Join Our Telegram channel to stay up to date on breaking news coverage

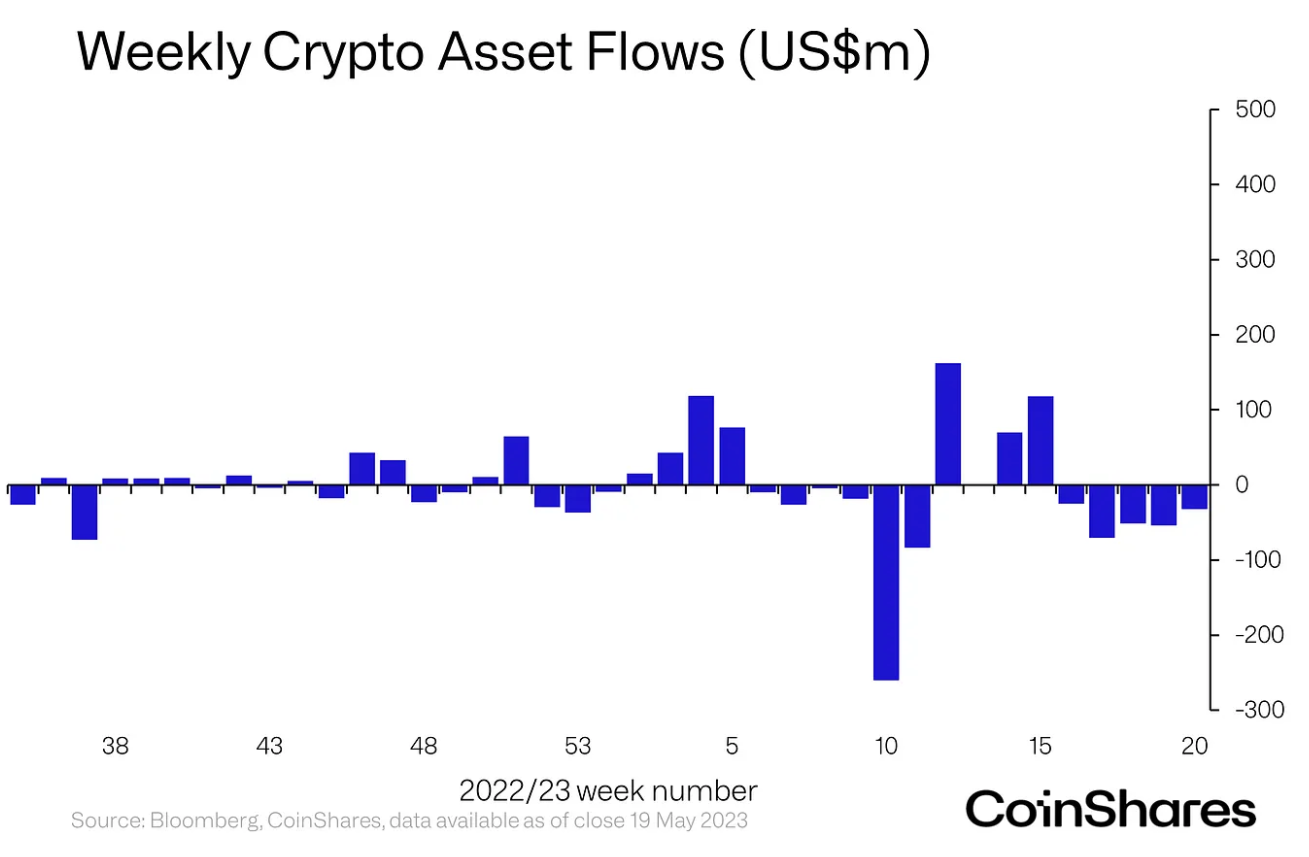

Digital asset investment products witnessed outflows totaling $32 million for the week ending on May 19, marking the fifth consecutive week of outflows and bringing the total outflows over the past five weeks to $232 million, equivalent to 0.7% of total assets under management.

Trading volumes have decreased, reaching $900 million for the week, approximately 40% lower than the 2023 average. This decline in volumes reflects the lowest level since late 2020 and coincides with the overall decrease in crypto prices and concerns about sell-offs.

5th Consecutive week of crypto outflows of US$32m, poor sentiment focussed on BTChttps://t.co/55HiQejp0o

— James Butterfill (@jbutterfill) May 22, 2023

The negative sentiment towards Bitcoin was evident, with outflows of $33 million, while short-Bitcoin products experienced minor outflows of $1.3 million, bringing the total outflows for short BTC investment products to $235 million over the past five weeks, in line with the recent trend

Institutional Confidence Wanes as Bitcoin Faces Value Decline and Persistent Outflows

Institutional investors continued to show lack of confidence in digital assets last week, particularly in the Bitcoin price, resulting in a significant decrease in its value to $27,307 and leading to another week of outflows from digital asset investment products.

The latest edition of CoinShares’ “Digital Asset Fund Flows Report,” published on May 22, revealed that crypto funds experienced outflows of $32 million between May 15 and May 19, making it the fifth consecutive week of outflows.

CoinShares’ Head of Research, James Butterfill, observed that the negative sentiment primarily focused on Bitcoin, with a total outflow of $232 million during this period.

During the five-week period from April 21 to May 19, the price of Bitcoin declined by approximately 4.8% to reach $26,842. At the time of writing, Bitcoin’s price stands at $27,257, according to CoinMarketCap.

A market analyst suggested that the price of Bitcoin has remained stagnant in recent weeks as traders await a significant market catalyst that could either push the price higher or lower. He highlighted the upcoming decision on interest rate hikes by the Federal Reserve in June as a potential trigger for market movement.

Butterfill further stated that Bitcoin investment products have experienced outflows totaling $112 million so far this year, with $100.8 million of that amount occurring in May alone. Short-Bitcoin products also saw outflows of $34.8 million in May. However, the reasons behind the coordinated negative sentiment toward both long and short investment products remain unclear.

In terms of outflows by exchange country, Germany led the way with $24.1 million, followed by U.S. exchanges with $5 million. Interestingly, despite the European Union’s adoption of the Markets in Crypto-Assets (MiCA) regulation on May 16, which theoretically should have a positive impact on the European crypto market, Germany still experienced significant outflows.

Despite the prevailing negative sentiment, Litecoin and Avalanche managed to attract some inflows into their investment products, deviating from the broader trend in the crypto investment products market. Litecoin received inflows of $0.7 million, while Avalanche saw inflows of $0.3 million. Ethereum, on the other hand, faced outflows of $1 million.

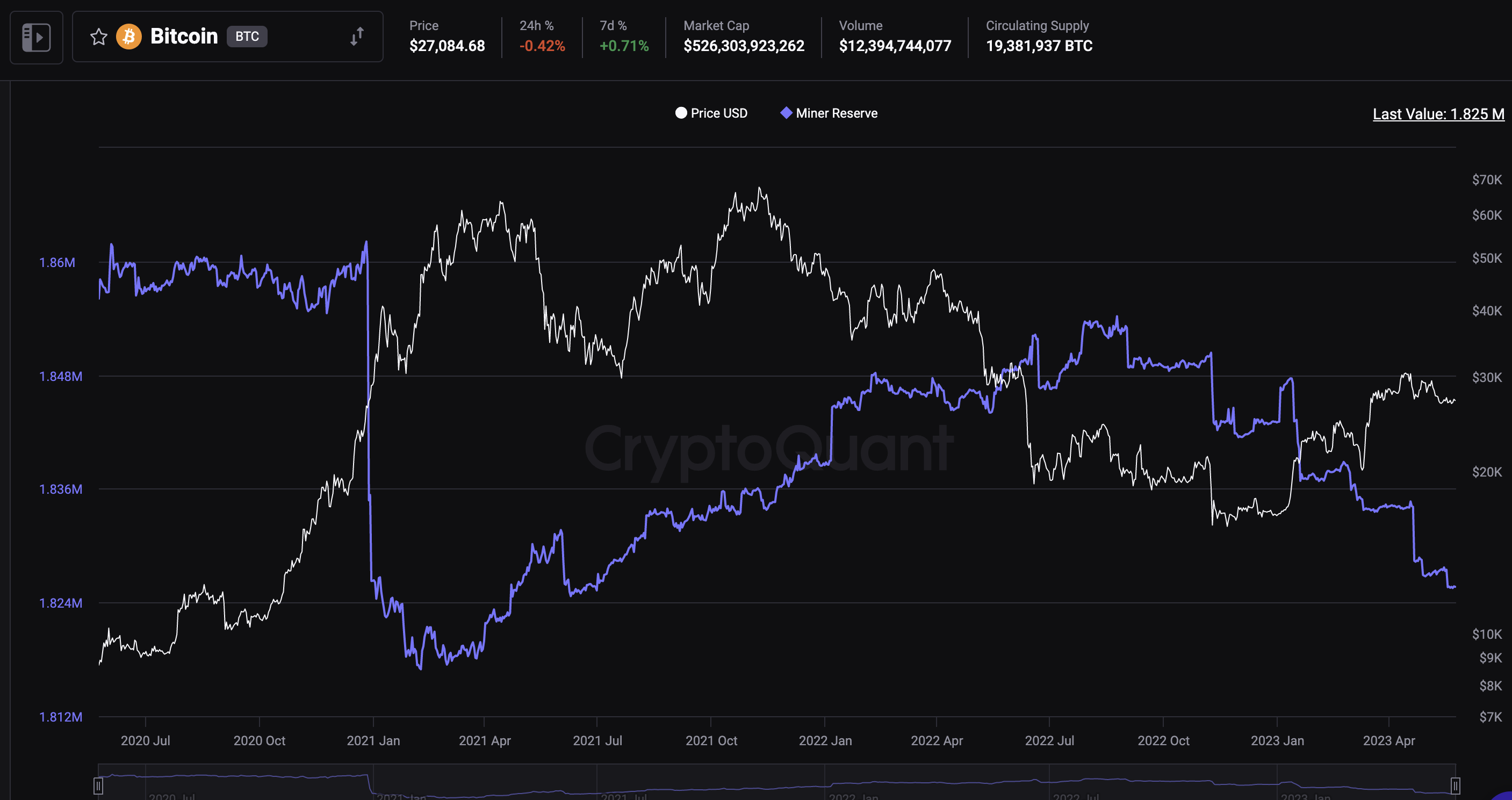

Bitcoin Miners’ Reserves Decline as Selling Pressure Mounts

A recent report from CryptoQuant highlighted the movements of Bitcoin miners on May 19. The report indicated a decline in Bitcoin miners’ reserves, suggesting that miners are selling their holdings and exerting selling pressure on the market.

The report contained a chart that displayed a significant drop in reserves following the peak of Bitcoin’s price in mid-April, with another smaller decline occurring later in the month, both coinciding with subsequent price declines.

CryptoQuant noted that the most recent drop in mining stocks occurred this week and coincided with a transfer to Binance, according to their analysis.

Two transactions of 1,750 BTC were identified from miners’ wallets to an exchange, with a high probability that they ultimately ended up on Binance, as per the analyst’s assessment. The coins were moved from the address of the Poolin Bitcoin miner, with an approximate value of $47 million based on current prices. Although this is just one miner, similar selling patterns among miners could contribute to downward pressure on the markets.

On May 18, Glassnode, an on-chain analytics firm, reported a decrease in Bitcoin mining profitability. They found that on 47.7% of trading days, miners’ revenue exceeded the daily cost of production, indicating that 52.3% of trading days were not profitable for the average miner.

Based on the Hash Rate Index, the hash price, which indicates mining profitability, has experienced a notable decline to $0.076 per terahash per second per day. This marks a substantial decrease from the peak of $0.127 observed during the memecoin minting frenzy on May 9.

In comparison to the corresponding period in the previous year, the hash price has decreased by 38%, resulting in reduced profitability for Bitcoin mining operations.

Furthermore, the hash rates are currently near peak levels of 373 EH/s (exahashes per second), combined with a near maximum difficulty level and high energy prices. These factors contribute to the challenging conditions faced by Bitcoin miners.

In the short term, the expiration of a large number of Bitcoin options could lead to further selling pressure. BTC prices have already declined 2.3% from their intra-week high of $27,500, settling at $26,863 at the time of writing and showing signs of weakening over the weekend.

In case of selling pressure intensifies, there is support at $26,300 in the short term, followed by a higher level at $25,000. However, the longer-term outlook remains bullish.

Related Articles

Join Our Telegram channel to stay up to date on breaking news coverage