Join Our Telegram channel to stay up to date on breaking news coverage

Ethereum Price Prediction – January 3

ETH/USD market trading activities have seen a significant increase. That has been at the expense of sellers’ weaknesses around the $750 price level.

ETH/USD Market

Key Levels:

Resistance levels: $850, $900, $950

Support levels: $650, $600, $550

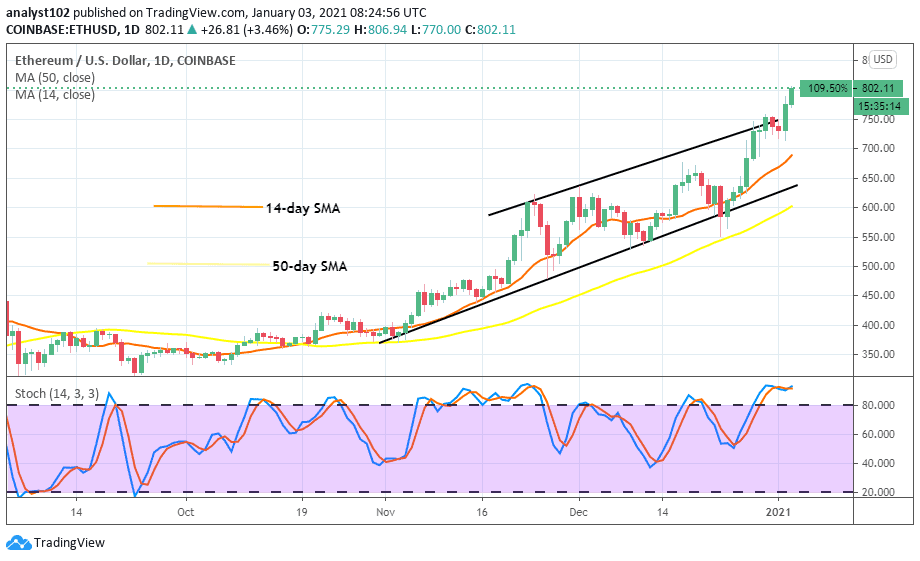

ETHUSD – Daily Chart

The daily trading chart clearly shows that the ETH/USD market buying mote is on a firm moving mote as the price is struggling to trade northbound above a resistance value at $800. The northward upper channel-line has left below the current price upswing at the $750 line. Some trading indicators also point to the north trading-direction to affirm the upward price movement of the crypto-economy.

Where is ETH Price Going Next?

ETH/USD trade operations have now come to maintain a straight-line path in its journey to the upside. As the crypto has traded past the value of $750 may in no time reach the next immediate trading region at $850. A price rejection around the said zone could make the crypto-currency pair to revisit a low point between or around the $750 and, $700 price levels.

About the retracement of this current ETH/USD bullish trend in the talk, bears may have to their position on hold for the emergence of a sizeable bearish candlestick needed to form against about one or two immediate bullish candlesticks that might have formed previously. And, in the event of that scenario, the 14-day SMA trend-line also needs to be used in determining any possible resurface of downward price moves of this crypto-trade. But, the $850 seems much in focus.

ETHBTC Price Analysis

In comparing the ETH trade position with that of the BTC’s, the Ethereum has been under downward pressure to some reasonable degree. The bearish trend-line between the two market-trading instruments has been for days’ long trading sessions. However, presently, the base currency appears to find a base-line for a catalyst to regain its stand against its counter instrument.

Join Our Telegram channel to stay up to date on breaking news coverage