Join Our Telegram channel to stay up to date on breaking news coverage

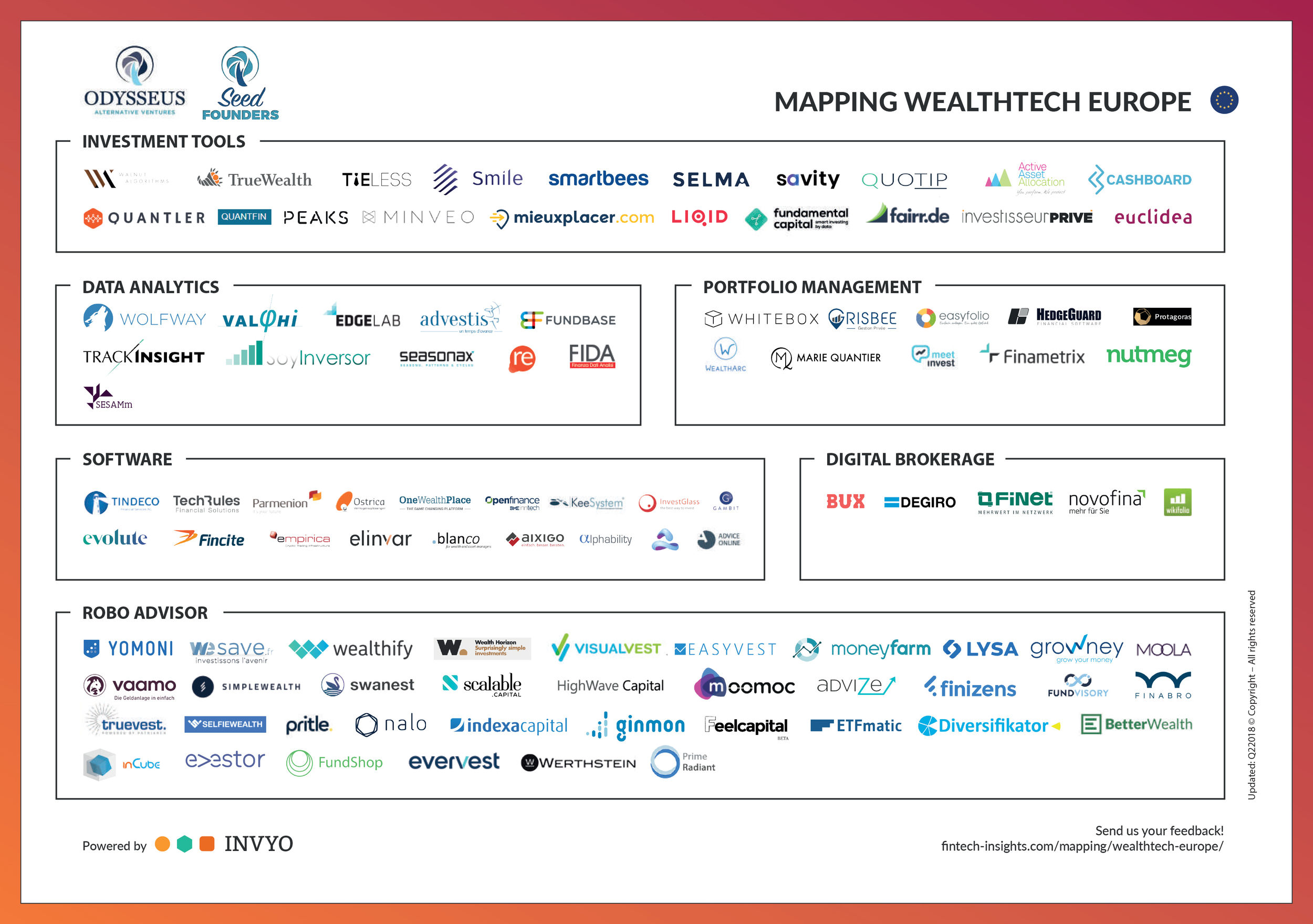

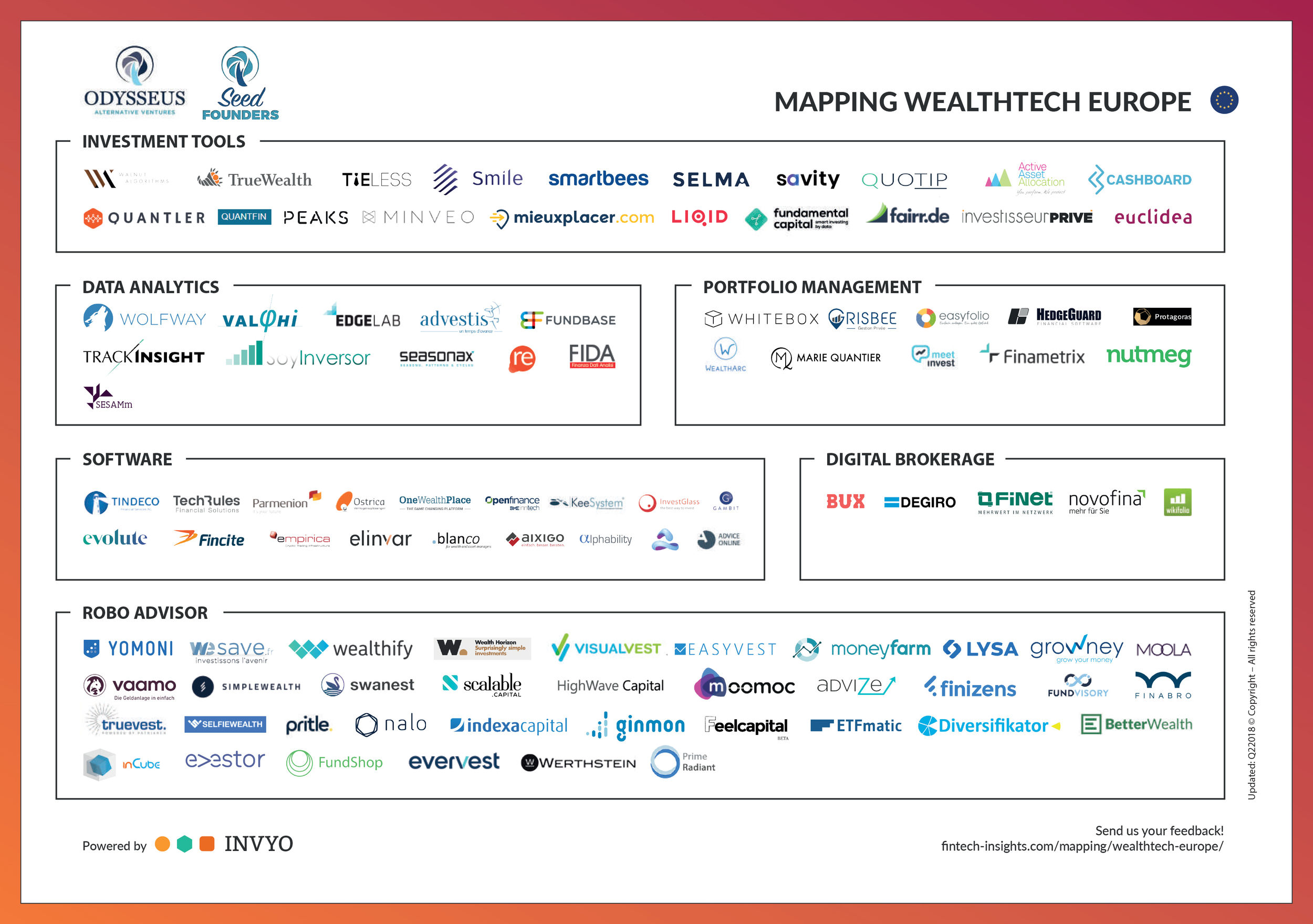

There are currently 100 wealthtech players in Europe spread across 12 countries, according to the newly released Mapping Wealthtech Europe by Invyo, Seed Founders and Odysseus Alternative Ventures.

Wealthtech refers to a segment of fintech that focuses on enhancing wealth management and the retail investment process using cutting-edge technologies including artificial intelligence (AI) and big data.

Wealthtech has been growing rapidly in the past few years, a trend driven by the numerous challenges that the traditional wealth management sector has been facing including intense competition, fee compression, stricter regulations and evolving customer needs.

Wealthtech in Europe

In Europe, wealthtech companies are operating in six segments:

Investments tools, which include software and services providing comparison tools, research, and access to a network of advice. Companies include Swiss TrueWealth and Selma, and German Liqid.

Data analytics for investment and market intelligence, among other areas. Providers include Italy’s WolfWay, and Switzerland’s Edge Laboratories and Fundbase.

Portfolio management solutions and software that help investors and advisors centralize investment portfolios in one platform, analyze and forecast portfolio performance, and make portfolio allocation decisions. Companies include Switzerland’s WealthArc and Meetinvest, and the UK’s Nutmeg.

Specialized software that supports adoption of a digital wealth management and investing strategy. Providers include Spain’s TechRules, and Switzerland’s InvestGlass and Tindeco.

Digital brokerage platforms for retail investors and software to implement a digital brokerage. Companies include Austria’s Wikifolio, the Netherlands’ Degiro, and Malta’s Novofina.

Robo-advisory, or automated investment platforms that leverage technology to lower account minimums and reduce advisory fees. The investments offered are tailored to the client’s goals and risk profile. Notable robo-advisory platform providers in Europe include Italy’s Moneyfarm, Germany’s Werthstein and Vaamo, and the UK’s Scalable Capital.

Mapping Wealthtech Europe 2018 by Invyo, Seed Founders and Odysseus Alternative Ventures

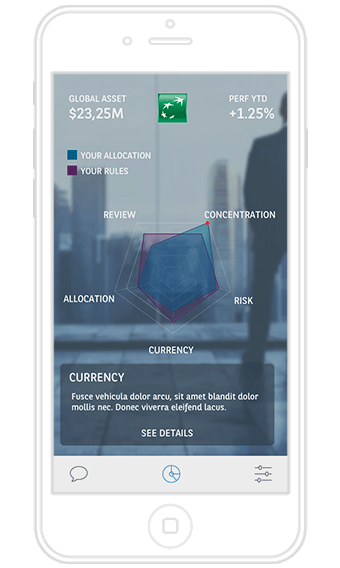

In June, the Wealth Tech Awards 2018 by Professional Wealth Management magazine, a publication of the Financial Times Group, awarded French private bank BNP Paribas Wealth Management the Best Private Bank, Use of Technology, Global, award for its key achievements in wealthtech. BNP Paribas Wealth Management manages EUR 362 billion in assets under management.

myAdvisory, BNP Paribas Wealth Management

“We are dealing with fundamental changes in our clients’ mindset, how they want to be served and considered,” Mariam Rassai, head of client experience at BNP Paribas Wealth Management, told Professional Wealth Management.

“At the heart of the client experience transformation, there is the will to create a new form of wealth management to adapt the banking services to every aspect of a client’s life. We want to develop both a digitalization strategy for our private clients and a strong culture of innovation.”

Since 2016, BNP Paribas has launched 20 new digital services. These include myAdvisory, an app which provides personalized financial advisory, myChat&Trade, a trading app, and Leaders’ Connection, a platform that lets ultra high net worth individuals interact, share investment ideas and find co-investors.

myWealth is the bank’s new “one-stop digital platform” for international clients, offering customized investment advice, a chatroom, videoconferencing, an electronic safe, and biometric connection.

New features are currently being tested, such as myMeeting, a platform that would help clients prepare for meetings with their private banker, and myVirtualAssistant, a solution that uses AI to allow users to access the bank 24/7.

Featured image: Mapping Wealthtech Europe 2018, by Invyo, Seed Founders and Odysseus Alternative Ventures.

The post Europe Now Hosts +100 Wealthtech Players appeared first on Fintech Schweiz Digital Finance News – FintechNewsCH.

Join Our Telegram channel to stay up to date on breaking news coverage