Join Our Telegram channel to stay up to date on breaking news coverage

Key Highlights

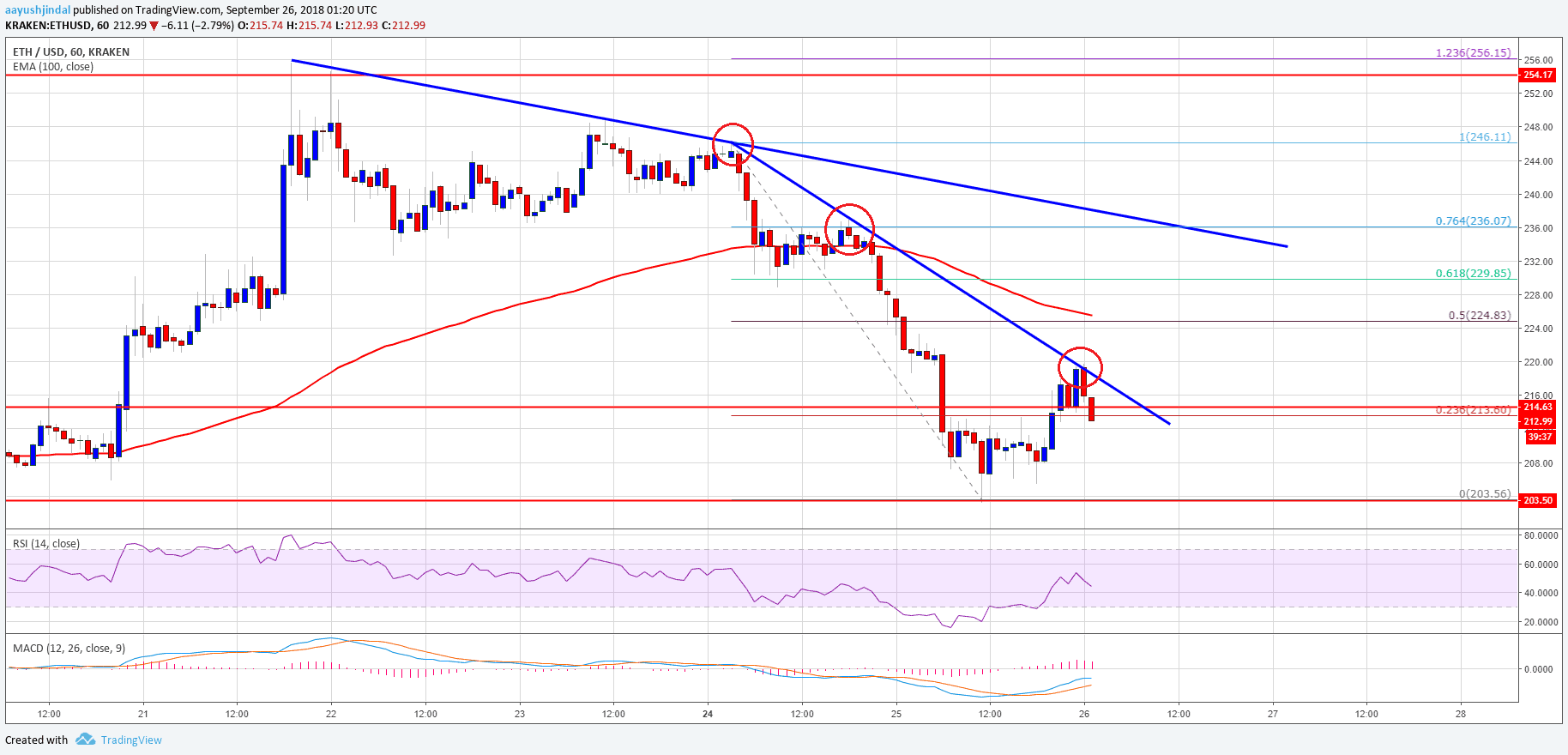

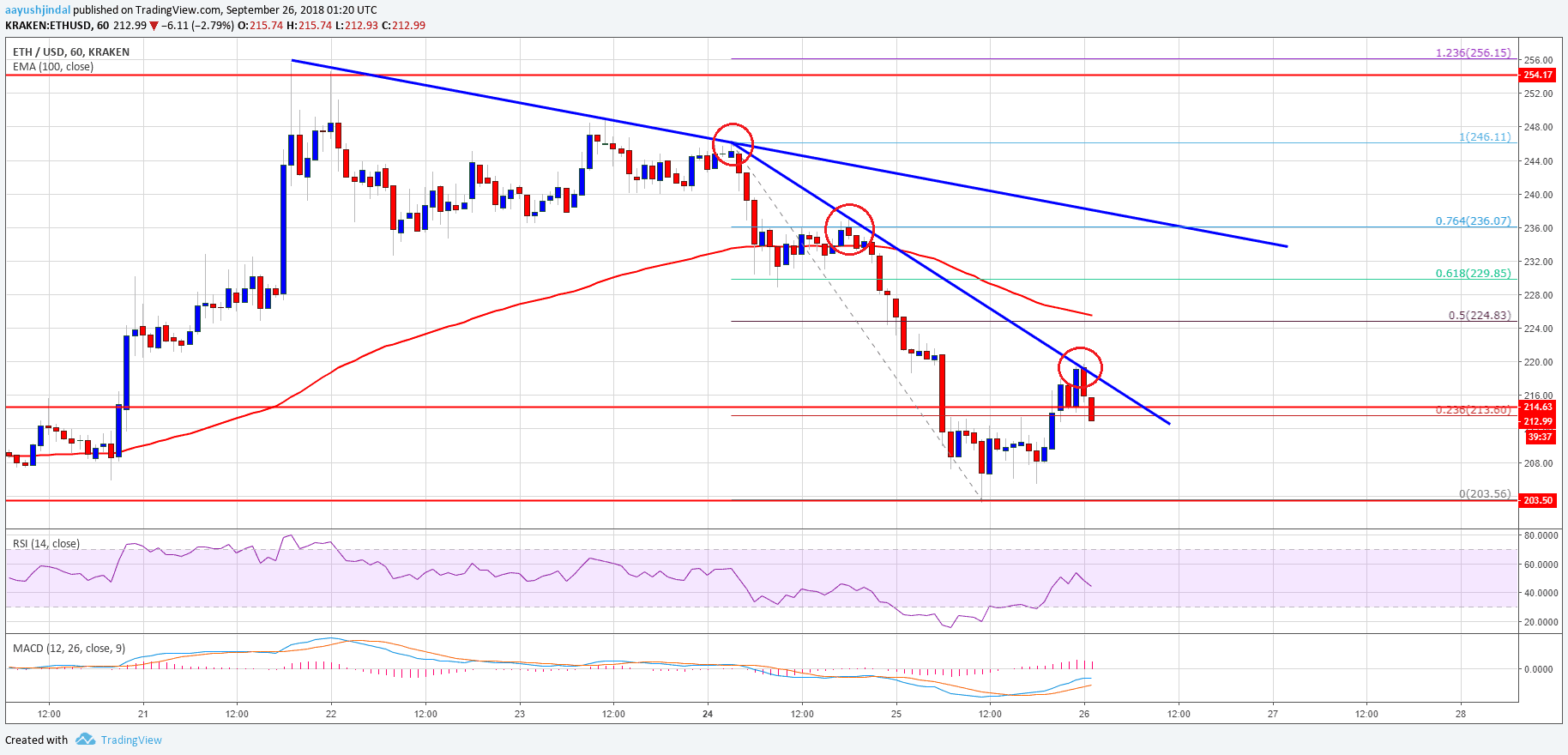

- ETH price traded further lower and tested the next support at $204 against the US Dollar.

- There are two bearish trend lines in place with resistance at $220 and $234 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair has to move back above the $224 and $228 resistances to recover in the short term.

Ethereum price is facing an increased selling pressure against the US Dollar and bitcoin. ETH/USD could accelerate losses as long as the price is below $224.

Ethereum Price Analysis

Yesterday, we saw the start of a downside move from the $236-238 zone in ETH price against the US Dollar. The ETH/USD pair declined and broke the $225 and $220 support levels. Later, there was a close below the $220 level and the 100 hourly simple moving average. The price tested the $204 level and later corrected higher. There was a push above the 23.6% Fib retracement level of the last decline from the $246 high to $204 low.

However, the price failed to move above the $220 and $222 levels. More importantly, there are two bearish trend lines in place with resistance at $220 and $234 on the hourly chart of ETH/USD. Above the first trend line, the next resistance is near $224. It represents the 50% Fib retracement level of the last decline from the $246 high to $204 low. Moreover, the 100 hourly SMA is also near $224. Therefore, buyers are likely to struggle near the $224 and $225 levels in the near term.

Looking at the chart, ETH price remains at a risk of more losses if there is no break above $220 and $224. Above these two, the next barrier is close to $232. On the downside, a break below $204 may call for more losses below the $200 level.

Hourly MACD – The MACD is slowly moving in the bullish zone.

Hourly RSI – The RSI is currently below the 50 level.

Major Support Level – $204

Major Resistance Level – $224

The post Ethereum Price Analysis: ETH/USD Sellers In Control Below $224 appeared first on NewsBTC.

Join Our Telegram channel to stay up to date on breaking news coverage