Join Our Telegram channel to stay up to date on breaking news coverage

ETH Price Prediction – February 3

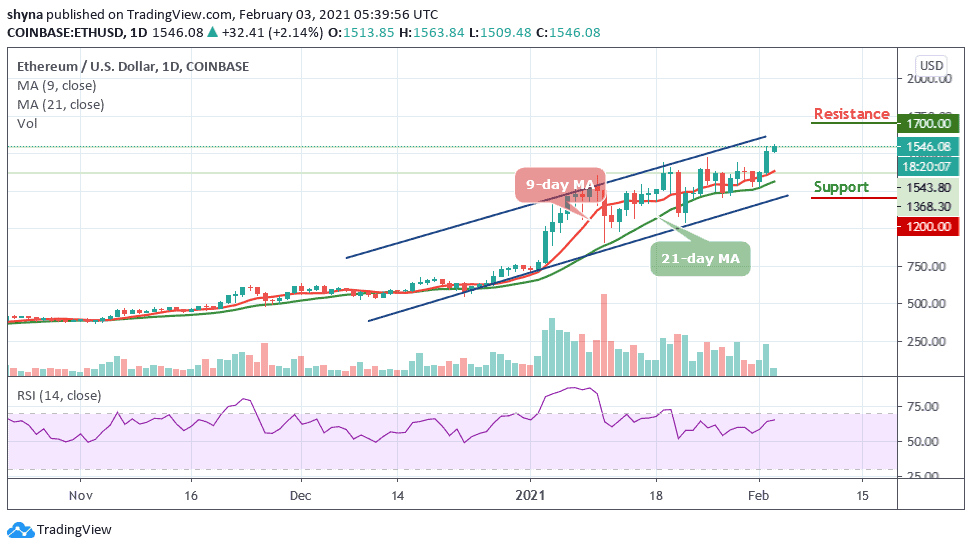

As reveals in the daily chart, Ethereum (ETH) breaks out as the price aims for new all-time highs at $1,800.

ETH/USD Market

Key Levels:

Resistance levels: $1700, $1800, $1900

Support levels: $1200, $1100, $1000

ETH/USD with all its blazing guns hits a new all-time high above $1563 surging more than 2% at the time of writing. More so, as expected, the second-largest cryptocurrency has finally given a breakout about its previous all-time high and has now entered the price discovery mode. However, the journey has just started for the coin as ETH/USD is eyeing $1800 level to be its next target.

Where is Ethereum Price Going Next?

ETH/USD can be expected to rise to $1700 over the next few days while the on-going trend may move a little bit higher in the coming days. The Ethereum price may cross above the channel to touch the nearest resistance at $1600. Therefore, as the 9-day MA remains above the 21-day MA, the coin may continue to do well and the price could hit the resistance levels at $1700, $1800, and $1900 respectively.

Meanwhile, ETH/USD is currently changing hands at $1,546 amid a building bullish momentum. However, the technical indicator RSI (14) also confirms the uptrend as the signal line is seen moving around 65-level, suggesting more bullish signals into the market but any bearish movement below the channel may roll the market down to the support levels of $1200, $1100, and $1000 respectively.

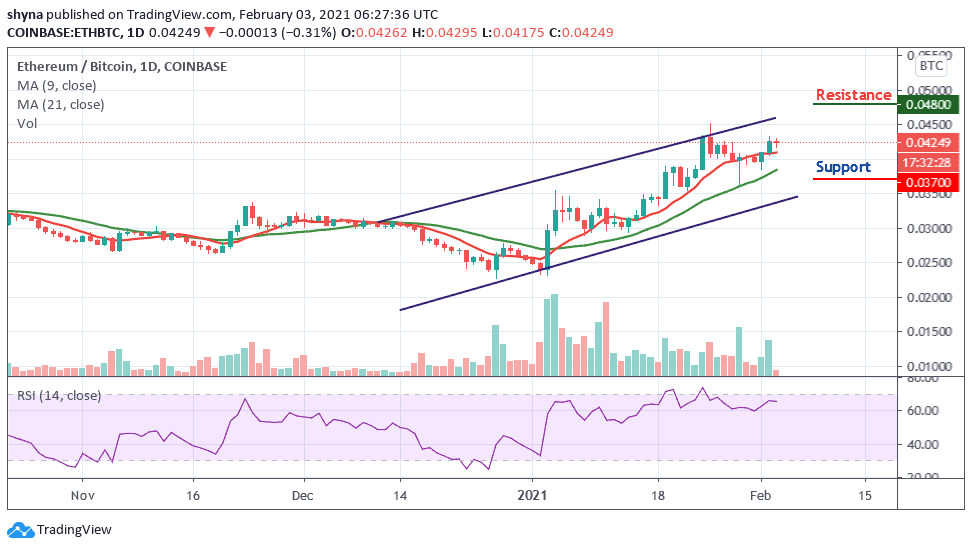

Against Bitcoin, the market price focuses on the uptrend within the channel as the price trades above the 9-day and 21-day moving averages. ETH/BTC is currently trading at the 4249 SAT and if the market continues to rise, the next key resistance may be at 4800 SAT and above.

On the contrary, a possible bearish movement below the moving averages may likely come into play, which could lead to the support level of 3700 SAT and below. Meanwhile, the market may continue to have a bullish day today because the RSI (14) indicator remains at the upside, suggesting more bullish signals.

Join Our Telegram channel to stay up to date on breaking news coverage