Join Our Telegram channel to stay up to date on breaking news coverage

Top review and news platform DeFi Coins today announced a new guide for cryptocurrency enthusiasts. The platform’s latest guide titled Top 10 DeFi Guide focuses on the decentralized finance (DeFi) sector.

The platform’s launch will provide industry insiders and enthusiasts with a roundup of the best DeFi coins available for purchase and investment.

DeFi is a subcategory of the cryptocurrency space that integrates the blockchain into traditional financial services.

DeFi protocols run on automated systems, connecting parties in a transaction and facilitating these transactions seamlessly. You can find DeFi protocols that specialize in just about every financial transaction, from lending and liquidity provision to savings and asset exchange.

Over the past year, the DeFi space has been on a significant uptrend. Data from DeFi Pulse shows that DeFi protocols now hold $75.8 billion in assets locked. For an industry that is still considered to be nascent, this is beyond impressive.

With the untold potential for growth, there is a lot of attention coming to the DeFi space. Industry newcomers will be looking to find as much information as they can, and this is where the DeFi Guide comes in.

Understanding the DeFi Coins Guide

Like other subcategories of the crypto industry, users access the services of DeFi protocols via native tokens.

Depending on the protocol, token holders can access financial products in areas such as lending and borrowing, with yield distribution and repayments all controlled automatically on a decentralized network. Each DeFi protocol will have its own particular take on incentives for liquidity providers and collateralization mechanisms. The tokens themselves can provide a capital return if their value increases.

Investing funds in a DeFi protocol is easy these days. Many of the popular cryptocurrency exchanges list the tokens of DeFi projects. DeFi Coins lists a few in their guide on the best defi coins. When it comes to investing in DeFi coins, carry out your research and only invest on a regulated platform.

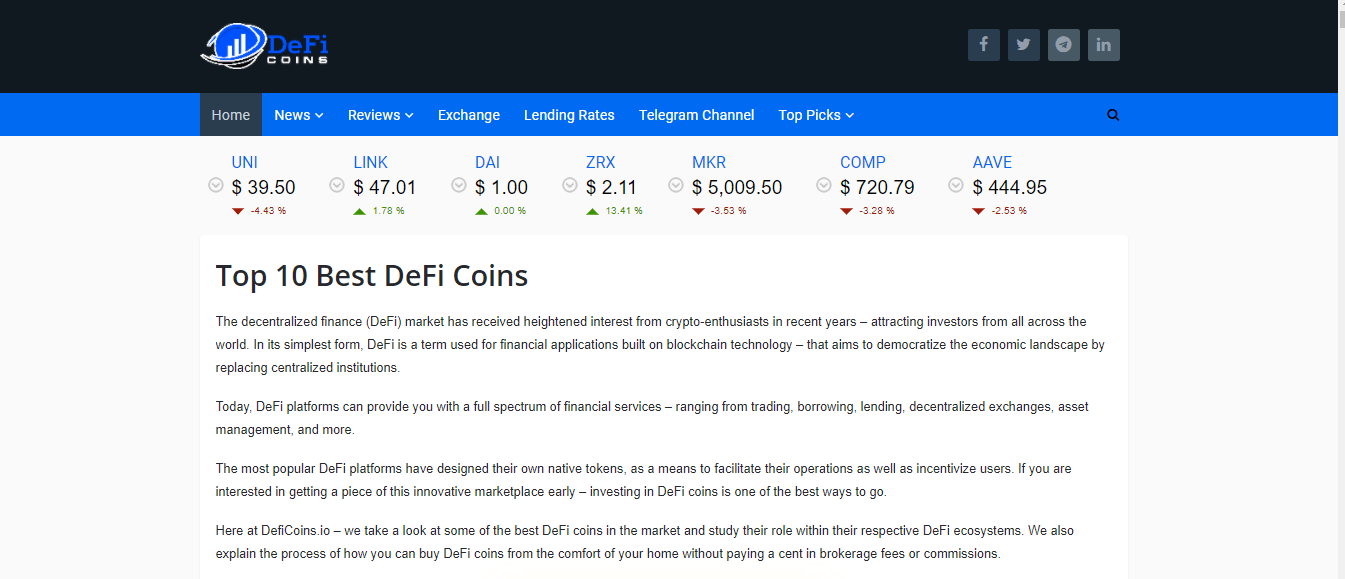

The DeFi Coins guide includes tokens such as UNI, the governance token for the top decentralized exchange (DEX) Uniswap.

Launched in September 2020, UNI has grown by almost 1,600 percent since launch. The asset derives its value primarily from its use on Uniswap, and with the exchange growing its user base, there is a significant upside for UNI.

Other tokens covered by the guide include LINK, the token for top blockchain oracle protocol Chainlink. Chainlink has established itself as the leading oracle protocol over the past few months, with DeFi projects and blockchain developers integrating its technology for securely receiving critical off-chain information in real-time. LINK is another token with significant price upside as Chainlink adoption grows.

The creators of the site claim that the information it provides will help individuals and corporate entities in the crypto space to make the right purchase decisions and enhance portfolio value.

Important Explainers and a FAQ Section

Beyond analysis of the best DeFi coins to purchase, the guide also provides useful explanations of DeFi applications. There are explainers on how decentralized applications for DeFi loans and DeFi lending work, for those exploring joining the growing ranks of DeFi enthusiasts.

In addition to the educational material, there is also a well-crafted FAQ section in case you have further questions that need addressing. The section provides both short and in-depth explanations.

Join Our Telegram channel to stay up to date on breaking news coverage