Join Our Telegram channel to stay up to date on breaking news coverage

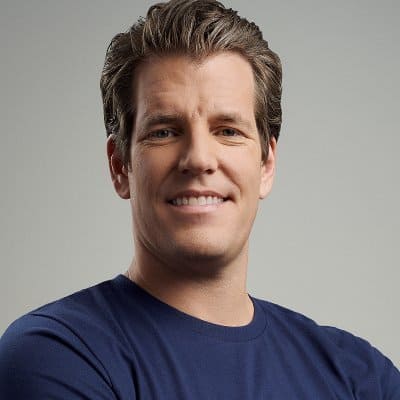

Tyler Winklevoss, the co-founder and co-chief executive of the Gemini Trust Foundation, has weighed in on the potential for stablecoins to achieve mass adoption.

In a recent interview, the crypto executive explained that the emergence of this fledgling asset class would depend significantly on that of the decentralized finance (DeFi) sector – primarily with traditional finance.

DeFi and Stablecoin Growth in Tandem

Tyler shared his views while appearing in an interview with Camilla Russo from The Defiant. While there, he explained that Wall Street would need to embrace DeFi to kick off the stablecoin race.

“When Wall Street wants to start investing in decentralized finance, they’ll need a currency. When a decentralized Real Estate Investment Trust pays off a dividend or a stock, is it going to pay it to investors in Ether? Probably not because of the volatility, but in a stablecoin.”

Speaking on the value proposition of stablecoins for DeFi, he explained that the assets provide investors with a way to earn money through staking. At the same time, stablecoins offer higher price stability levels than a lot of traditional fiat currencies. So, in a world where hyperinflation is a possibility, these assets could help investors to hedge.

While he was full of praise for the asset class, he has also criticized several prominent stablecoins. As he explained, a lot of stablecoins have the habit of propping up their cash balances and assets under management to give a false perception of how large they are.

To help, he pointed out that his company plans to support assets that will help to “drive the DeFi revolution.” With experience in aspects such as custody and trading, they could prove to helpful allies down the line.

DeFi Has a Long Way to Go

In truth, stablecoins have been a top asset class over the past few months. With the coronavirus pandemic and plunging oil prices putting several major economies on the brink of recessions, investors have purchased more of stablecoins to hedge against risks.

Data from blockchain analytics platform Coin metrics confirmed that the entire market value of stablecoins had crossed $9 billion earlier this month. That number is up from $6 billion a few weeks ago, thus giving the impression that many investors have been more inclined to embrace the assets.

As for DeFi, however, there have been some problems so far. DeFi is an innovative aspect of the crypto space, providing investors with a wide array of financial services and lucrative opportunities to apply their funds. Sadly, the space has also suffered some significant setbacks.

Most prominent, of course, is the “hack” of the DAO. The service launched in 2016 as an automated venture capital fund. However, less than a month after it launched, a hacker was able to exploit a vulnerability in its smart contract and steal over $60 million in Ether.

In February 2020, the bZx decentralized trading platform suffered two separate hacks and lost about $954,000. Last month, the Chinese lending platform Lendf.me lost $25 million – about 99.95 percent of the funds it held – to hackers. For now, DeFi still has quite a lot to do before it gains prominence and Wall Street attention.

Join Our Telegram channel to stay up to date on breaking news coverage