Join Our Telegram channel to stay up to date on breaking news coverage

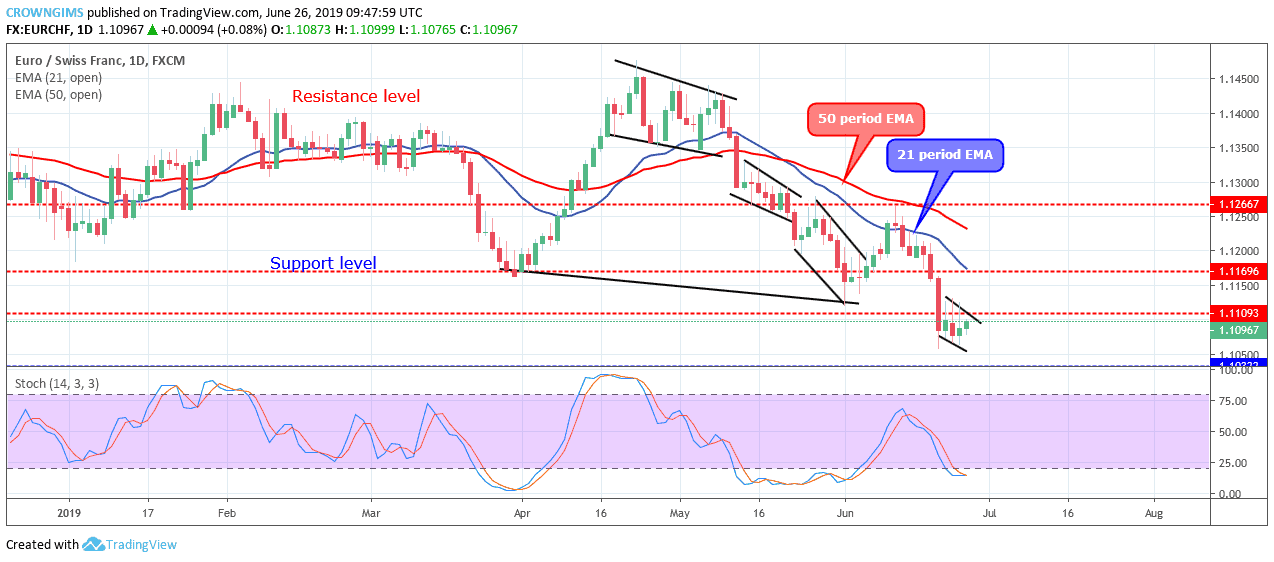

EURCHF Price Analysis – June 26

EURCHF price may decrease further in case the Bears exert more pressure, the Bears may push the pair to reach the support level of $1.103.

EUR/CHF Market

Key levels:

Resistance levels: $1.110, $1.116, $1.126, $1.134

Support levels: $1.103, $1.095, $1.086

EURCHF Long-term trend: Bearish

On the long-term outlook, EURCHF is bearish. The Bears hold tight to the EURCHF market. The price was at the supply level of $1.116 last week. The downtrend continues and the price penetrated the former demand level of $1.110. The support level of $1.103 has been exposed. The Bulls were trying to pull back the price for a retracement but the Bears would not allow. The price is slowly moving down to the $1.103 level.

EURCHF price is trading under the 21 period EMA and 50 periods EMA and the price is moving away from the two EMAs which imply that bearish momentum is increasing. The Bears are still in control of the EURCHF market. However, the Stochastic Oscillator period 14 is below 20 levels with the signal lines bending down to indicate sell signal.

EURCHF price may decrease further in case the Bears exert more pressure, the Bears may push the pair to reach the support level of $1.103.

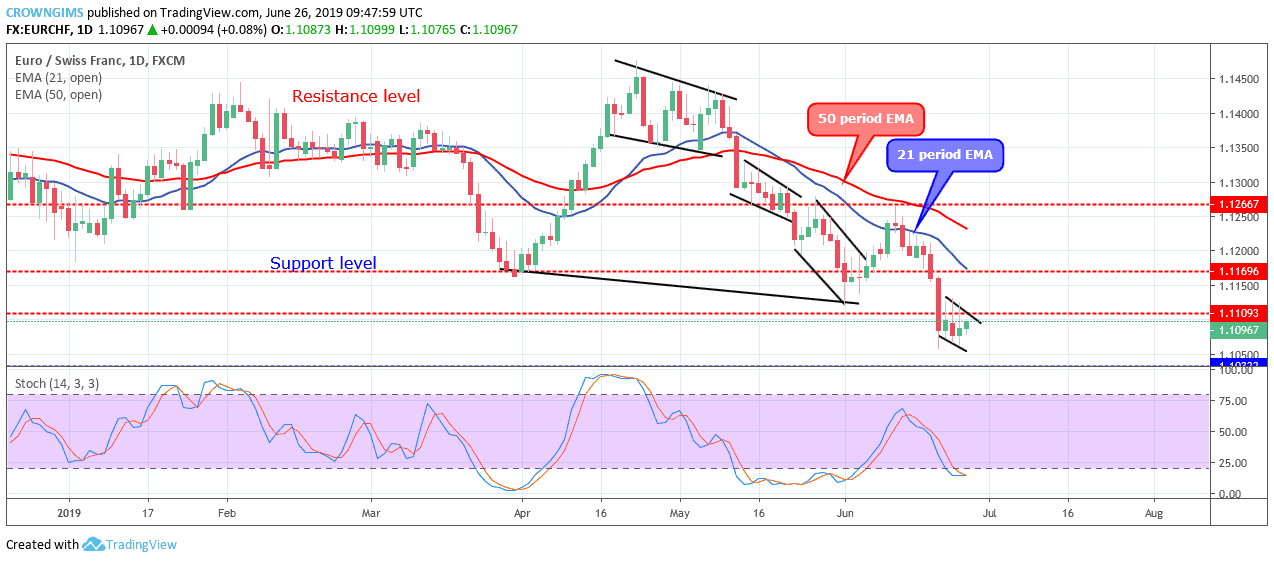

EURCHF medium-term Trend: Bearish

EURCHF is bearish on the medium-term outlook. Another descending channel has formed on the 4-hour chart in the EURCHF market. EURCHF price is moving zigzag within the channel. The price is having direct contact with the 21 periods EMA which indicates low momentum from both the Bulls and the Bears.

EURCHF is trading under the 21 periods EMA and 50 periods EMA. The Stochastic Oscillator period 14 is above $25 level and the signal lines pointing up to indicate a buy signal.

Please note: insidebitcoins.com is not a financial advisor. Do your own research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Join Our Telegram channel to stay up to date on breaking news coverage