Join Our Telegram channel to stay up to date on breaking news coverage

Jacobi Asset Management listed Europe’s first spot Bitcoin ETF on Euronext Amsterdam, putting the region ahead of the US, where firms from BlackRock to Fidelity are hopeful of getting similar investment vehicles up and running in the near future.

BREAKING: Jacobi lists Europe’s first spot Bitcoin ETF on Euronext Amsterdam with Article 8 classification with support from @euronext @DigitalAssets @FlowTraders @DRWTrading @JaneStreetGroup @collascrill @MidshoreConsulting @zumopay @Wilshire pic.twitter.com/Wp18jnoIrY

— Jacobi Asset Management (@JacobiAssetMgt) August 15, 2023

Regulated by Guernsey Financial, Jacobi FT Wilshere Bitcoin ETF will trade under the ticker “BCOIN”. Jacobi said that Fidelity Digital Assets will provide custody, and operating as the market maker will be the trading firm Flow Traders.

Spot Bitcoin ETF for Institutional Investors – Jacobi CEO

“It is exciting to see Europe moving ahead of the US in opening up Bitcoin investing for institutional investors who want safe, secure access to the benefits of digital assets using familiar and regulated structures like our ETF,” said Martin Bednall, CEO of London-based Jacobi.

Jacobi had won approval for the spot Bitcoin ETF back in 2021. However, due to the onset of crypto winter led by the Terra crash and the subsequent dampening of interest in Bitcoin due to FTX’s collapse, the asset management firm deferred its launch.

Racing Ahead of the US

US firms are also racing to get spot Bitcoin ETFs approved with BlackRock, Fidelity, and Ark Invest among those in the queue.

The road to approval may not be smooth, as seen in the SEC’s decision to delay its decision on the application filed by Ark Invest to January 2024. Still, Ark Invest’s Cathie Wood was anticipating the delay and said she is hopeful the SEC will approve multiple spot Bitcoin ETFs simultaneously.

An Environmentally Conscious Spot Bitcoin ETF

Jacobi’s spot Bitcoin ETF is also the first digital asset fund complaint with SFDR Article 8, which aligns with the firm’s decarbonization strategy.

Jacobi’s Wilshire Bitcoin ETF will offer an ESG-aligned digital asset solution, allowing eco-conscious buyers to consider Bitcoin ETF as an appropriate investment.

Kirsteen Harrison, Environmental Manager of Zumo, said, “The decarbonisation of crypto is one of the most pressing challenges facing the nascent digital asset sectors.”

“We’ve been working closely with Jacobi Asset Management to help them build out an ESG-aligned, future-proofed crypto offering for their customers,” she added.

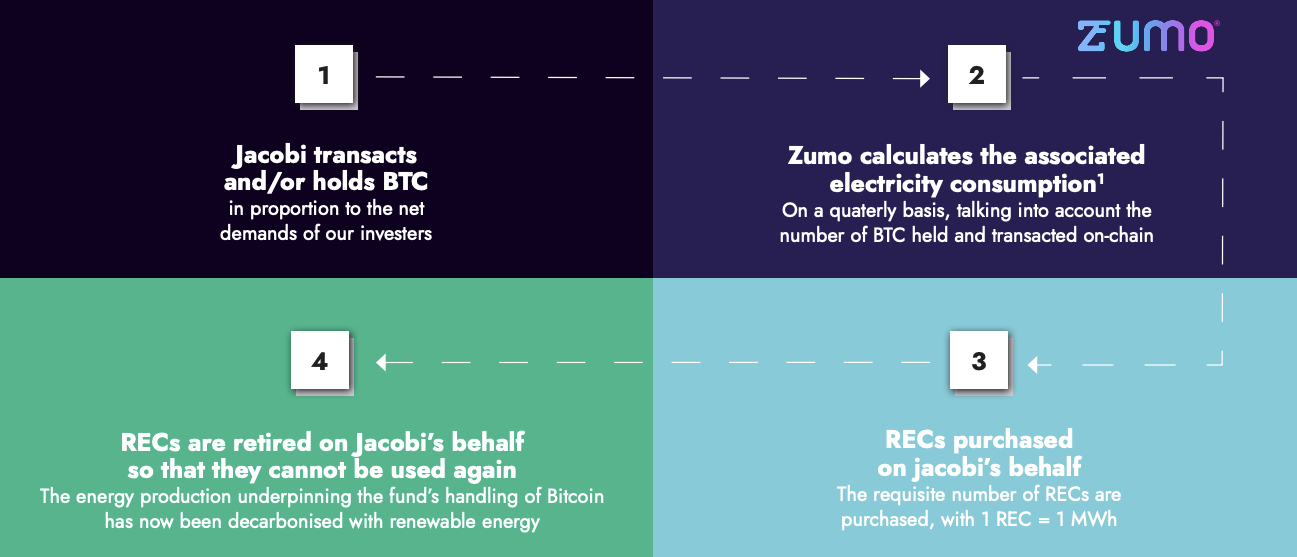

This partnership between Zumo and Jacobi involves procuring Renewable Energy Certificates (RECs). Jacobi FT Wilshire ETF’s brochure states that this solution will work to offset the electricity consumption related to the fund’s Bitcoin holdings.

It explains a four-step process that involves Jacobi transacting and holding the BTC, for which Zumo will calculate the electricity consumption. Based on that, a set number of RECs will be bought by Zumo on Jacobi’s behalf, which will then be retired and rendered useless.

Related

- Binance Seeks Protective Order Against SEC’s “Fishing Expedition”

- SEC Won’t Approve Spot Bitcoin ETF’s But US Crypto Crackdown Will “Grind to a Screeching Halt” Under this 2024 Scenario

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage