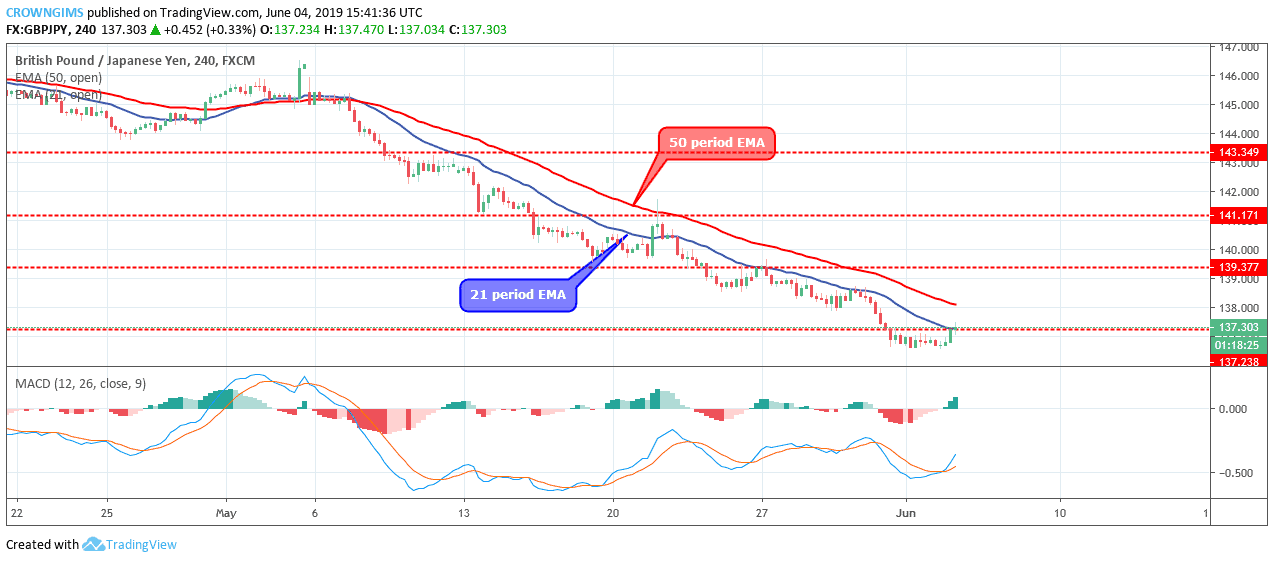

GBPJPY medium-term Trend: Bearish

On the medium-term outlook, GBPJPY continues its trade under the strong bearish momentum. The Bears maintain their momentum in the market of GBPJPY currency pair. The price is steadily rolling down below the $137 level. It seems the currency pair is retesting the broken level of $137 in which the downtrend may continue.

However, the MACD period 12 with the histogram is above zero levels and the signal lines bending upward to indicate a buy signal.

Please note: insidebitcoins.com is not a financial advisor. Do your own research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Join Our Telegram channel to stay up to date on breaking news coverage