Join Our Telegram channel to stay up to date on breaking news coverage

A crypto whale has made a $150 million bet that says Ethereum (ETH) is about to fly.

The whale bought mostly “out of the money” options for Ether, with one large block of 40,000 contracts having a strike price of $2,200 for December and another block of 50,000 contracts with a strike price of $2,000 for October, anticipating increases for the cryptocurrency of at least 20% by next month and 33% by year end, according to data from options data tracking site Greeks.Live. Ether traded at $1,658 at 11:55am ET.

The transactions were executed as block trades that occur outside the exchange’s order book to minimize their impact on the market price. Such block trades are often seen as a proxy for institutional involvement in the cryptocurrency market.

The bet on Ether, the second-largest cryptocurrency by market volume, involved the purchase of 92,600 ETH carried out on Deribit, where each call option contract represents 1 ETH.

These option contracts provide the holder the right to purchase 1 ETH at a predetermined price in the future, without any obligation to do so.

In just the past hour, over 40,000 ETH Block calls were traded, almost all buying 29DEC23-2200-C, and with the nearly 50,000 buying 27OCT23-2000-C last night, the cumulative number of block calls traded has reached 92,600 ETH.

The whale actively bought $150 million worth of… pic.twitter.com/GwI39Ph0GZ— Greeks.live (@GreeksLive) September 18, 2023

All of these options were naked buys, indicating a speculative position taken without protective coverage against potential adverse price movements, said Greeks.Live.

Ether’s Market Valuation Indicates Fair Value

Research by RxR, a research-focused joint venture between Republic Crypto and Re7 Capital, agrees with the whale that Ethereum is currently trading at a substantial discount to its fair value.

RxR’s valuation suggests Ether is trading at a 27% discount to its fair market value.

RxR’s valuation model takes into account the Metcalfe law and the active user adoption of layer 2 scaling networks on the Ethereum blockchain. The model also takes into consideration the Ethereum mainnet’s user base to determine the network’s fair value.

The rapid growth of layer 2 protocols has added a new dimension to Ethereum’s ecosystem, providing solutions to scalability issues and significantly increasing network activity.

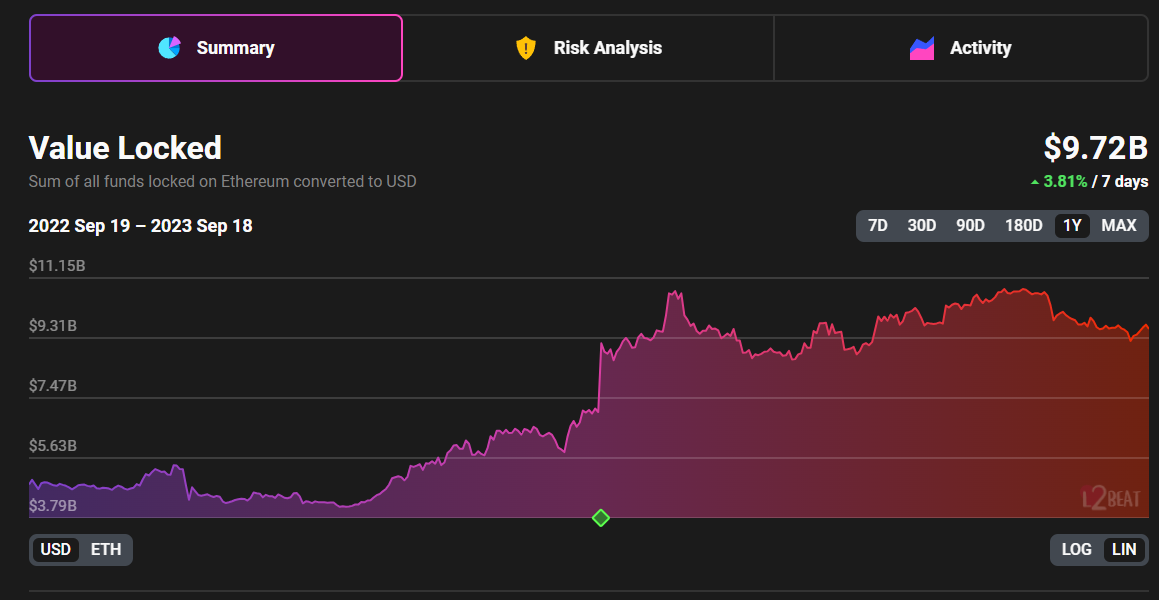

Coinbase’s BASE, Arbitrum, and Optimism are among the key players in this space, each contributing to Ethereum’s overall growth. According to data from L2Beat, the total value locked in layer 2 protocols has more than tripled in just two years, reaching over $9 billion. RxR’s analysis underscores the importance of layer 2 scaling solutions, which have rapidly gained traction in the crypto market.

ETH Downward Trajectory

Ether, which hit a six-month low of $1,532 just last week, has faced turbulent times recently. This downward trajectory was exacerbated by concerns over the digital asset exchange FTX potentially liquidating assets from its multi-billion-dollar cryptocurrency holdings.

However, the whale’s large bet on Ether may potentially signify a turning point in market sentiment. Ether is up 2.2% today at $1,657.9 as of 11:20am ET.

Related News

- SEC’s Hostile Crypto Regulation Risks 4 Million US Jobs By 2030, Slashes America’s Web3 Market Share

- 5 Best Altcoins To Invest In Right Now – Theta Fuel, Wemix Token, Monero

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage