Join Our Telegram channel to stay up to date on breaking news coverage

ETH Price Analysis – August 17

Ethereum opened with a downtrend as the market begins today. The coin recently experienced a heavy pullback in price due to the market pressure.

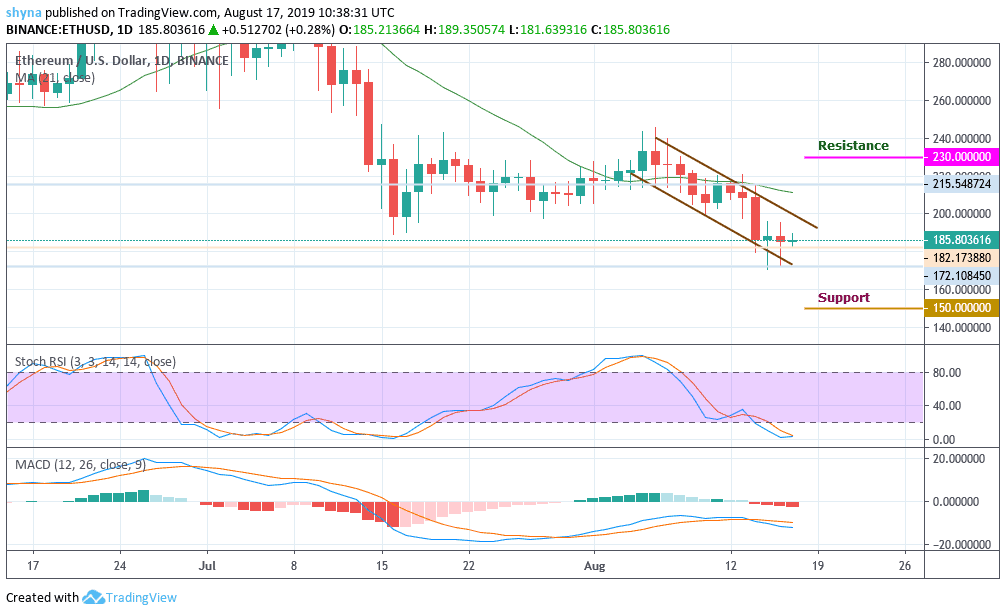

ETH/USD Market

Key Levels:

Resistance levels: $230, $240, $250

Support levels: $150, $140, $130

Ethereum is currently consolidating within a descending channel since the last two days. The daily chart shows that as the market opens today, the price first went down to $182.17 trying to meet the nearest support of $170 but the bulls enter the market to drag the price up to where it is changing hands at $185.80.

The daily price is trending below the 21-day moving average around the immediate market resistance. The bulls will have to move above the mentioned moving average to reach the resistance levels at $230, $240 and $250. Meanwhile, the support levels to watch are $150, $140 and $130 respectively. The moving average convergence/divergence (MACD) on the chart shows four straight bearish sessions as the RSI (14) is at the oversold zone, indicating more downtrends.

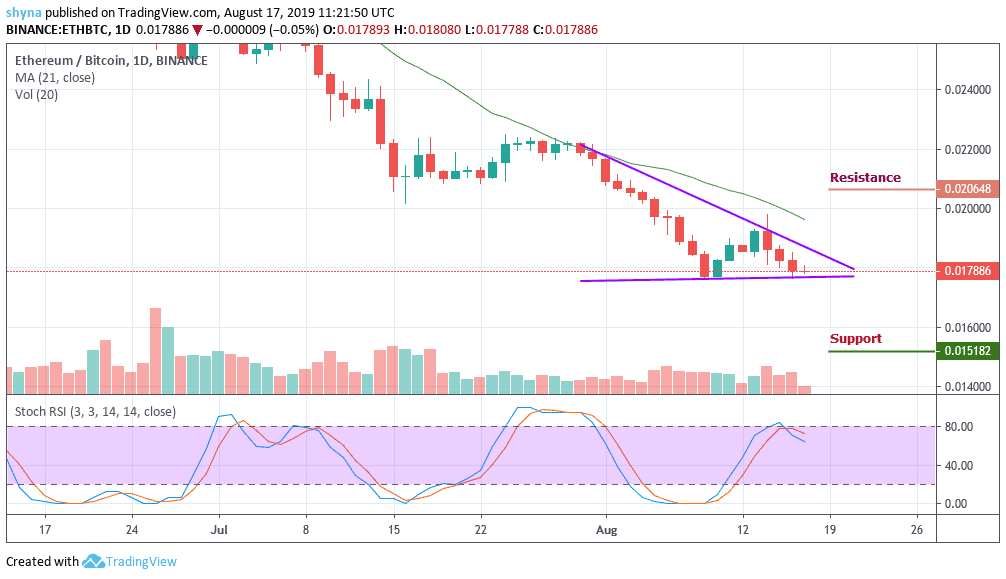

ETH/BTC Market

Against the BTC, looking at the daily chart, we can see that Ethereum is clearly bearish. As the price falls, sellers are posing an additional threat for buyers to reach the 0.016BTC support level where the nearest target is located. However, an eventual break below the lower line of the symmetrical triangle may cause Ethereum collapse.

Meanwhile, a continuation of the downtrend could hit the main support at 0.015BTC before falling to 0.014BTC and below, while the buyers could probably push the market to critical potential resistance at 0.020BTC and above. The stochastic RSI has recently experienced a rapid decline in price with a sharp drift from the overbought territory. ETH will continue to fall if the sellers continue to release the pressure.

Please note: insidebitcoins.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Join Our Telegram channel to stay up to date on breaking news coverage