Join Our Telegram channel to stay up to date on breaking news coverage

Key Highlights

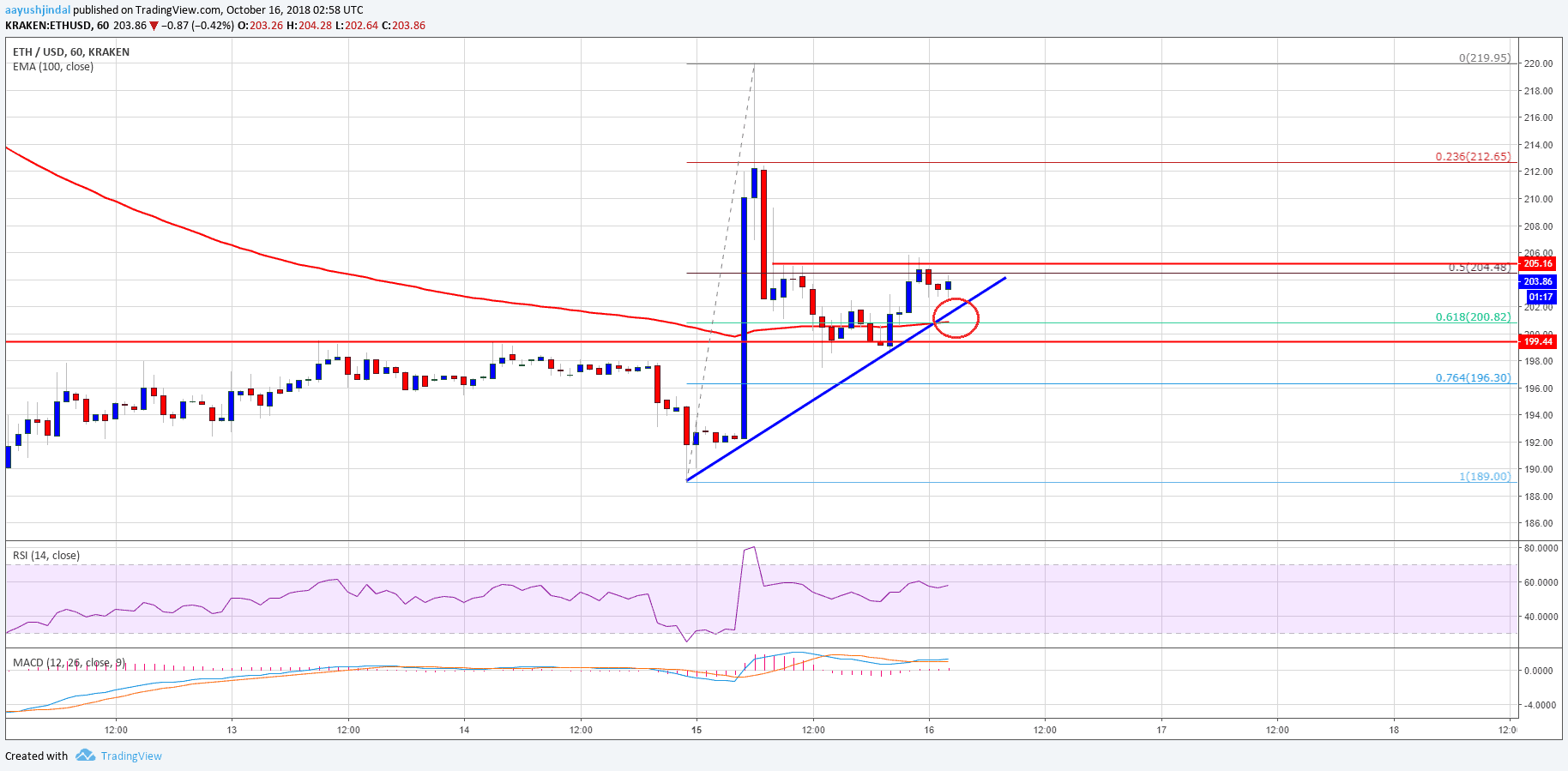

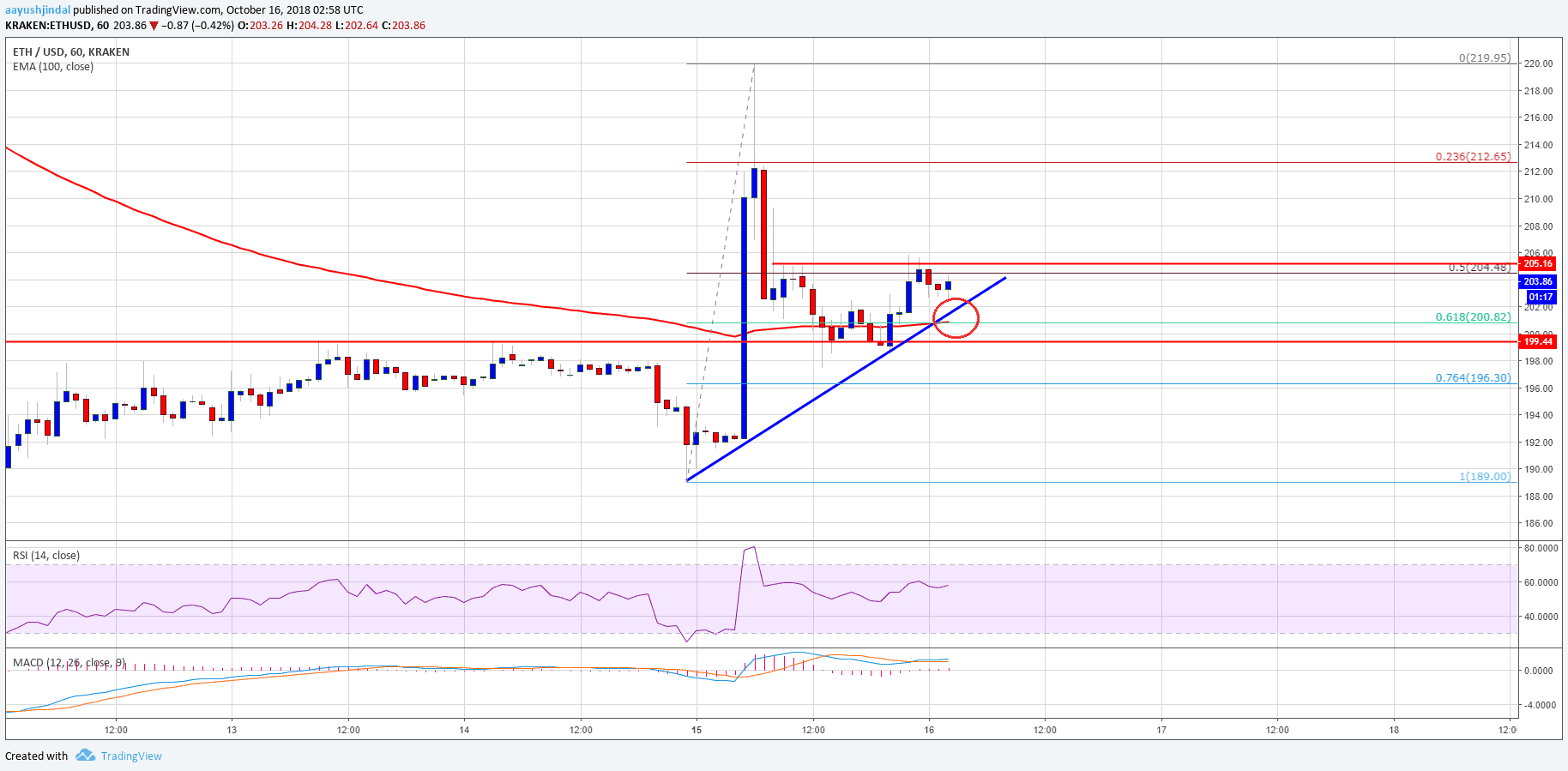

- ETH price surged above the $215 level and later retreated towards $200 against the US Dollar.

- There is a key connecting bullish trend line in place with support at $202 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair needs to break the $204-205 resistance area to resume its upside move in the near term.

Ethereum price is currently consolidating against the US Dollar and bitcoin. ETH/USD must stay above $200 to climb higher towards $205 and $210.

Ethereum Price Analysis

Yesterday, we saw a solid upward move above the $197 and $200 resistances in ETH price against the US Dollar. The ETH/USD pair traded above the $208 and $210 resistance levels. It traded close to the $220 level and formed a high at $219.95. Later, the price retreated sharply and trimmed most of its gains above $210. There was a break below the 50% Fib retracement level of the last wave from the $189 low to $219 high.

However, the downside move found support near the $199-20 zone. The price traded close to the 76.4% Fib retracement level of the last wave from the $189 low to $219 high. Later, it recovered and settled above the $200 level and the 100 hourly simple moving average. It seems like there is a key connecting bullish trend line in place with support at $202 on the hourly chart of ETH/USD. On the upside, the price has to break the $204-205 resistance area to climb higher. The next major resistance is near $212, above which the price could test $215.

Looking at the chart, ETH price is placed nicely above the $200 support and the 100 hourly SMA. If buyers fail to keep the price above $200, there could be a break down towards the $195 and $192 levels.

Hourly MACD – The MACD is slowly moving in the bullish zone.

Hourly RSI – The RSI currently well above the 50 level.

Major Support Level – $200

Major Resistance Level – $205

The post Ethereum Price Analysis: ETH/USD Holding Gains Above $200 appeared first on NewsBTC.

Join Our Telegram channel to stay up to date on breaking news coverage