Join Our Telegram channel to stay up to date on breaking news coverage

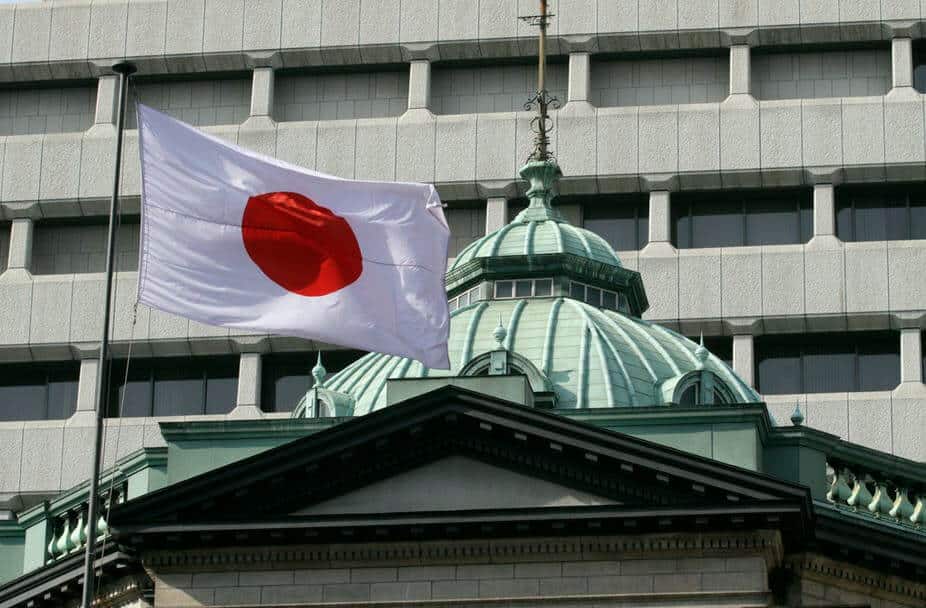

Japan’s status as a leader in the global blockchain and crypto space has never been in doubt, with the country excelling due to its favorable regulatory landscape. Now, industry players are set to launch a new initiative to bring some of blockchain’s benefits to the traditional financial space.

All Systems Go

On Thursday, a report on the Nikkei Asia Review confirmed that two financial giants in Japan are working on launching a digital stock exchange in the country. The initiative is a collaboration between commercial bank Sumitomo Mitsui Financial Group (SMFG) and financial services giant SBI Holdings.

As the report explained, the companies are working on launching the digital exchange in the spring of 2022. However, it isn’t expected to begin handling securities until next year. The exchange will operate with a proprietary trading system and an electronic trading venue run by a securities provider. With its infrastructure, the platform is expected to handle trading outside any other traditional public exchange.

SMFG and SBI will also set up the Osaka Digital Exchange as a parent company to act as the exchange’s operator. Shares in the Osaka Digital Exchange will be split between the two collaborators, with SBI getting 60 percent.

The partners are specifically looking to provide a reliable alternative to the Tokyo Stock Exchange. A system glitch caused the latter to suffer a significant service outage last September, causing it to suffer its first full-day shutdown since switching to a fully digital operation in 1999.

While the outage’s financial and operational implications are unknown, it goes without saying that issues like these shouldn’t happen. Japan is the world’s third-largest equities market, and this new digital exchange is looking to ensure that operational challenges don’t happen again.

Blockchain Meets Traditional Securities Exchanges

SBI and SMFG see an opportunity to revolutionize the Japanese securities trading space, and they believe that blockchain technology can be of immense use.

However, they aren’t the only companies working on such a project. In April 2020, Tokai Tokyo Financial Holdings, a Tokyo-based brokerage service provider, also announced that it would work on a digital securities exchange. The company, a major investor in Huobi Japan, explained that it had invested in blockchain firm Hash Dash Holdings and would partner with the latter on the objective.

The planned exchange will focus on tokenized real estate, with the partners looking to explore the sector by digitizing local real estate and trading it on iSTOX – a Singapore-based digital securities exchange. The partners added that they would explore trading in corporate bonds and intellectual properties as well.

Join Our Telegram channel to stay up to date on breaking news coverage